S&P 500 was due for a little setback, but this one took 5 hrs and break of 4,492 support to play out – only the Monday top of 4,482 support did hold, just in time with the FOMC minutes game plan laid out for premium subscribers yesterday. Good enough to take that long opportunity – solidly in the black now – and today‘s CPI game plan is in place too – especially relevant since PPI yesterday did come in hot. The kneejerk decline reaction would present opportunities to thoughtfully add to one‘s longs (medium-term view) Let‘s dive into the charts and more upcoming real-time commentary on Telegram and Twitter.

Let‘s move right into the charts – today‘s full scale article contains 4 of them.

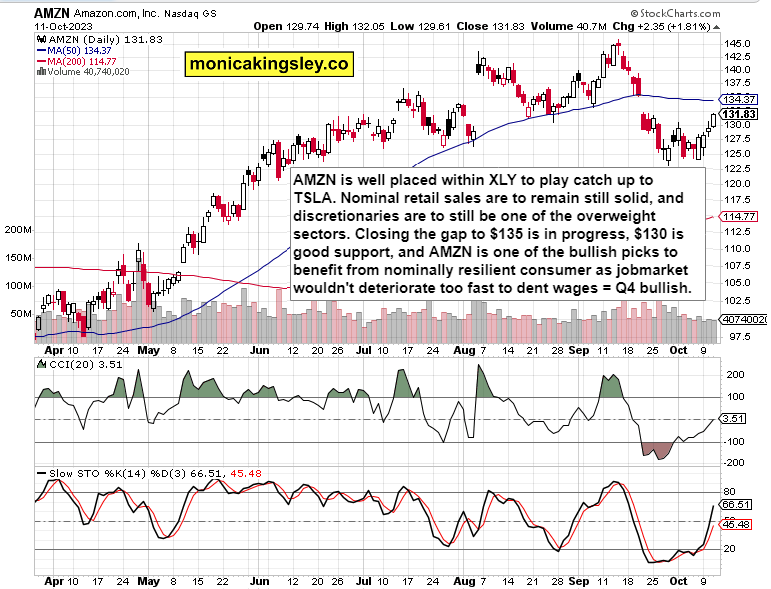

Sectors and stocks

Consumer is not folding, and even if excess corona savings are gone, household balance sheets, debt levels and serviceability are good. I still like discretionaries, especially with the current retreat in yields as of the NFPs Friday. AMZN remains another of my medium-term bullish picks.

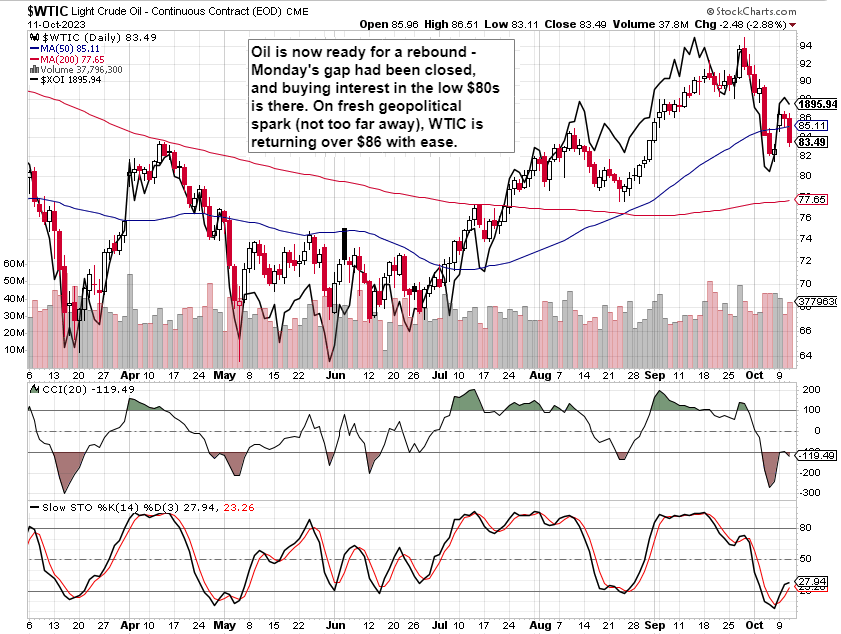

Crude Oil

Crude oil is turning the corner, readying to rise again. Higher low will now be put in place, and yesterday mentioned $84 is to serve as support in worst case scenario today. Outllok though is rather bullish.

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

GBP/USD clings to recovery gains near 1.2600 ahead of BoE rate decision

GBP/USD holds ground near 1.2600 after declining more than 1% following the Federal Reserve’s hawkish cut on Wednesday. The Pound Sterling gains upward support as the Bank of England is anticipated to keep interest rates unchanged later in the day.

EUR/USD retakes 1.0400 amid the post-Fed recovery

EUR/USD is recovering ground to near 1.0400 in the European session on Thursday. The pair corrects higher, reversing the hawkish Fed rate cut-led losses. Meanwhile, the US Dollar takes a breather ahead of US data releases.

USD/JPY extends rally toward 157.00 on BoJ Ueda comments

USD/JPY preserves its bullish momentum and climbs toward 157.00, refreshing monthly highs following the BoJ's decision to leave policy rate unchanged. In the post-meeting press conference, Governor Ueda said they will adjust the degree of easing if the price outlook is to be realized.

Gold price recovers further from one-month low, climbs to $2,620 amid risk-off mood

Gold price attracts some haven flows in the wake of the post-FOMC sell-off in the equity markets. The Fed’s hawkish outlook lifts the US bond yields to a multi-month high and might the XAU/USD. Traders now look to the US Q3 GDP print for some impetus ahead of the US PCE data on Friday.

Sticky UK services inflation to come lower in 2025

Services inflation is stuck at 5% and will stay around there for the next few months. But further progress, helped by more benign annual rises in index-linked prices in April, should see ‘core services’ inflation fall materially in the spring.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.