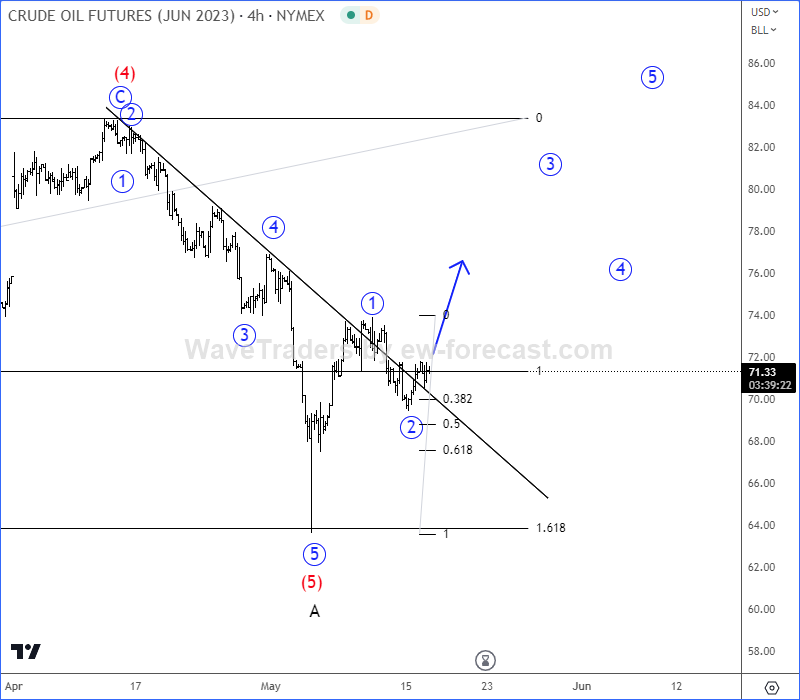

We see a drop on Crude Oil from 130 area as a five-wave impulse into wave A that seems to be finished at 63 support area. Recent strong drop in the 4-hour chart, can be also considered as a final spike into new lows, meaning it can be the end of wave (5) of A. So, be aware of a bigger recovery now, potentially five-wave rally back to 85 area, especially now when we have a nice intraday impulse into first wave 1 from the lows that is also trying to break the trendline resistance. So, we think that more upside is coming after a current pullback in wave 2.

We also covered Crude oil in our latest live webinar. You can watch the recording below:

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

By using Wavetraders website, any services, products, and content contained here, you agree that use of our service is entirely at your own risk. You understand that there is a very high degree of risk involved in trading on the markets. We assume no responsibility or liability for your trading and investment results. The charts, and all articles published on www.wavetraders.com are provided for informational and educational purposes only!

By using the information and services of www.ew-forecast.com you assume full responsibility for any and all gains and losses, financial, emotional or otherwise, experienced, suffered or incurred by you.

Recommended Content

Editors’ Picks

AUD/USD edges higher above 0.6350 ahead of PBoC rate decision

The AUD/USD pair trades in positive territory around 0.6380 during the Asian session on Monday, bolstered by the weaker US Dollar. Traders await the developments surrounding the United States and China trade discussions, while tensions between the two largest economies are intensifying.

EUR/USD stalls, Dollar crawls as trade fears are back

EUR/USD remained close to the area of recent peaks near the 1.1400 barrier. The Greenback maintained its offered stance near three-year troughs. The ECB left the door open to further easing in the next few months.

Gold: US-China tensions continue to fuel bullish rally

Gold started the week in a quite manner but gathered bullish momentum mid-week to reach a new record peak above $3,350 on Thursday. In the absence of high-tier data releases, geopolitical headlines are likely to continue to drive XAU/USD’s action.

The Monetary Sentinel: The PBoC and the BI expected to hit the “pause” button Premium

With a quiet calendar on policy moves, both the People’s Bank of China and Bank Indonesia are poised to sit tight in prudent mode, waiting for greater clarity on the trade‑war horizon before pulling any trigger on rates.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.