Crude oil is heading towards highs

On Monday, 17 January, the Brent price remains “in the black”; investors are clearly intending to update 7-year highs in the instrument. Brent is trading at $86.40 and may continue improving.

So, the oil is trading close to its 7-year highs and market players are focused on nothing but positive news. On one hand, the oil price is supported by the fact that investors are absolutely sure of the stable and strong demand for energies. Some OPEC+ members are really behind the previously approved oil extraction plans – this is another reason for buying oil right now. on the other hand, Libya is back to its normal pace of oil production after repairing the pipelines. In addition to that, the rumour has it that China will sell oil from its strategic resources closer to the Lunar New Year. This news is rather negative for the commodity market.

Last Friday’s report from Baker Hughes showed that the Oil Rig Count in the US added 11 units, up to 492. The same happened in Canada, with +43 units.

In the H4 chart, having completed the ascending structure at 83.96 and broken this level, Brent continues trading upwards. Today, the asset may reach 87.55 and then start a new correction towards 80.00. Later, the market may form another ascending structure with the target at 91.00. From the technical point of view, this scenario is confirmed by MACD Oscillator: its signal line is moving above 0 inside the histogram area, thus indicating a further uptrend in the price chart.

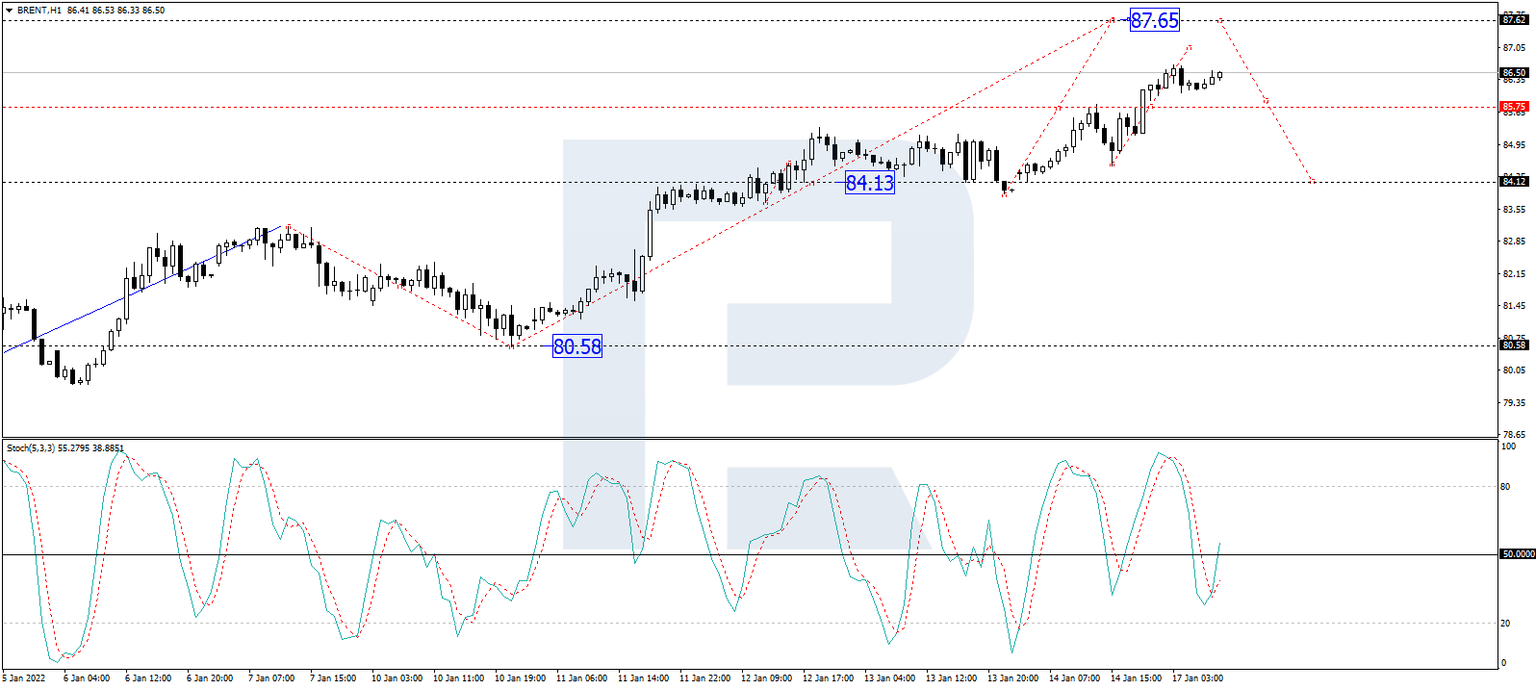

As we can see in the H1 chart, after forming a new consolidation range around 84.12 and breaking it to the upside, Brent continues growing with the short-term target at 87.65. After that, the instrument may correct to return to 84.12 and then resume growing with the target at 91.00. From the technical point of view, this idea is confirmed by the Stochastic Oscillator: its signal line is moving upwards to break 50 and may later continue growing to reach 80.

Author

Dmitriy Gurkovskiy

RoboForex

Dmitriy was fond of literature and movies about business, financial markets and psychology since childhood.