Oil prices fell yesterday after investors weighed the effects of surging CV cases seen in the United States and China, the two biggest consumers of oil. Traders have been torn about how to react to the future outlook for demand and supply of oil. On the supply side, the data for crude inventories is set to be released today and it is expected to be lower. This supported the price from falling even further.

Similarly, traders are cautious of Iran increasing the global supply of oil. Iran's new President, Ebrahim Raisi, has vowed to work to lift the "tyrannical" sanctions imposed by the US on its banking and energy sectors. Iran has been in talks with the US about reviving the nuclear agreement, but no agreement has been reached.

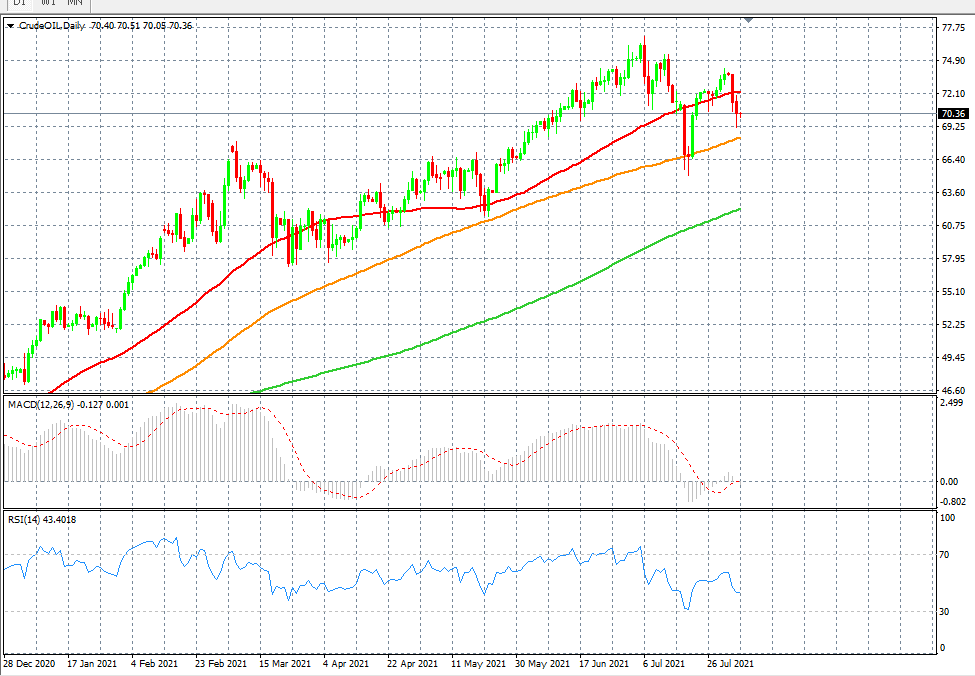

The futures for Brent crude settled at $72.41 per barrel, dropping 0.66%, and the futures for WTI crude settled at $70.56 per barrel, falling 1.0%.

Investors must keep an eye on the upcoming Crude inventory as that can bring higher volatility for both Crude and Brent oil prices. Remember, big institutions such as Goldman Sachs and JP Morgan believe that the oil prices will continue to move higher and they could touch the 100 dollar price mark.

The information is purely for education purposes only and cannot be perceived as an advise.

Recommended Content

Editors’ Picks

EUR/USD holds on to intraday gains after upbeat US data

EUR/USD remains in positive ground on Friday, as profit-taking hit the US Dollar ahead of the weekend. Still, Powell's hawkish shift and upbeat United States data keeps the Greenback on the bullish path.

GBP/USD pressured near weekly lows

GBP/USD failed to retain UK data-inspired gains and trades near its weekly low of 1.2629 heading into the weekend. The US Dollar resumes its advance after correcting extreme overbought conditions against major rivals.

Gold stabilizes after bouncing off 100-day moving average

Gold trades little changed on Friday, holding steady in the $2,560s after making a slight recovery from the two-month lows reached on the previous day. A stronger US Dollar continues to put pressure on Gold since it is mainly priced and traded in the US currency.

Bitcoin to 100k or pullback to 78k?

Bitcoin and Ethereum showed a modest recovery on Friday following Thursday's downturn, yet momentum indicators suggest continuing the decline as signs of bull exhaustion emerge. Ripple is approaching a key resistance level, with a potential rejection likely leading to a decline ahead.

Week ahead: Preliminary November PMIs to catch the market’s attention

With the dust from the US elections slowly settling down, the week is about to reach its end and we have a look at what next week’s calendar has in store for the markets. On the monetary front, a number of policymakers from various central banks are scheduled to speak.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.