Russia has launched an attack on Ukraine during the Asian trading hours, so stocks are coming sharply down across the board while USD is coming higher with JPY. Metals and energy markets are on the rise.

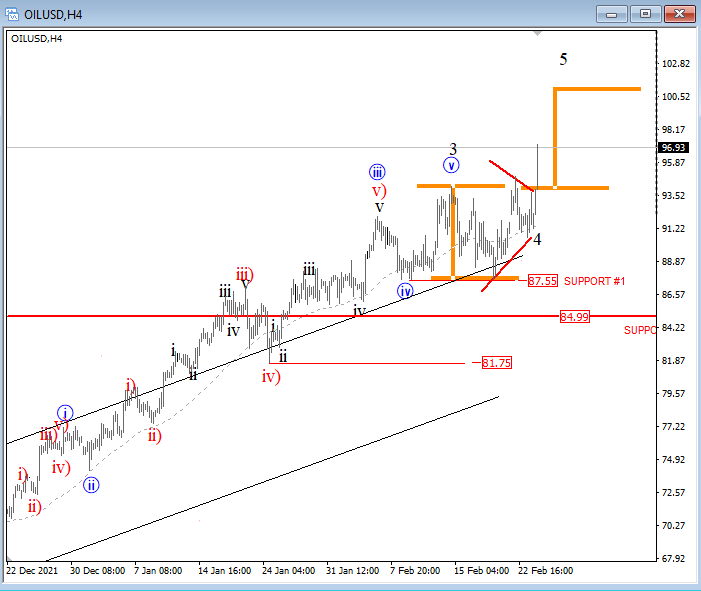

We see a sharp break out of a range, so ideally wave 4 is finished and fifth wave is underway with a target near 100 area.

Crude oil 4h Elliott Wave analysis

Check more of our analysis for currencies and cryptos in members-only area. Visit Wavetraders for details!

By using Wavetraders website, any services, products, and content contained here, you agree that use of our service is entirely at your own risk. You understand that there is a very high degree of risk involved in trading on the markets. We assume no responsibility or liability for your trading and investment results. The charts, and all articles published on www.wavetraders.com are provided for informational and educational purposes only!

By using the information and services of www.ew-forecast.com you assume full responsibility for any and all gains and losses, financial, emotional or otherwise, experienced, suffered or incurred by you.

Recommended Content

Editors’ Picks

AUD/USD recovers above 0.6200 on upbeat Chinese PMI data

The AUD/USD pair recovers some lost ground to near 0.6215, snapping the six-day losing streak during the early Asian session on Monday. The upbeat Chinese economic data provides some support to the pair.

USD/JPY faces some resistance near 151.00 mark

USD/JPY struggles to capitalize on a modest Asian session uptick to the 151.00 mark, warranting caution before positioning for an extension of last week's recovery from the lowest level since October 2024. The growing acceptance that the BoJ will hike interest rates and geopolitical risks underpin the JPY.

Gold: Bulls finally let go as key support fails

Gold turned south after setting a new all-time high to begin the week. Investors will remain focused on Trump tariff talks ahead of February US employment data. The technical outlook points to a bearish reversal in the near term.

Week ahead: NFP and ECB to steal the show

NFP take center stage amid DOGE layoffs. ECB decides monetary policy after CPI data. Canada jobs report and RBA minutes also on tap.

Weekly focus – Tariff fears are back on the agenda

While the timing of the EU measures remains still uncertain, Trump surprised markets on Thursday by signalling that the 25% tariffs on Canada and Mexico will be enacted when the one-month delay runs out next Tuesday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.