Crude Oil Elliott Wave technical analysis [Video]

![Crude Oil Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Energy/Oil/hand-full-of-oil-14004600_XtraLarge.jpg)

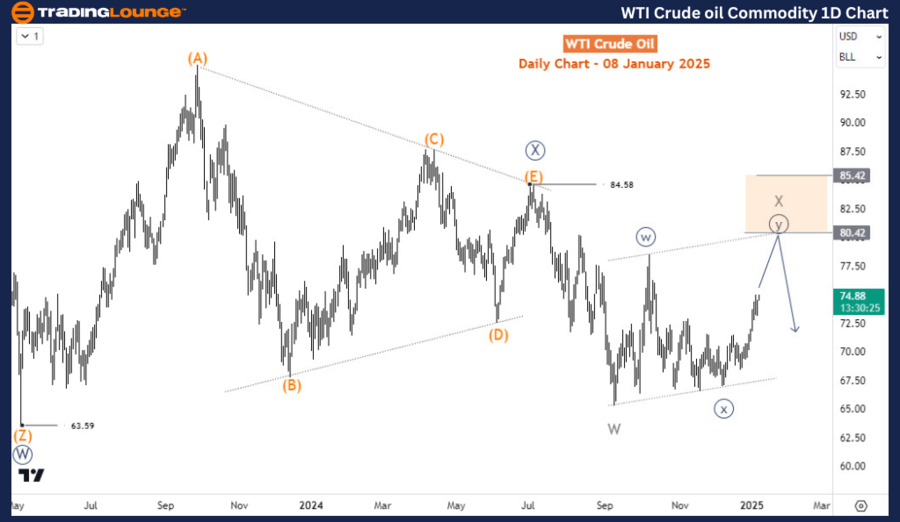

WTI Elliott wave analysis

WTI continues the minor recovery from September and may reach $80 in the coming days. However, if the rally is capped below $84.5 at the top of July 2024, the commodity will likely lose its bullish pace and then sell off.

WTI daily chart analysis

The commodity is still within the corrective bearish sequence from March 2022 where it reached its peak of the last 16 years. On the daily chart, this corrective sequence is evolving as a double zigzag structure. Wave ((W)) finished in May 2023 followed by a choppy bounce in the form of a triangle structure for wave ((X)). Wave ((X)) ended at 84.58 in July 2024. Since that time, wave ((Y)) has emerged lower. Wave W of (W) of ((Y)) finished at 65.25 in September 2024. Afterward, wave X emerged as a double zigzag with ((w)) and ((x)) of Y ending in October 2024 and December 2024 respectively. The current surge from 67 is expected to extend higher toward $80 to finish wave X before the price starts turning lower again.

WTI four-hour chart analysis

Price is close to finishing wave (a) of ((y)) of X with an impulse structure. A pullback in wave (b) should emerge soon. However, the pullback in (b) should finish above 67 while the price emerges higher toward 80 to complete wave X.

Crude Oil Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.