CPI game plan

S&P 500 partially recovered from Thursday‘s setback, but the bulls didn‘t get back to the driver‘s seat. Market breadth improved though sufficiently, and all would look fine unless you would notice the tech leading to the downside, financials with Russell 2000 sputtering, and… the wildly non-confirming bond market.

Rising yields haven‘t woken up the dollar that‘s readying a break above 130.50 – more rate hikes and intention to keep rates restrictive for longer (that‘s three 25bp hikes for 2023 taking Fed funds rate from current 4.75% to below 5.25%), preemting easing of monetary policy as previously and too optimistically anticipated by markets, during late 2023. At the same time, markets are positioning for Fed funds rate at 6%, which would be a major surprise for risk assets. The prevailing narrative is of decelerating inflation, but I wonder for how many readings more would markets be satisfied with the downside momentum. Odds are that Tuesday‘s figure wouldn‘t be a positive surprise, to put it mildly – but the change in calculation methodology virtually guarantees an easy time even if energy and used car prices aren’t exactly in a decline mode, and core inflation data remain rather resilient.

This all ties in well with sticky inflation and my call for its return later in 2023. Similarly the job market is to soon start increase in unemployment – the recent employment gains were mostly in the lower paying end while tech layoffs continue, so far limited to tech only.

The recession countdown is on, and upcoming CPI is to eventually prove a realization of hawkish Fed as right – which the bond market is sensing already, and stocks didn’t get the memo yet. While the new inflation calculation methodology helps (ignore some prior readings revisioned higher, the base effects), I’m not looking for any risk-on spike to last. Ride with caution.

Keep enjoying the lively Twitter feed serving you all already in, which comes on top of getting the key daily analytics right into your mailbox. Plenty gets addressed there (or on Telegram if you prefer), but the analyses (whether short or long format, depending on market action) over email are the bedrock. So, make sure you‘re signed up for the free newsletter and that you have my Twitter profile open with notifications on so as not to miss a thing, and to benefit from extra intraday calls.

Let‘s move right into the charts.

S&P 500 and Nasdaq outlook

4,093 has been overcome on a closing basis, but cryptos and Nasdaq with bonds point to the downswing as likely to continue – it’s stocks that are defying the gravity here. Yet, they can pull it off above this level some more, even approach the 4,128 resistance - but any CPI spike would be sold into rather than sticking.

Credit markets

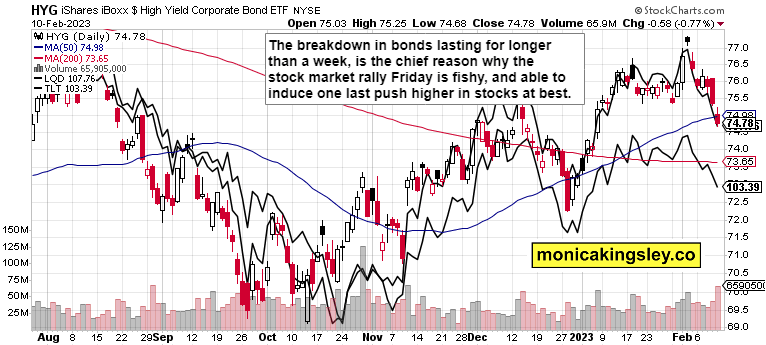

Bonds are positioning for hawkish Fed – not discounting soft landing, no matter the golden cross in stocks. The 200-day moving average is still declining, and the rally has fooled enough buyers already – this isn’t a new bull market.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.