CPI fireworks ahead

S&P 500 buyers stepped in quite early indeed – no surprise as the sell into the open couldn‘t yet have lasted. Even the battle around intraday lows spelled the return of the bulls. The table was set for no selling into downswing attempts, and sure enough stocks closed on a relatively fine note, which favors more of the back anf forth price action today – before tomorrow‘s likely 5.4% YoY CPI gets celebrated by the Fed pivot afficionados:

(…) Still, the key theme of this week is going to be Wednesday‘s CPI – look for the headline YoY figure to come in at 5.4% (no higher than 5.5% really), but for the core CPI to remain more resilient. The market will in my view again take that as „the Fed will really pivot now“ (really this time), even though the core CPI wouldn‘t support that notion. I continue to think the market is getting it terribly wrong expecting 100bp rate cuts this year – the Fed would continue keeping Fed funds rate at 5.25% (that means one more hike is

ahead, and then a pause). First though, the poor earnings would catch up with SP 500, followed by more real economy deterioration in the face of restrictive Fed and rising oil prices (these are the shadow Fed funds rate).

Keep enjoying the lively Twitter feed via keeping my tab open at all times – on top of getting the key daily analytics right into your mailbox. Combine with Telegram that never misses sending you notification whenever I tweet anything substantial, but the analyses (whether short or long format, depending on market action) over email are the bedrock. So, make sure you‘re signed up for the free newsletter and that you have my Twitter profile open in a separate tab with notifications on so as to benefit from extra intraday calls.

Let‘s move right into the charts

S&P 500 and Nasdaq outlook

Monday‘s close indeed wasn‘t below 4,115 – and stocks are to keep meandering around this level today as well. Taking on the 4,160s resistance though has to wait, won‘t happen today either. I‘m looking for a relatively narrow range day, offering just enough whipsaws.

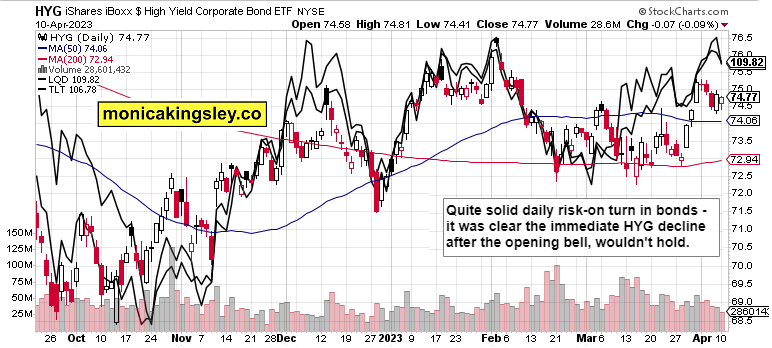

Credit markets

Bonds turned sufficiently risk-on, but the underperformance vs. stocks is still there. And that‘s telling, medium-term telling – similarly to the poor market breadth (looming divergence vs. prior rally tops), For today, expect nothing more than weak clues regarding tomorrow‘s CPI positioning.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.