Covid Special Report: How will worst coronavirus variant seen to date affect markets this week?

- 'Omicron' contagion risks will unsettle the markets for the foreseeable future.

- Gold and forex markets are under scrutiny as volatility shoots higher.

The markets are embarking on a huge month with the latest strain in the coronavirus 'Omicron' sending risk into a tailspin, resurfacing as a worry for investors and a potential driver of more big market moves to follow. This variant has been classified by the World Health Organisation as a 'concern', and it has slammed markets worldwide.

The S&P 500 index made its biggest one-day percentage loss in nine months on Friday, in what was arguably thinner markets conditions with US investors away for the long weekend and as part of the Thanksgiving holidays. With little known about the new variant, longer-term implications for global markets are still unclear, but things do not sound good. For forex, traders have already given us an insight into what could lie ahead if the fears of the worst-case scenario gain traction and come to fruition.

Coronavirus 'Omicron', how worried should markets be?

We have been here before when the new variant 'Delta' arrived. At that time, markets took the view that this will be the new norm. It was well telegraphed that coronaviruses can and will mutate. As such, so long as the vaccines were rolled out, the human race would just need to get to max immunity as soon as possible and all would come out in the wash eventually with no lasting harm to markets.

Subsequently, risk appetite continued to prevail as investors looked through the pandemic and instead cheered the easy money conditions that would be expected to see global economic growth back on track. Consequently, due to supply chain bottlenecks as well as pent up consumer demand as the nations came out of lockdowns, inflation risks were instead the main concern. This is where the trade has been for several months now, ultimately underpinning the greenback, supporting both commodities and US yields higher.

Delta was indeed initially feard as more contagious than the original COVID-19 strain that emerged in Wuhan, China. This was supporting a bid in the greenback and safe-haven-FX, weighing on stocks and higher beta currencies. However, concerns were quickly nipped in the bud when vaccine makers and the WHO assured the world that vaccines would at least reduce the severity of the illnesses it could cause in patients. Markets took solace in such sentiment and risk eventually rallied again. With regards to the new variant, however, it is early days still, but markets have really slammed on the breaks due to the initial findings that are highly alarming.

The BBC has written that '''Omicron' is the most heavily mutated version discovered so far - and it has such a long list of mutations that is described by one scientist as 'horrific', while another said it was the worst variant they'd seen.''

''Prof Tulio de Oliveira, the director of the Centre for Epidemic Response and Innovation in South Africa, said there was an 'unusual constellation of mutations' and that it was 'very different to other variants that have circulated.''

"This variant did surprise us, it has a big jump on evolution [and] many more mutations that we expected," he said.

The BBC wrote that ''Prof de Oliveira said there were 50 mutations overall and more than 30 on the spike protein, which is the target of most vaccines and the key the virus uses to unlock the doorway into our body's cells.''

''Zooming in even further to the receptor-binding domain (that's the part of the virus that makes first contact with our body's cells), it has 10 mutations compared to just two for the Delta variant that swept the world.''

This is where the risk lies. The variant may have mutated beyond where the current vaccines will be effective. Prof Richard Lessells, from the University of KwaZulu-Natal in South Africa, said: "They give us concern this virus might have enhanced transmissibility, enhanced ability to spread from person to person, but might also be able to get around parts of the immune system."

Prof Ravi Gupta, from the University of Cambridge, said: "Beta was all immune escape and nothing else, Delta had infectivity and modest immune escape, this potentially has both to high degrees."

For markets, this cannot be something that can be looked through and the implications for world growth are worrisome, to put it mildly. If it is evident, and we will only know in good time, that this variant can and will spread fast to all corners of the world, as delta has done, then without vaccination, it will be catastrophic news which can only lead to one outcome for monetary-easing-air-filled-markets - DOWN!

What to watch in forex for the week ahead?

In forex, we are seeing a massive pick up in volatility, which, however, is excellent news for traders.

Meanwhile, the high beta currencies, such as the Australian dollar, took the brunt of the risk-off flows into month-end and around the squaring of books into the Thanksgiving holidays. The US dollar was already drifting lower from its cycle highs before the covid fears started to circulate which was giving the euro an edge.

Therefore, while AUD/USD fell in the panic selling, moves in EUR/AUD were more dramatic with EUR/USD bid up. AUD/JPY was another head-turner, playing out its typical role as the forex space's risk barometer. The yen was stronger vs the Swiss franc, another safe-haven currency with closer ties to Europe for which is growing in a fresh wave of contagion and thus subject to risks of negative trade implications.

The events in the markets took place just after a very hawkish set of minutes from the Federal Reserve which in hindsight, did little to move the needle in neither the US dollar nor US yields despite what they revealed. It was widely expected that members were concerned about inflation and would be willing to tighten policy and that officials would be willing to raise interest rates “sooner than participants currently anticipated” should it continue to run hot.

The minutes also indicated that members of the board feel conditions warranted a reduction in monthly asset purchases, with some members pushing for a more aggressive tapering that could even come as soon as December. That’s important because inflation has gotten even hotter since the November meeting.

Nevertheless, the US 10-year yield failed to rally, in fact, fell on the day. The two-year yield did reflect the market's hawkish outlook and a faster pace of tapering, but not by much. The US dollar that had already moved in on the 97 figure subsequently fell, potentially due to squaring of books, selling the fact into the holidays and month-end with expectations that the dollar can run higher when fuller markets return for another note of the apple and at the turn of a new month.

However, 'Omicron' may have taken that immediate opportunity off from the table, given the race for euro's which could have a detrimental impact on the dollar for the days ahead, especially when taking into consideration the Swiss National Bank (SNB). The SNB is following the Swiss franc's exchange rate "very closely" given the recent bout of risk-off which tends to see flows into the safe-haven currency at times of panic and uncertainty.

The SNB has stated that it will continue to monitor its impact on the economy and remains ready to intervene when necessary. This came from comments by the governing board Member Andrea Maechler. "At the SNB, we're always ready to intervene in foreign exchange markets if needed," Maechler said during the interview with RTS' TV programme Forum. "We don't target a specific exchange rate, neither a specific level nor a specific rate versus the euro or the dollar, but we follow it very closely to see the impact on the economy."

The Swiss franc hit its highest level against the euro in six years on Friday, without signs of any of the currency interventions by the SNB so far. The SNB will buy euros and sell CHF when they do intervene, so that is something that could support EUR even higher vs the US dollar. EUR/USD has already gained 1.3% during the last two days of trade.

Maechler said it was difficult for the economy to deal with sudden changes in the exchange rate, while gradual adjustments were easier to handle. However, inflation levels will be something that markets will also need to take into consideration before doubling down on bets that the SNB is going to intervene immediately. "An exchange rate is a value versus a foreign currency so it also depends on the inflation we have here in Switzerland versus the inflation abroad," Maechler said.

It was not the central bank's role to react to "each and every shock", she said, but rather to maintain inflation within the SNB's 0% to 2% target range over a mid-term horizon of two to three years. The SNB might regard strength in the franc as a natural hedge against stagflation risks, so it could be comfortable to let this ride out for a little longer, but it is definitely something to keep in mind when surveying the landscape for risks in the forex space.

When looking at individual currencies and what to expect from them, it will depend on where Omicron is going to turn up. The numbers of confirmed cases outside southern Africa remain small, but there are worries the virus could have spread more widely before scientists discovered it. There are already reports of the virus hitting the UK, Germany, Belgium and Italy.

We can expect, therefore, for the euro and the British pound to come under renewed pressure as the divergence between the central banks, the Fed, BoE and ECB, to play its role in strengthening the greenback. The yen would also be expected to remain in demand as investors keep a watchful eye on the contagion of Omicron.

EUR/USD & DXY technical analysis

For the open, unless the variant is found in the US as well, then the bias would be with the downside in the euro. The W-formation is a regression chart pattern and the 38.2% Fibonacci retracement level, in this regard, is compelling. This comes in at around 1.1250 and a good 100 pips from the close on Friday. If, however, the virus does show up in the US, then there is the technical case for higher EUR/USD that should not be ignored.

The technicals would align in this case with the fundamentals. That is to say, should the virus turn up in the US, the Fed would be expected to water down its 'faster' tapering language. In turn, markets would likely dial back their expectations of a sooner rate hike which could anchor the greenback and give some room for EUR/USD to correct higher in coming weeks with eyes on the 78.6% Fibo near 1.1520:

Meanwhile, longer-term, the monthly chart's counter-trendline is also compelling:

We could see a deeper test of this counter-trendline which brings in 1.10 into focus on a break of the current lows and horizontal support. If the US dollar smile theory plays out, then this is inevitable.

That is to say, strong US data are feeding into increased dollar bullishness and the Fed / ECB divergence lives on. On the other hand, risk-off and uncertainty pertaining to the global pandemic are also expected to support the US dollar over other currencies. Therefore, the greenback would be expected to benefit in either situation. Hence, the ''dollar smile'' as the dollar turns up at both ends of the risk spectrum. Something that was forecasted in the prior analysis, back in August when a measure of the greenback, DXY, was trading below 93.00:

Since that analysis, the greenback has moved higher. It is now testing a key level of resistance near 97. A pullback could be warranted at this juncture to test the old resistance and a confluence of the 61.8% Fib near 96.55 prior to the next meaningful rally:

Gold technical analysis

In such a scenario, where the dollar does correct, and for its safe-haven allure and inflation heading qualities, gold would be expected to take flight.

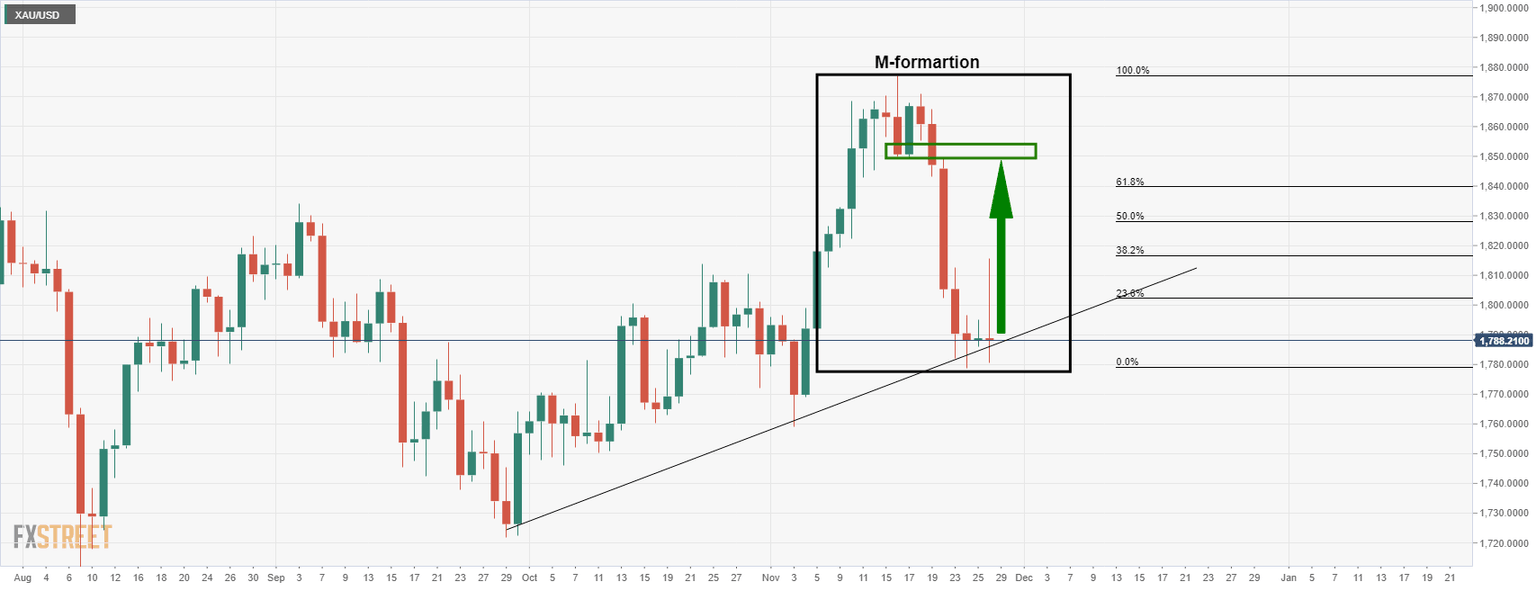

The price has left an M-formation on the chart which is a bullish reversion pattern. The neckline of the M pattern comes in near $1,850, a target for the bulls for the week ahead.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.

-637736462263738374.jpeg&w=1536&q=95)