Could Gold return above 2,000? [Video]

-

Gold extends last week’s sideways move below 2,000.

-

Bullish structure in progress above 1,980.

![Could Gold return above 2,000? [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/stack-of-golden-bars-in-the-bank-vault-60756080_XtraLarge.jpg)

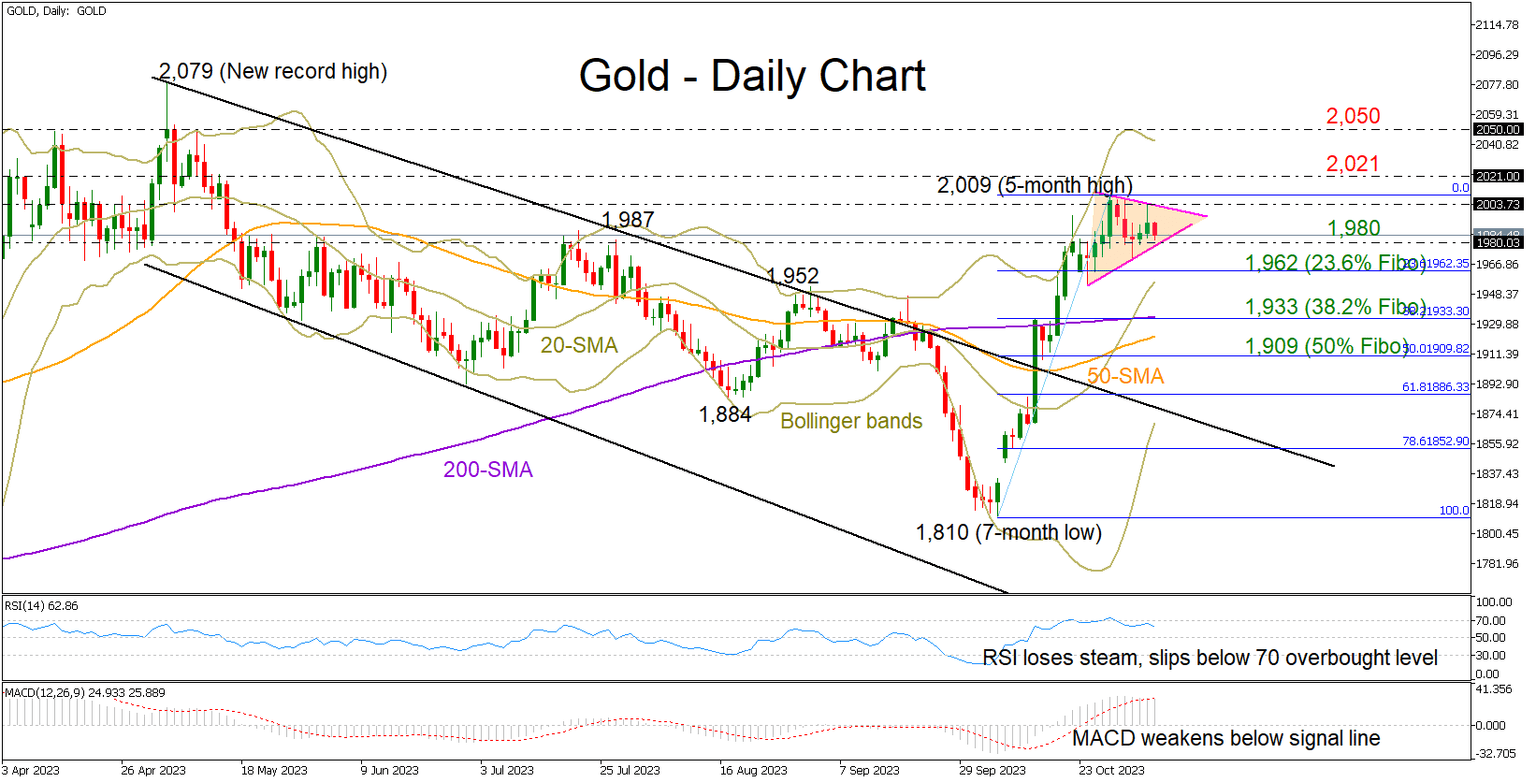

Gold shifted to a sideways pattern after its impressive rally from a seven-month low of 1,800 run out of steam slightly above the 2,000 mark.

The consolidation phase seems to be developing within a bullish pennant formation, feeding hopes that the bulls have more fuel in the tank. In other encouraging signals, the 20-day simple moving average (SMA) has drifted above the longer-term SMAs, while the price itself has yet to meet the upper Bollinger band.

On the other hand, the RSI has topped in the overbought zone and is set for its next downward move, while the MACD has slipped below its red signal line, both pointing to negative sessions ahead.

Given the mixed technical signals, traders will look for a break above the triangle and the 2,003 level before they shift their attention to the 2,021 barrier. This overlaps with the 78.6% Fibonacci retracement of the previous downleg and could be a prerequisite for gaining momentum towards the key 2,050 resistance. Above the latter, the spotlight will turn to the record high of 2,079, a break of which could test the 2,100 psychological mark or stretch up to 2,150.

On the downside, sellers might show up below the triangle and the 1,980 level. In this case, the 23.6% Fibonacci retracement of the latest upleg could provide a footing along with the 20-day SMA at 1,962. A continuation lower could then examine the 38.2% Fibonacci of 1,933 and the 200-day SMA, while a steeper decline could stabilize near the 50% Fibonacci of 1,909.

All in all, gold is in a neutral condition, waiting either a close above 2,000 or below 1,980 to get new guidance.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.