- Coronavirus third straight day of a drop in new cases.

- Financial and commodity markets are in recovery.

- Markets have been encouraged by the Chinese authorities early response to the outbreak.

- Disruptions outside China are likely to be limited to parts of Asia.

- Watching for the upside correction in AUD/USD.

In history, 2020's Black Swan event will be recalled as being the new coronavirus, although at the start of the year, we still do not know the full extent of how the novel virus will play out. The extensive efforts to contain it have will have caused economic growth in China to slow abruptly and it will be having repercussions around the world, although a relatively quick recovery is expected at this juncture, and markets are cheering the drop in new cases as China steps up measures to contain the virus.

Much of the data that is due in the weeks ahead will start to reveal how business sentiment has been affected, starting with this weeks EU/UK PMIs. "UK sentiment, in particular, may also be affected by antagonistic language around EU-UK trade negotiations, and the announcement that there will be frictions at the border beginning in 2021," analysts at TD Securities explained.

However, we really need to consider the contagion with China's major dependents, such as emerging market economies in Asia and what the tail risks are likely to be for the major economies around the world. Firstly, we can take a look at China and the latest developments in the virus, attempts to contain it, wider contagion risk and the types of measures the Chinese and global authorities can take to prevent a domestic and global economic meltdown.

China indicates a decline in new cases

In mainland China reached the death toll reached 1,770 as of the end of Sunday, up by 105 from the previous day, according to the country's National Health Commission. At least 100 of the new deaths were from the province of Hubei, the epicentre of the epidemic, the commission said on Monday morning. Across the country, there were 2,048 new confirmed infections, about 1,933 from Hubei alone, pushing the new total to 70,548.

At first glance, those numbers and the rate of contagion are alarming, however, its the third straight day of a drop in new cases and markets are looking through the data, choosing instead to take a more optimistic approach, anticipating that we have seen the worst of the spread of disease. China's State Council also reported that the proportion of infected patients in a serious condition had fallen nationwide. Foreign Minister Wang Yi also said that along with a drop in infections within Hubei there had been a rapid increase in the number of people who had recovered. Bloomberg also reported the head of a Wuhan hospital as saying that a turning point has been reached in the epicentre of the outbreak as new cases fell over the weekend.

WHO praises China's measures to contain the virus

Outside China, there have been more than 500 cases in nearly 30 countries. However, the measures China has taken to stop the spread of the coronavirus are starting to have an impact, Mi Feng, a spokesman at the National Health Commission, said on Sunday.

WHO's head, Tedros Adhanom Ghebreyesus, praised Beijing's response to the outbreak."China has bought the world time. We don't know how much time," he said. "We're encouraged that outside China, we have not yet seen widespread community transmission."

China had imposed more restrictions on the 60 million people living under lockdown in the centre of the outbreak in an attempt to control the epidemic. The use of private cars has been banned and residents have been told to stay at home unless there's an emergency. Officials say there will be only one exception to this rule – every three days a single person from each household will be allowed out to buy food and other essential items.

The most recent additional measures that China's government plans to use to prevent the contagion is using a colour-based QR code system based on health status for tracking individuals affected with the coronavirus nationwide. Meanwhile, authorities in the capital, Beijing, have ordered everyone returning to the city to go into quarantine for 14 days or risk punishment. China's central bank will also disinfect and store used banknotes before recirculating them in a bid to stop the virus spreading.

Indeed, markets have been encouraged by the Chinese authorities early response to the outbreak and levels of communication on an international level, with the more developed nation's capabilities to handle and contain the virus. Speaking to reporters in Geneva, the WHO chief cited a new Chinese medical report that analyses more than 44,000 coronavirus cases and when asked whether the outbreak was a pandemic, Mike Ryan, head of WHO's emergencies programme, said: "The real issue is whether we are seeing efficient community transmission outside of China and at the present time we are not observing that".

Virus not as deadly as SARS and MERS – WHO

The latest announcements embolden this sentiment, with the head of the World Health Organization (WHO) saying that the Chinese medical data shows that more than 80 per cent of patients have mild symptoms and will recover, while 14 per cent suffer from severe complications such as pneumonia, 5 per cent are in critical condition and 2 per cent die from the disease.

"It appears that COVID-19 is not as deadly as other coronaviruses, including SARS and MERS," Tedros Adhanom Ghebreyesus told reporters in Geneva, adding that officials were starting to get a clearer picture of the outbreak. The UN health agency's chief also said that children were not suffering from COVID-19 the same as adults and that the risk of death increases the older you are.

Markets taking the virus in their strides

The People's Bank of China announced a cut in the 1yr loan rate Monday and the bank regulator announced measures on Friday, relaxing NPL measures, which should be encouraging for risk sentiment. Indeed, we have seen far less of a bid in the safe haven complex and US benchmarks have continued to go not print fresh record highs and closes, pretty much day and day out. Last week, global equities continued to recover as virus fears subsided, with the S&P 500 finishing at all-time highs and STOXX 600 hitting its own highs intraday before finishing down slightly on Friday.

In other markets through which the coronavirus was having an impact resulted in lower commodity prices with some quite a large adjustment in the prices of oil, copper and iron ore, which have all

fallen by at least 10% since concerns about the coronavirus intensified in late January. However, when looking to the CRB index, we can now see a solid correction unfolding this month, lead by the energy sector, as efforts to offset the impact of the coronavirus were announced.

China, Hong Kong, and Singapore have pledged further fiscal stimulus to counter the coming hit. Consequently, WTI was closing up 0.5% at $52.33 and Brent up 0.5% at $57.62 on Monday 17th – both were closing highs for the month. Metals have also been boosted by the prospect of fiscal stimulus across Asia. Copper prices have now completed 38.2% Fibonacci retracement of the coronavirus sell-off.

Stimulus, stimulus, stimulus

As stated, China, Hong Kong, and Singapore have pledged further fiscal stimulus to counter the coming hit. China's central bank lowered a key interest rate and injected more money into markets, which saw the Shanghai Composite rise 2.3 per cent on Monday, allowing the gauge to recover all its losses since the Lunar New Year holiday when disruption caused by the epidemic led to a market crash. Futures tied to the Dow Jones Industrial Average ticked up 0.2%, on a day when US stock markets were closed for Presidents Day. The pan-continental Stoxx Europe 600 index closed 0.3% higher.

Indeed, Asian countries have all stepped up measures to offset the impact of the virus which also bolster prospects of an economic recovery. However, this is not some new phenomenon – this is something we have been seeing worldwide, and not just because of the virus – markets had been buoyed by such efforts long before the breakout.

Not least, we have a US presidential campaign underway and on Friday, there were reports circulating that the US government may already be considering further stimulus. Ahead of the November election, President Trump is seeking to distinguish himself from Democrat rivals whom he has accused of following ‘socialist’ policies. Several market strategists, however, are also stressing the risks that such a policy could stoke a stock market bubble. In the UK, the resignation of Javid as Chancellor last week has opened the door for Downing Street to oversee an increase in fiscal spending in the budget which could make further rate cuts less likely. The European Central Bank is also calling on the member nations to step up fiscal stimulus plans.

Effect of virus on eurozone to be 'temporary'

The Eurogroup head, Mario Centeno, said he expected the effect of the coronavirus outbreak on the economy of the eurozone to be "temporary". Speaking to reporters in Brussels, Centeno said the EU should carefully assess developments for the long term.

Disruptions outside China are likely to be limited to parts of Asia

China's Xi Jinping recently said that China would still meet its economic targets this year despite the outbreak – "the most important of these is the Party’s longstanding target to double 2010 GDP by 2020. To do that, the government will need to publish annual growth this year of at least 5.7%,"

The consequence will be a loss of output for surrounding emerging markets, but not such of an impact that they cannot recover from later in the year. "Our central forecast is that aggregate EM GDP growth will average 3.8% over 2020 as a whole (compared with our estimate of 3.7% in 2019)," Niel Shearing, Chief Economist at Capital Economics argued.

But there are clearly risks to this view, particularly if factory closures in China cause problems in global supply chains. That could lead to a much larger hit to Asian economies and commodity producers. In that situation, the coronavirus could plausibly knock a full percentage point off EM growth, taking it to around 3%.

Over the past 30 years, EM growth would only have been slower during the global financial crisis and the Asian financial crisis. Financial markets seem to be pricing in a pretty benign outcome for China’s economy. So there’s certainly a risk of larger falls in EM equities and currencies, and a further widening of bond spreads,

Niel Shearing warned.

FX implications

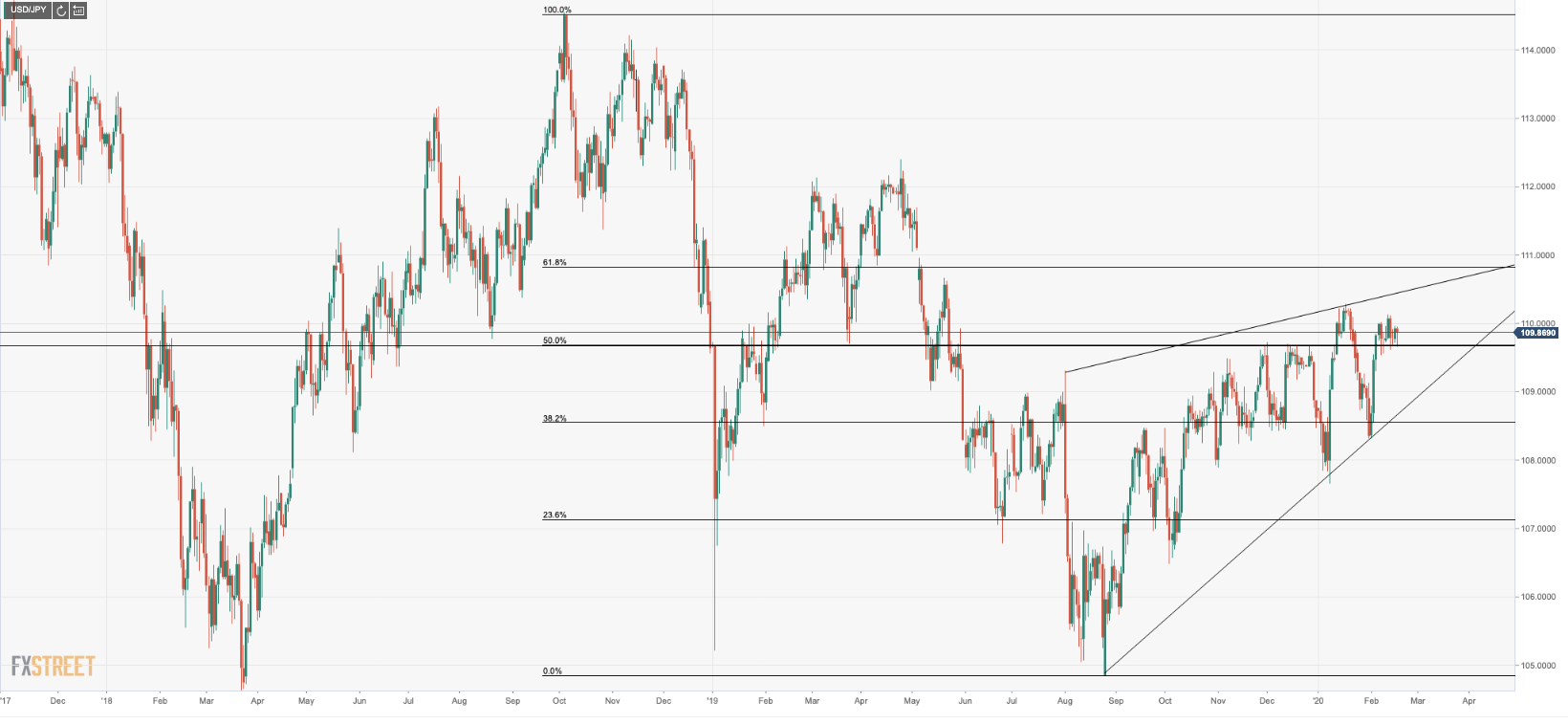

With respect to how this could potentially impact the FX space, the Yen has been relatively weak considering the implications. However, with the US economy sucking in investment into dollar-denominated assets, then its hardly a surprise that the 110 handle remains a feasible target while US benchmarks continue to print fresh record highs.

As markets continue to cheer positive updates to the virus being contained and international survival rates, whatever risk has been priced into the yen will quickly be unravelled which could be leading to further gains in USD/JPY with the golden ratio, 61.8%, Fibonacci retracement as a keen initial target around the 111 handle. However, the bearish wedge formation could act as a strong barrier for further gains much beyond the target.

The Aussie is a proxy to the virus also, and we can expect an upside continuation vs the dollar as the virus threat dissipates, especially should the Reserve Bank of Australia be seen to be on hold for the rest of 2020. See below for full price analysis:

Chart of the week

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

USD/JPY remains below 158.00 after Japanese data

Soft US Dollar demand helps the Japanese Yen to trim part of its recent losses, with USD/JPY changing hands around 157.70. Higher than anticipated Tokyo inflation passed unnoticed.

AUD/USD weakens to near 0.6200 amid thin trading

The AUD/USD pair remains on the defensive around 0.6215 during the early Asian session on Friday. The incoming Donald Trump administration is expected to boost growth and lift inflation, supporting the US Dollar (USD). The markets are likely to be quiet ahead of next week’s New Year holiday.

Gold hovers around $2,630 in thin trading

The US Dollar returns from the Christmas holidays with a soft tone, although market action seems contained. The positive tone of Asian shares weighs on the Greenback.

Floki DAO floats liquidity provisioning for a Floki ETP in Europe

Floki DAO — the organization that manages the memecoin Floki — has proposed allocating a portion of its treasury to an asset manager in a bid to launch an exchange-traded product (ETP) in Europe, allowing institutional investors to gain exposure to the memecoin.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.