Coronavirus Headlines Push 10-Year Yields to New All Time Lows, Tracking USD/JPY

U.S. CDC SAYS NOW IS THE TIME FOR BUSINESSES, HOPSTIALS, COMMUNITIES AND SCHOOLS TO BEGIN PREPARING TO RESPOND TO CORONAVIRUS – TELEBRIEFING

U.S. CDC SAYS WANTS TO PREPARE AMERICAN PUBLIC FOR POSSIBILITY THAT THEIR LIVES WILL BE DISRUPTED AS CORONAVIRUS SPREADS IN U.S. – TELEBRIEFING

US CDC: “VERY STRONG CHANCE OF AN EXTREMELY SERIOUS OUTBREAK OF THE CORONAVIRUS HERE IN THE UNITED STATES.”

…….and with those comments, the selloff on Wall Street continues. The S&P 500 is down an additional 3.25% and the Dow Jones is down an additional 3.1% from yesterday. Of course, because the stock markets are selling off from all time highs, that means the dips have ALWAYS been bought at some point. But that is for another day.

Today, 10-Year government bond yields have made all time new lows, trading as low as 1.303% vs the previous low in July 2016 at 1.321%.

The flight to safety into bonds was in play again today as bonds were bought while stocks were being sold:

- Stocks and bonds have an inverse relationship with each other. When stocks move lower, bonds traditionally move higher.

- Bonds and yields are inversely related. As bonds move higher, yields move lower.

- As a result, when stocks move lower, yields move lower as well.

Taking aa conservative approach to the pennant formation in 10-year yields, the target is near .67%. If one chooses to look for a more aggressive target, he or she can extend the length of the flagpole towards 3.25%, then take the flagpole and add it to the breakdown out of the pennant. However, before the target is support at the 127.2% and 1.618% Fibonacci extensions near 1.281% and 1.096%, respectively. In addition, watch the RSI, as it has moved into oversold territory. This indicates that if price is to reach the target, there will most likely be a bounce first.

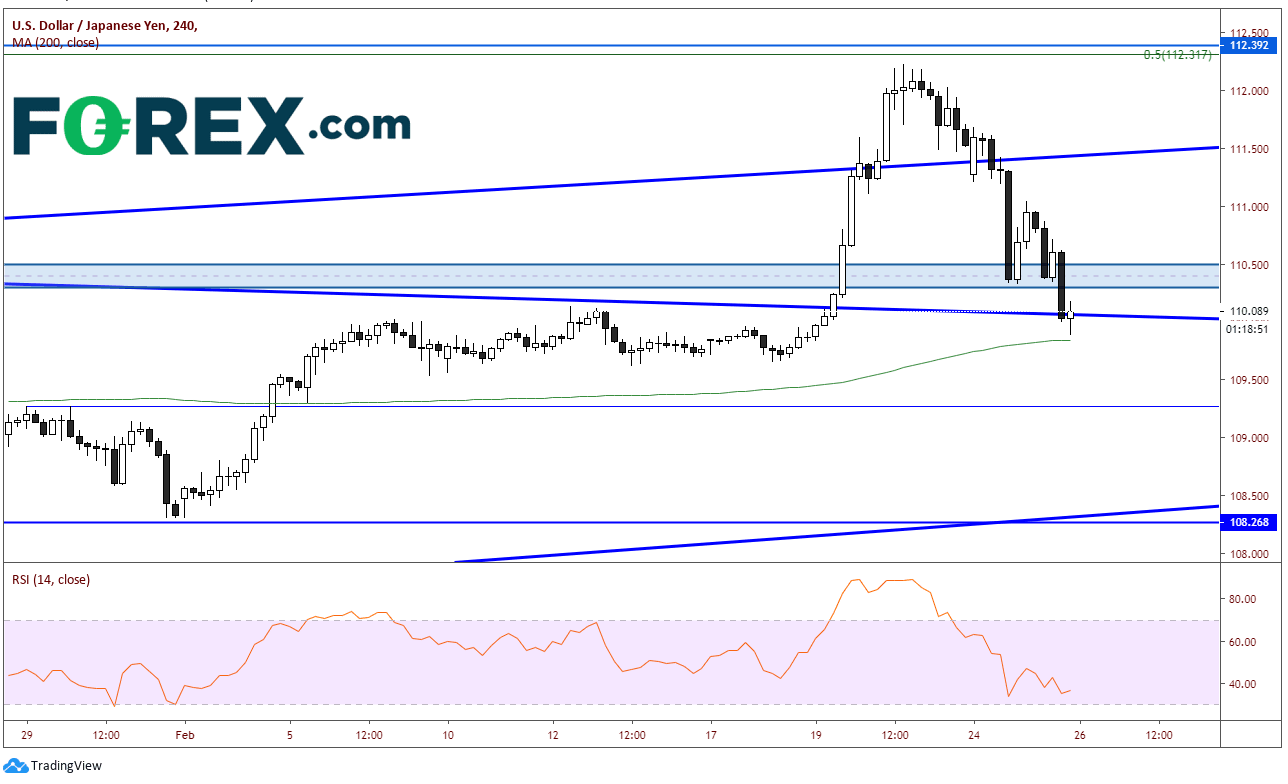

When we overlay USD/JPY on the 10-year yields, we can see that, for the most part, these 2 assets are correlated. When USD/JPY moves lower, 10-year yields move lower. We can see this on a 240-minute time frame, with the inexplicit runup in USD/JPY early last week being the exception (blue line). The scale of the left side show price for USD/JPY, which is currently near 110.00. This big round number acts as psychological support. Note that on the shorter-term timeframe, yields and the RSI are diverging. If yields do bounce soon, USD/JPY sellers will be looking to enter the market near yesterdays support (now acting as resistance) near 110.30.

On a 240-minute timeframe, USD/JPY has put in a doji candle, a candle of indecision. This may also indicate that the pair is ready for a bounce (and a bond pullback). Again, expect resistance and sellers at 110.30.

Author

Joe Perry CMT

Forex Analytix

Joe Perry is currently Global Head of Business Development at Forex Analytix. From 2000-2018, Joe traded at SAC Capital Advisors and then Point72 Asset Management. He has traded foreign exchange and commodity futures for the last 20 years.