- Delays in administrative work over the weaken may create false optimism on Mondays.

- Catch-up counting on Tuesdays tends to trigger a disappointing surge in cases.

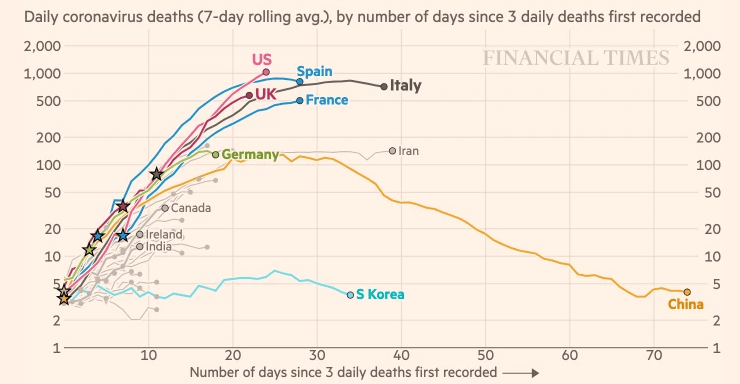

- Seven-day rolling averages serve as a better guide to cases.

"Tell me why I don't like Mondays" – the 1980s Boomtown Rats' song is the opposite of what those following COVID-19 statistics see. Figures on Mondays tend to show a drop in cases and deaths in various places in the world. such as Spain, and New York's figures all provide hope, contributing to a massive stock market rally on Monday, April 6.

However, the picture changed on Tuesday, April 7, when Spain broke the streak of the falling number of mortalities and New York reported its deadliest day on record. Markets came off their lows in response. The UK figures also disappointed, adding to the gloomy market mood as Prime Minister Boris Johnson is in intensive care.

However, the figures on the first two days of the week may be misleading. Statistics published on Monday refer to Sunday when some of the administrative teams in hospitals are off for the weekend. Some of the figures are not transmitted to central authorities in time to be reported. That artificially lowers the number of cases.

When these workers return to work on Mondays they clear their desks and send updated stats to the national or regional health officials, thus pushing infections and deaths up in reports published on Tuesdays.

Seven-day rolling averages

Some leading indicators have become stale in coronavirus times. The fast pace of events has made the Non-Farm Payrolls publication – published just days after the month ends – to somewhat lagging. The higher-frequency weekly jobless claims are more relevant.

However, with COVID-19 stats, the daily updates provide a significant amount of noise. Seven-day rolling averages clear up the ups and downs of weekends and provide a clever picture.

The Financial Times' seven-day rolling moving average is providing a clearer picture, distinguishing in April 7's case between the fall in Spanish and Italian deaths and the rapid rise in US and UK mortalities.

Source: FT

When things calm down, the Non-Farm Payrolls will likely return to its leading position while weekly jobless claims will probably be considered as noise once again – with investors eyeing the four-week moving average.

The exit in some countries is already on the horizon.

See Coronavirus Exit Strategy: Three critical factors to watch and how they impact currencies

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.