Corn Elliott Wave analysis

The corn price action still favors the downside to continue while it’s resisted below 475. In the long term, the current bearish sequence from April 2022 appears to correct the preceding impulse rally between April 2020 and April 2022.

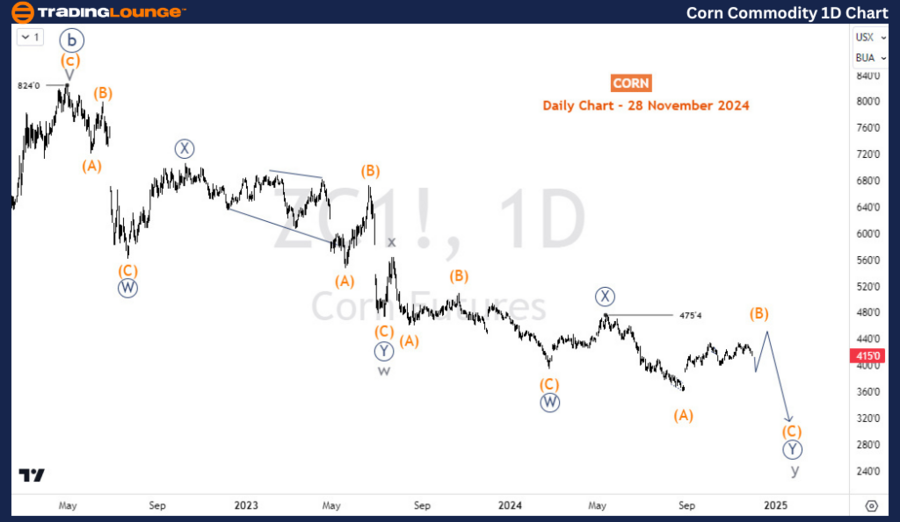

Long term view

In the long term, Corn prices are in a bearish corrective phase that began in July 2012. This phase is correcting the diagonal 5-wave sequence that started in the 1970s. Corrective structures, apart from triangles, are typically composed of three waves. The first wave of this corrective phase was completed in April 2020, followed by strong rallies that completed the second wave in April 2022. Starting from April 2022, the current decline is expected to represent the third wave, which could extend to $295. Therefore, the corrective phase remains incomplete, and further price declines are anticipated.

Daily chart analysis

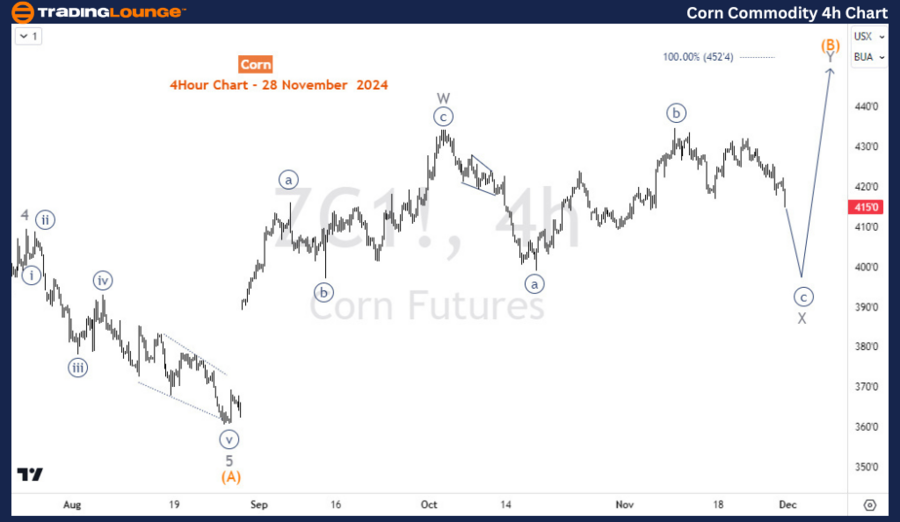

The daily chart focuses on the 3rd leg of this bearish corrective cycle. From $824, the commodity started the 3rd leg which is evolving into a double zigzag structure. After completing waves W and X in the cycle degree, Corn is now in wave Y. However, wave Y is still incomplete, as it is currently still in wave (B) of ((Y)) of Y. As the H4 chart shows, wave (B) could be evolving into a double zigzag structure and currently within the 2nd wave.

Four-hour chart analysis

Within wave (B), the price appears to be evolving in a flat structure for wave X. The current dip is wave ((c)) of X and can continue below the 17-October low before wave Y pushes higher, attempting to complete wave (B). Thus, prices can remain choppy in the coming few weeks with no major dominance between the two sides of the market.

Corn Elliott Wave technical analysis [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

Recommended Content

Editors’ Picks

EUR/USD struggles to hold above 1.0550, eyes on German inflation data

EUR/USD stays on the back foot and trades in negative territory slightly below 1.0550 on Thursday. Soft regional inflation data from Germany seems to be weighing on the Euro as investors await nation-wide Consumer Price Index figures.

GBP/USD trades below 1.2700 on modest USD recovery

GBP/USD stays under modest bearish pressure and fluctuates below 1.2700 on Thursday. The US Dollar corrects higher following Wednesday's sharp decline, making it difficult for the pair to continue to push higher. US markets will remain close on Thanksgiving Day.

Gold clings to small daily gains near $2,650

Gold (XAU/USD) reverses an intraday dip to the $2,620 area and trades near $2,650 on Thursday, albeit it lacks bullish conviction. Investors remain concerned that US President-elect Donald Trump's tariff plans will impact the global economic outlook.

Fantom bulls eye yearly high as BTC rebounds

Fantom (FTM) continued its rally and rallied 8% until Thursday, trading above $1.09 after 43% gains in the previous week. Like FTM, most altcoins have continued the rally as Bitcoin (BTC) recovers from its recent pullback this week.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.