Copper Elliott Wave technical analysis [Video]

![Copper Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Copper/copper-wire-530233_XtraLarge.jpg)

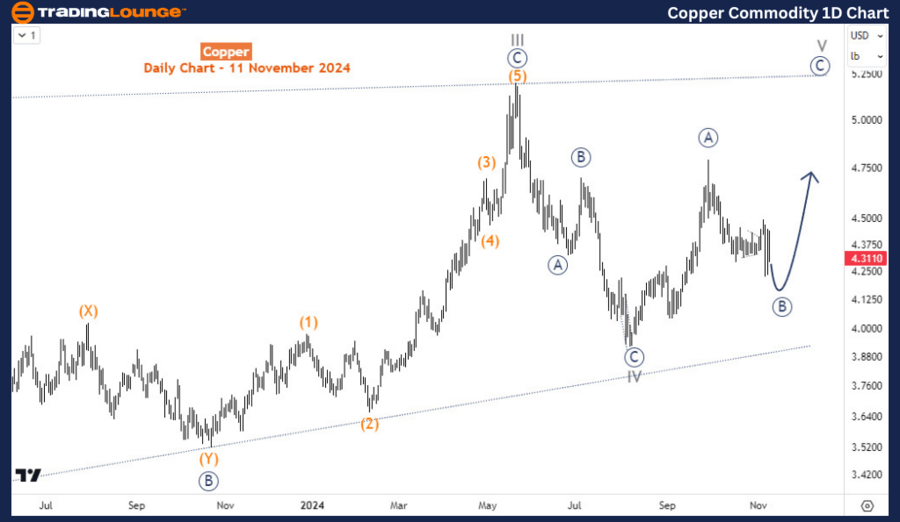

Copper Elliott Wave analysis

The sell-off on Copper from the late September high is set to continue lower toward the September lows. However, the phase is corrective. Thus, the larger bullish cycle from August 2024 and October 2023 should continue afterward toward the highs of the year 2024.

From the long-term perspective, the commodity is clearly within the bullish cycle that started in March 2020. In addition, Copper's long term from the March 2020 low is structurally evolving in a diagonal structure. Meanwhile, this diagonal structure is expected to complete the much larger bullish cycle that started pre-2000.

The daily chart analysis

On the daily chart, the evolving diagonal from March 2020 has probably completed wave IV and is now correcting the wave ((A)) of V. This means, the price is down in wave ((B)) of V. Provided the August 2024 low of wave IV is unbreached and wave ((B)) completes a corrective structure, the idea in the long-term still supports the upside.

The four-hour chart analysis

The H4 chart focuses on the sub-wave development of wave ((B)) which is emerging into a double zigzag wave pattern. Wave (X) of ((B)) has already finished and the price is in wave (Y) - precisely in wave C of (Y) of ((B)). Thus, the corrective phase from September 2024 could extend lower toward 4.15-4.00 to complete wave ((B)) before the next bullish phase begins for wave ((C)).

Copper Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.