Copper Elliott Wave technical analysis [Video]

![Copper Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Copper/copper-wire-530233_XtraLarge.jpg)

Copper Elliott Wave analysis

Copper retreats lower from the high of September 2024. The fall is correcting the August & September 2024 bullish run. It appears the bullish run will resume after the current sell-off is completed.

Daily chart analysis

From the long term, price is unfolding into a diagonal structure from the lows of March 2020. On the daily chart, wave I of the cycle degree finished in March 2022 before a decline for II that ended in July 2022. Wave III and IV were finished in May 2024 and AUgust 2024 respectively. The current resurgence from the lows of AUgust 2024 is expected to be wave V after which a larger pullbackcan begin to correct the entire diagonal 5-wave structure from March 2020. Wave V is expected to be corrective i.e unfolds in a 3-wave structure. It now appears wave ((A)) of V finished in September 2024 leading to the current pullback for ((B)). The H4 chart can help using the sub-waves to determine how far wave ((B) has gone and further it could go.

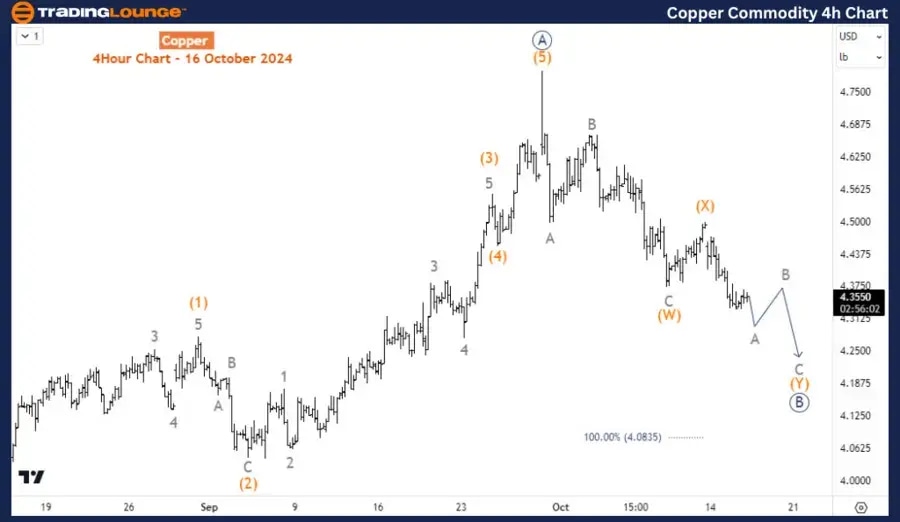

H4 chart analysis

On the H4 chart, wave ((A)) completed an impulse 5-wave structure. Current pullback for ((B)) is emerging into a double zigzag structure. By projection, wave (Y) of ((B)) could continue lower to 4.083. If the price doesn’t reach that level and makes a significant 5-waves resurgence toward the highs of October, then we can confirm wave ((B)) has finished and ((C)) on the way. Otherwise. short term appears to favored the down side to 4.083

Technical analyst: Sanmi Adeagbo.

Copper Elliott Wave analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.