Cooling inflation in July amid sustained consumer spending

Summary

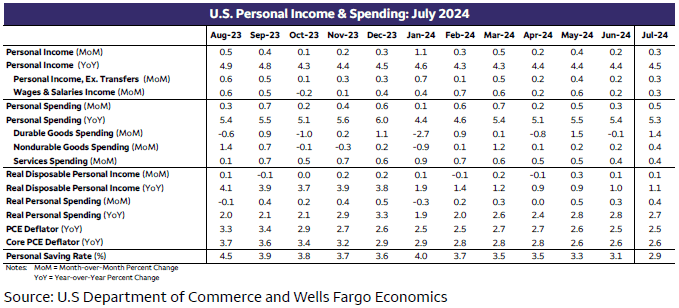

Spending still outpaced income in July, setting up for a decent Q3, and inflation continued to cool. With the 3-month annualized rate of core PCE inflation back below the Fed's 2.0% target, the case for "higher-for-longer" is not a compelling one.

Argument for restrictive policy looks Weaker

Yesterday's GDP report already showed that consumer spending was stronger in the second quarter than first reported; today's personal income and spending report reveals July data and shows that the third quarter is off to a compelling start.

Today's report also offers affirmation that inflation is indeed on a cooling path with core PCE inflation at 2.6% (chart). For policymakers at the Federal Reserve, maintaining restrictive policy is becoming difficult to justify with the three-month annualized rate now back below target at 1.7%.

At the start of this month, financial markets were cast into a tailspin when July employment data came in much softer than expected. It is difficult to square that jobs market weakness with not only sustained consumer spending, but income gains that feel more like the sort you would see in a stronger labor market. Driven by a 0.3% increase in wages and salaries, overall compensation also rose 0.3%. Both measures are up 4.4% over the past 12-months. After accounting for inflation and taxes, real disposable personal income rose 0.1% in July and is up 1.1% over the past year. In plain English, paychecks are growing slightly faster than inflation and that is allowing consumers to spend—at least for now. A key concern is that if the jobs market gets worse amid a policy environment that remains too restrictive, income could slip. The wage gains are still encouraging for July, but we are skeptical pay will continue to rise at such a solid pace if there is further softening in jobs.

In the meantime, remarkably, income is still not keeping up with spending. In order to sustain the increased outlays, households have pared back saving to 2.9%. That is just the second time in 16 years that the savings rate has had a 2-handle.

Author

Wells Fargo Research Team

Wells Fargo