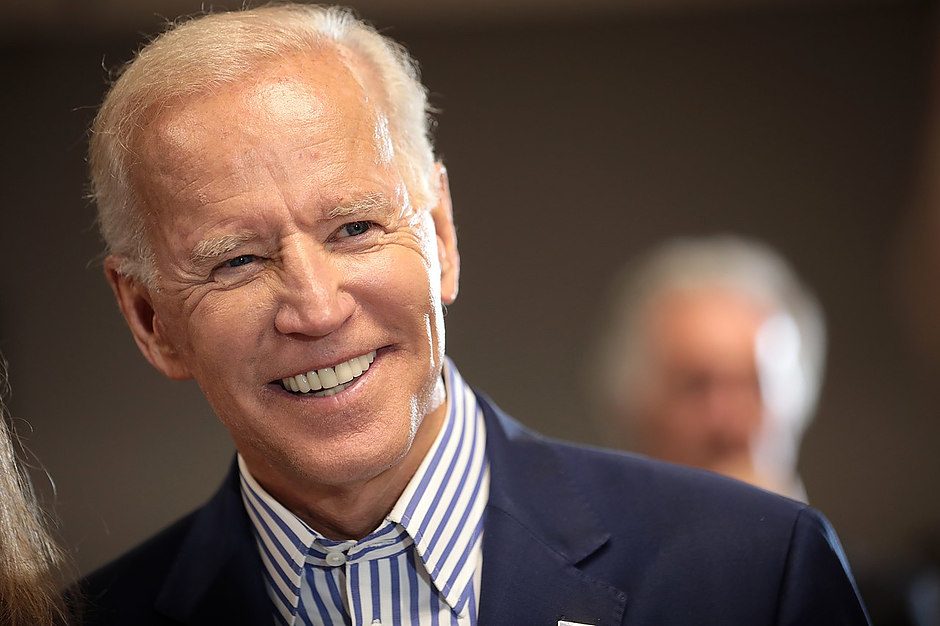

Congress formally certifies Biden's victory

Notes/Observations

- US Congress formally certified electoral votes and declared Joe Biden the winner

- German Nov factory orders beat expectations despite coronavirus restrictions

- ECB expects Q4 GDP to contract

Asia:

- Japan Nov Labor Cash Earnings registered its 8th straight decline (Y/Y: -2.2% v -0.9%e)

- Australia Nov Trade Balance: A$5.0B v A$6.5Be; Exports M/M: +3% v -2%e; Imports M/M: 10% v 3%e

Coronavirus:

- Total global cases 87.2M (+0.9% d/d); total deaths: 1.88M (+0.8% d/d)

Europe:

- Scotland First Min Sturgeon said to be facing pressure to delay Scottish election planned for May

Americas:

- Senate rejected Trump allies' challenge to Arizona and Pennsylvania election results

- Democrats won both Georgia State Senate runoff elections and now have control of the Senate

- President Trump’s Twitter account was locked for 12 hours on Wed; his Facebook account was locked for 24 hours

- Some Trump admin officials said to considering resigning (National Sec staff and the Dep WH Chief of Staff are said to be among them)

- FOMC Dec Minutes: Economic activity and employment continued to recover but remain well below early 2020 levels; Officials feel the current pace of bond buying is appropriate. Increased challenges for economy in coming months due to COVID-19 surge

SPEAKERS/FIXED INCOME/FX/COMMODITIES/ERRATUM

Equities

Indices [Stoxx600 +0.29% at 407.58, FTSE -0.36% at 6,817.09, DAX +0.63% at 13,979.35, CAC-40 +0.44% at 5,655.57, IBEX-35 -0.33% at 8,323.00, FTSE MIB +0.03% at 22,740.50, SMI -0.45% at 10,699.20, S&P 500 Futures +0.42%]

Market Focal Points/Key Themes: European indices open higher across the board but later turned around to trade mixed; reports through the morning of rising covid cases in the wake of year-end holidays sap risk sentiment; materials and engery sectors among those leading to the upside; underperforming sectors include consumer discretionary and technology; Bayer confirms collaboration with CureVac; EnLabs to be acquired by Entain; Veolia intends to file for 70.1% stake in Suez; earnings expected during the upcoming US session include Micron Technologies, Walgreens Boots and Bed Bath & Beyond

Equities

- Consumer discretionary: Saint-Gobain [SCO.FR] +6% (prelim sales), Delivery Hero [DHER.DE] -1.5% (capital raise), Ryanair [RYA.UK] -3% (traffic cut), Mitchells & Butlers [MAB.UK] -5% (trading update)

- Healthcare: Bayer [BAYN.DE] +2% (agreement with Curevac)

Speakers

- ECB Economic Bulletin noted that the latest data and survey suggested that Q4 GDP was seen contracting

- German Chancellor Merkel stated at a CSU party even that the most difficult time of the pandemic had yet to come

- Spain Econ Min Calvino: Domestic economy had a positive trend in Q4 despite 2nd wave of pandemic and was sure the economy would experience growth in 2021

- Japan PM Suga formally declared a State of Emergency for Tokyo and three other prefectures to curb spread of conoravirus; effective between Jan 8th through Feb 7th

- Japan MOF official: Closely watching market movements

- US Congress formally certified electoral votes and declared Joe Biden the winner (**Note Both House and Senate previously rejected Trump allies' challenge to Arizona and Pennsylvania election results)

- White House official Scavino: President Trump says there will be an orderly transition on Jan 20th

Currencies/Fixed Income

- USD moved off its multi-year lows aided by the recent pick-up in Treasury yields

- EUR/USD moved back below the 1.23 level as surging Covid-19 cases and lockdown measures seen contracting Q4 GDP growth in the region.

- Higher US Treasuring yield supported the USD/JPY pair as it recovered to test 103.40 area

- Government bond issuance remained heavy in the Euro Zone as Spain and France conducted their respective first bond auctions of the year

Economic Data

- (DE) Germany Nov Factory Orders M/M: +2.3% v -0.5%e; Y/Y: 6.3% v 2.1%e

- (SE) Sweden Dec PMI Services: 56.6 v 58.3 prior (7th month of expansion); PMI Composite: 58.9 v 58.8 prior

- (CH) Swiss Nov Real Retail Sales Y/Y: 1.7% v 4.3% prior

- (HU) Hungary Nov Retail Sales Y/Y: -0.8% v -2.0% prior

- (AT) Austria Dec Wholesale Price Index M/M: 1.2% v 0.3% prior; Y/Y: -2.7% v -3.8% prior

- (BR) Brazil Dec FIPE CPI (Sao Paulo) M/M: 0.8% v 1.0%e

- (TW) Taiwan Dec CPI Y/Y: 0.1% v 0.1%e; CPI Core Y/Y: 0.7% v 0.8%e; WPI Y/Y: -5.1% v -5.9% prior

- (HK) Hong Kong Nov Foreign Reserves: $491.6B v $486.0B prior

- (DE) Germany Dec Construction PMI: 47.1 v 45.6 prior

- (SG) Singapore Dec Foreign Reserves: $362.3B v $352.6B prior

- (PL) Poland Dec Preliminary CPI M/M: 0.1% v 0.3%e; Y/Y: 2.3% v 2.6%e

- (CZ) Czech Dec International Reserves $165.8B $162.5B prior

- (UK) Dec Construction PMI: 54.6 v 54.6e (7th month of expansion)

- (EU) Euro Zone Dec Advance CPI Estimate Y/Y: -0.3% v -0.2%e; CPI Core Y/Y: % v 0.2%e; CPI M/M: 0.3% v 0.3%e

- (EU) Euro Zone Nov Retail Sales M/M: % v -3.5%e; Y/Y: % v 0.9%e

- 0 (EU) Euro Zone Dec Economic Confidence: 90.4 v 89.8e; Industrial Confidence: -7.2 v -8.6e; Services Confidence: -17.4 v -15.0e; Consumer Confidence (final):

-13.9 v -13.9 prelim

- (IT) Italy Dec Preliminary CPI M/M: 0.3% v 0.2%e; Y/Y: -0.1% v -0.2%e

- (IT) Italy Dec Preliminary CPI EU Harmonized M/M: 0.2% v 0.3%e; Y/Y: -0.3% v -0.3%e

- (CN) China Dec Foreign Reserves: $3.2165T v $3.200Te

- (CY) Cyprus Dec CPI M/M: % v 0.5% prior; Y/Y: % v -0.6% prior

Fixed income Issuance

- (ES) Spain Debt Agency (Tesoro) sold total €552B vs. €5.0-6.0B indicated range in 2024, 2026 and 2050 SPGB Bonds

- Sold €2.58B in 0.25% July 2024 bonds; Avg yield: -0.501% v -0.103% prior; Bid-to-cover: 1.85x v 2.26x prior

- Sold €1.03B in 0.00% Jan 2026 SPGB; Avg Yield: -0.407% v -0.414% prior; bid-to-cover: 3.51x v 2.00x prior

- Sold €1.92B in 1.00% Oct 2050 SPGB Avg Yield: 0.854% v 1.091% prior; bid-to-cover: 1.62x v 1.25x prior

- (ES) Spain Debt Agency (Tesoro) sold €486M vs. €250-750M indicated range in 0.70% Nov 2033 Inflation-linked bonds; Real Yield: -0.856% v -0.392% prior; Bid-to-cover: 2.16x v 1.95x prior

(FR) France Debt Agency (AFT) sold total €11.0B vs. €9.5-11.0B indicated range in 2030, 2040 and 2052 bonds

- Sold €4.998B in 0.00% Nov 2030 Oat; Avg Yield: -0.33% v -0.38% prior; Bid-to-cover: 1.92x v 2.36x prior

- Sold €2.999B in 0.50% May 2040 Oat; Avg Yield: +0.10% v 0.17% prior; bid-to-cover: 2.01x v 1.99x prior

- Sold €2.998B in 0.75% May 2052 Oat; Avg Yield: 0.37% v 0.43% prior; Bid-to-cover: 2.40x v 1.81x prior

- (SE) Sweden sold SEK20.0B vs. SEK20.0B indicated in 3-month bills; Avg Yield: -0.1800% v -0.2681% prior; Bid-to-cover: 1.61x v 2.98x prior

Looking Ahead

- 05:30 (HU) Hungary Debt Agency (AKK) to sell Bonds

- Sells HUF in 1.50% Aug 2023 bonds; Avg Yield: % v % prior; bid-to-cover: x v x prior

- Sells HUF in 1.5% Apr 2026 bonds; Avg Yield: % v % prior; bid- to-cover: x v x prior

- Sells HUF in 3.25% Oct 2031 bonds; Avg Yield: % v %prior; bid- to-cover: x v x prior

http://www.akk.hu/en/statistics/auction-subscription-and-tap-issue-results/government-bond-auction

- 05:50 (HU) Hungary Central Bank One-Week Deposit Rate Tender

- 06:00 (IE) Ireland Nov Industrial Production M/M: No est v 0.0% prior; Y/Y: No est v -14.9% prior

- 06:00 (ZA) South Africa Nov Electricity Production Y/Y: No est v -2.8% prior; Electricity Consumption Y/Y: No est v -2.5% prior

- 06:30 (CL) Chile Dec Trade Balance: No est v $1.6B prior; Total Exports: No est v $6.2B prior; Total Imports: No est v $4.6B prior

- 07:00 (MX) Mexico Dec CPI M/M: 0.4%e v 0.1% prior; Y/Y: 3.2%e v 3.3% prior; CPI Core M/M: +0.6%e v -0.1% prior

- 07:00 (CL) Chile Nov Nominal Wage M/M: No est v 0.3% prior;; Y/Y: No est v 4.0% prior

- 07:00 (IN) India 2021 GDP Annual Estimate Y/Y: No est v 4.2% prior

- 07:30 (US) Dec Challenger Job Cuts: No est v +64.8K prior; Y/Y: No est v 45.4% prior

- 08:00 (PL) Poland Dec Official Reserves: No est v $144.4B prior

- 08:30 (US) Initial Jobless Claims: 803Ke v 787K prior; Continuing Claims: 5.10Me v 5.219M prior

- 08:30 (US) Nov Trade Balance: -$67.3Be v -$63.1B prior

- 08:30 (CA) Canada Nov Int'l Merchandise Trade: -3.5Be v -3.8B prior

- 10:00 (US) Dec ISM Services Index: 54.5e v 55.9 prior

- 10:00 (CA) Canada Dec Ivey Purchasing Managers Index (seasonally adj): No est v 52.7 prior; PMI (unadj): No est v 52.4 prior

- 10:00 (MX) Mexico Central Bank (Banxico) Dec Minutes

- 11:30 (US) Treasury to sell 4-Week and 8-Week Bills

- 14:00 (AR) Argentina Nov Industrial Production Y/Y: No est v -2.9% prior

- 18:00 (KR) South Korea Nov Current Account Balance: No est v $11.7B prior

- 18:30 (JP) Japan Nov Household Spending Y/Y: -1.0%e v +1.9% prior

- 20:00 (PH) Philippines Nov Trade Balance: No est v -$1.8B prior; Exports Y/Y: No est v -2.2% prior; Imports Y/Y: No est v -19.5% prior

- 22:30 (JP) Japan to sell 3-Month Bills

- 22:35 (JP) Japan to sell 30-year JGB bonds

Author

TradeTheNews.com Staff

TradeTheNews.com

Trade The News is the active trader’s most trusted source for live, real-time breaking financial news and analysis.