Conference Board Consumer Confidence rockets to 12-month high, dollar follows

- March confidence soars to 109.7, highest in a year.

- Indexes for Present Situation and Expectations also jump.

- Payrolls and vaccination provide economic and social optimism.

- US Treasuries sink, yields and dollar move higher.

Americans are unaccustomed to long periods of depression and restraint.

The combination of widespread vaccination, a reviving labor market and the stimulus sweetener has brought consumer optimism to its highest levels since the pandemic arrived last winter.

The March reading on Consumer Confidence from the Conference Board rose sharply and unexpectedly to 109.7 from 91.3 in February, far ahead of the 96.9 forecast. Sentiment is now about half-way between the February 2020 score of 132.6 and the April panic low of 85.7.

Reuters

Separate indexes for the Present Situation and Expectations also soared in March, to 110.0 from 89.6 and to 109.6 from 90.9.

Nonfarm Payrolls

The most important ingredient in consumer confidence is employment.

Consumer outlook reached its best pandemic level in October of 101.4 after six months of job restoration had returned employment to about 12.4 million of the 22.4 million laid off in March and April. The lockdowns and social restrictions had decimated lower-wage service jobs..

When November payrolls dropped by more than half to 264,000 from October’s 680,000, consumer optimism plunged almost ten points to 92.9.

California reimposed its lockdown in December and did not lift it again until late January. Other states tightened restrictions in response to rising infection rates and payrolls were hit hard, shedding 306,000 workers in December.

Predictably, confidence dropped along with employment to 87.1, the weakest reading since August’s 86.3.

The unexpected payroll gains of 166,000 in January and 379,000 in February, forecasts had been 50,000 and 182,000, produced commensurate increases in optimism to 88.9 and 91.3 respectively.

Nonfarm Payrolls

Employers are projected to hire or rehire 639,000 workers in March,which would be the best month since October. Given the recent US economic performance the risk is that employment will be even stronger.

Consumers have already given ringing approval to the labor market recovery. If March payrolls boom, likely consumer outlook will also

Vaccination

A second reason for consumer optimism is vaccination.The US has one of the highest availability, distribution and innoculation rates in the world. That success may have finally established hope that the worst of the pandemic will be overcome in the next few months.

Even the current rising counts in several states and dire warnings from the Center for Disease Control, have not been enough to dissuade people that normal life is around the corner.

Stimulus and Retail Sales

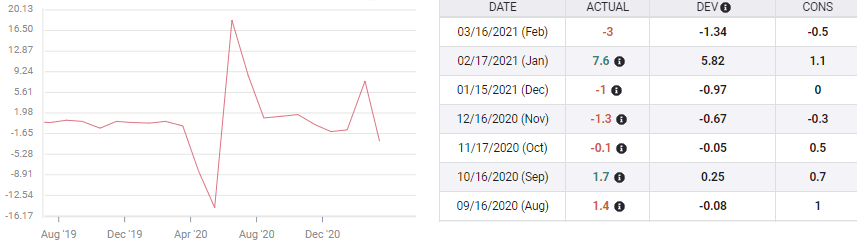

The $600 January stimulus payment to families and individuals translated into a 7.6% jump in Retail Sales, which, except for the May and June post-lockdown splurge, was the largest in over two decades. Sales then reversed in 3% in February as the grants expired.

Retail Sales

The latest $1400 gift, deposited in bank accounts this month, will likely record a second wave of consumption when Retail Sales for March are reported on April 15.

Americans do not mistake consumption, especially from free cash, for an improved labor economy. Optimism did not increase appreciably inJanuary but that does not mean spending free money was not enjoyable.

Conclusion and markets

Markets responded to the unexpected jump in consumer optimism as proof that the US economic outlook is brightening as predicted.

The dollar rose against all the majors as US Treasury rates continued their ascent with the 10-year benchmark trading back above 1.7%.

The euro fell to a five-month low and the USD/JPY reached a 12-month top. Even the USD/CAD, long a laggard at the US party, broke above 1.2620 for the first time in two weeks.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.