Conference Board Consumer Confidence January Preview: Inflation is a shock to the system

- January confidence forecast to drop to 111.8 from 115.8.

- Michigan Consumer Sentiment fell back to 68.8 in January from 70.6.

- December inflation at 7% was the highest in four decades.

- Markets focused on Wednesday’s Fed meeting, not consumer confidence.

Little is more discouraging to consumers than inflation so virulent that prices can be tracked in short term memory. Wasn’t that steak a dollar less last week? Cauliflower is $8 a head, really?

For many of the necessities in an American family budget, the 7% inflation figure of the Consumer Price Index (CPI) borders on black humor.

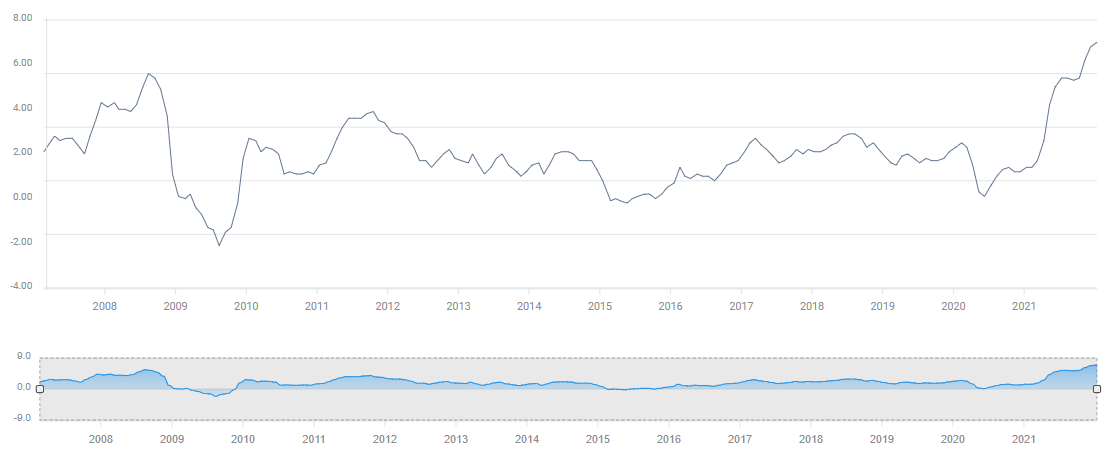

CPI

FXStreet

In the year to December, gasoline rose 49.6%, natural gas for heating and cooking climbed 24.1%, protein–meats, poultry, fish and eggs jumped 12.5%, used cars 37.3% and new cars 11.8%.

Wage increases, once or at most twice a year, cannot make up for this kind of inflation. Even in a labor sellers' market, workers cannot change jobs often enough to keep earnings on par with prices.

Inflation is not only a drain on household and individual budgets, it is a shock to consumers' sensibilities. In the last year before the pandemic, December 2019, gasoline had risen 7.9% in the prior 12 months. Natural gas prices had fallen 3.5%, edible protein had gained 2.3%, used cars were down -0.7% and new cars were 0.1% higher.

No one under 40 was alive the last time prices soared this much in a year. No one much under 60 has any experience in dealing with the frustration and helplessness of having a fixed income eroded by incessant consumer inflation.

Consumer Confidence: Conference Board and Michigan Index

The Consumer Confidence Index from the Conference Board is forecast to fall to 111.8 in January from 115.8 in December. The pandemic low came in April 2020 at 86.9 and it took more than a year for the index to recover to 128.9 in June 2021.

The Michigan Consumer Sentiment Index slipped to 68.8 in January from 70.6. For the last six months the index has averaged 70.3, below the pandemic low of 71.8 from April 2020.

Michigan Consumer Sentiment

FXStreet

Inflation and wages

The Consumer Price Index has been above 5% for seven months, above 6% for the last three and 7% in December. The last time annual price increases were this high was June 1982. Paul Volker at the Federal Reserve had induced the deepest post-war recession with a fed funds interest rate of 20% to eliminate the inflationary psychology that had built up in the economy over the previous two decades.

Annual gains in Average Hourly Earnings (AHE) have been trailing inflation for most of the last past year. The last month when annual wage increases were higher than yearly CPI was March 2021. In December, AHE rose 4.7% with CPI at 7%, the average wage-earner lost 2.3% in purchasing power in 2021.

Retail Sales

Retail Sales held up reasonably well until the fourth quarter despite the erosion of real wages from April on. Sales increased 1.8% in October, 0.2% in November but dropped 1.9% in December, leaving the quarter 0.1% higher, or 0.03% monthly.

Holiday purchases have moved earlier in the year over the past decade as the ease of on-line shopping has been encouraged by sales and bargains in October and November.

It may be that inflationary price restraints made many more people seek out bargains in October. Or it may be normal variation in the wide range of sales results. Over the second half of the year when CPI averaged 6.02%, sales rose 0.12% monthly. In 2019 sales averaged 0.45%, in 2018 they were 0.08% per month.

Conclusion

The astonishingly rapid increase in the rate of inflation last year, 500% from January to December, was the fastest 12-month jump in US records.

Inflation’s impact is not just the practical difficulties of making a family budget with less cash each month, but the debilitating fall from 2019, which had been the best year in a generation for many low and middle wage earners.

When inflation reality is contrasted with the insouciant assurances from the Federal Reserve, President Joe Biden and many others that price increases would be small and transitory, the drain on consumer optimism is understandable.

Consumer confidence could easily be less than expected in January but with markets focused on Wednesday’s Fed meeting, it is doubtful traders would even notice.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.