Conference Board Consumer Confidence December Preview: Where do Americans turn for optimism?

- December confidence expected to rise to 110.8 from 109.5.

- Michigan Consumer Sentiment in December was 70.4, little changed since August.

- Inflation at 6.8% in November, Omicron continues to depress sentiment.

Rampant inflation and the latest pandemic variation should keep the US consumer less than happy this holiday season, even though the unease is not showing up in Christmas shopping.

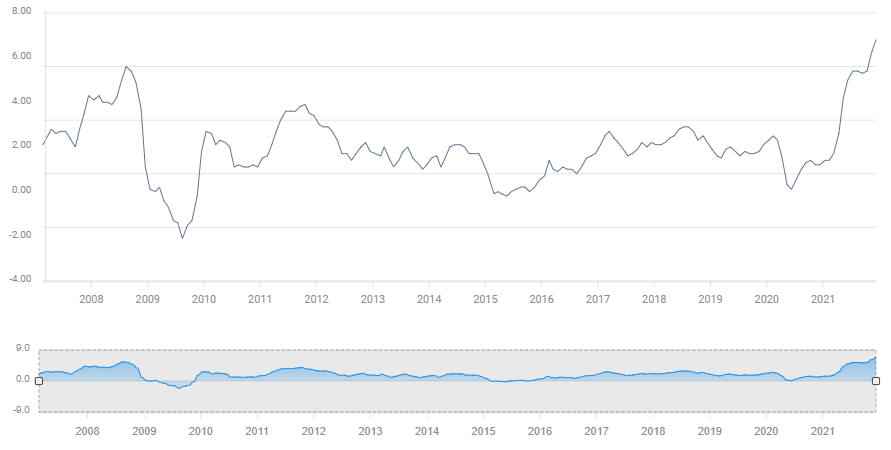

The Conference Board Consumer Confidence Index is expected to rise slightly to 110.8 in December from 109.5 in November. The index was 111.6 in October.

Conference Board Consumer Confidence

Conference Board

The quickly spreading Omicron variant of the COVID pandemic has become the dominant strain in the United States, precipitating a massive increase in cases, though not a proportional number of hospitalizations. Lockdowns and other draconian impositions are not being contemplated by the various state governments responsible but vaccine requirements for stores and restaurants and other public venues have been enacted in some places. It is probably less the direct restrictions which are few, than the dispiriting notice that the pandemic is still with us after almost two years, that is depressing consumer sentiment..

Inflation

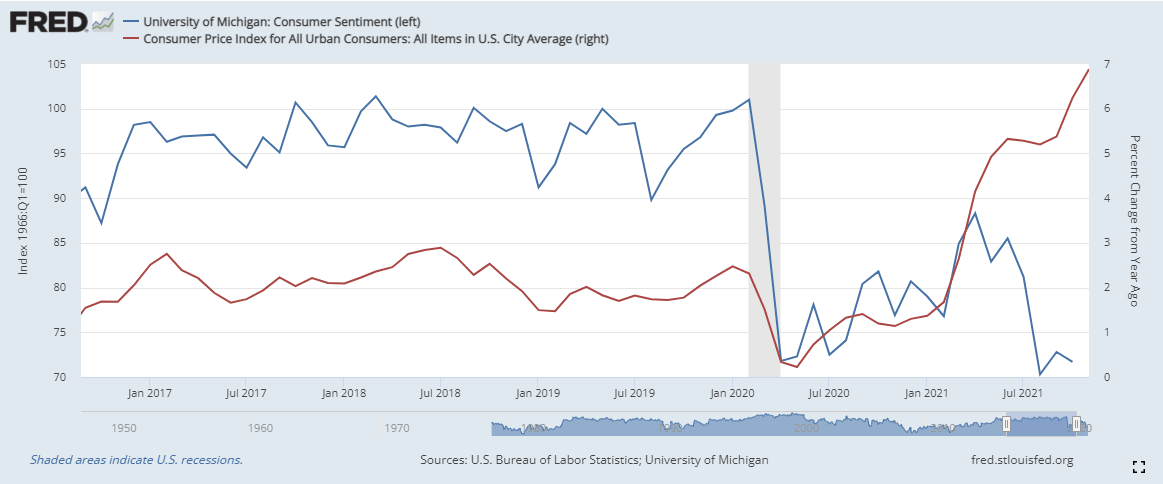

Prices have accelerated this year at the fastest pace in 70 years. From 1.4% in January to 6.8%, eleven months later the Consumer Price Index (CPI) has jumped 4.8 times over.

CPI

FXStreet

For Americans, the cost of many necessities, meat, poultry, gasoline, natural gas and home heating fuel have risen even faster.

In September, October and November average annual CPI was 1.4% higher than the wages gains in Average Hourly Earnings (AHE). In plain terms that means consumers’ purchasing power shrank 1.4% each month.

The Producer Price Index (PPI) , which tracks production costs, rose 9.6% in November, an all-time record. This all but guarantees a string of higher CPI readings in the months ahead.

There is little that is so disorienting and damaging to consumer outlook as rampant inflation. Partly because there is little consumers can do to avoid its ravages. There is no substitute for gasoline and Americans do not drive less when prices soar, they just pay more. Despite the exhortation of Transportation Secretary Pete Buttigieg to buy an electric car, the cost of an electric vehicle is nearly double the price of a traditional car.

For most Americans, inflation is an escalating drain on resources. Prices rise every week, every month. Wages, if they go up at all, are increased at long intervals or perhaps when an individual changes jobs. It is almost impossible for compensation to keep up with the type of inflation Americans are seeing now.

Retail Sales

Consumer spending has held up since the late summer even though CPI has been above 5% from May.

Retail Sales rose 0.9% in August, 0.8% in September and 1.8% in October. The fall burst was likely prompted by fears of product shortages for the holiday season and by ever rising prices. Waiting two months to buy presents in December would just mean paying more.

Sales added 0.3% in November, less than half the 0.8% forecast. The December Retail Sales figures will be released on January 14.

Michigan Consumer Sentiment

Michigan Consumer Sentiment led the plunge in outlook when it dropped to 70.3 in August from 81.2 in July. Since then it has averaged 70.5, a level typical of the range in 2009, 2010, and 2011 during the long recovery from the financial crisis.

Michigan Consumer Sentiment

There are no indications in the Michigan survey that US consumers have restored their good cheer.

Conclusion

Markets will be unmoved by the Conference Board numbers. As is true every month the Michigan data arrives first.

Inflation has the most direct impact on consumer attitudes. With CPI at a four-decade high and headed higher, there is no relief in sight and no reason for consumers' attitudes to improve.

Government officials are again warning about family gatherings at Christmas and President Joe Biden claims severe illness and death awaits the unvaccinated.

Where will Americans turn for optimism?

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.