Coming S&P 500 range breakout

S&P 500 had a risk-off day without breaking down, thanks in no small part to Bessent‘s announcement about an announcement some day next week. While Powell won‘t cut, accommodative messaging is on the table for today, and I look for some kind of verbal assurance coupled with job market focus. China rate cut reaction (clear accommodation) is not a good news for upcoming tariff deal framework that Wall Street would love to see.

Review the weekly and daily S&P 500 chart and sectoral perspectives the way I walked you through in today‘s extensive (9min) video – alongside DAX, winning plays such as BTC, gold and oil performing to expectations (trade plan for gold working out for Trading Signals clients, and oil thus far spent tellingly only a little time above $60 before collapsing again in line with expectations for the following weeks).

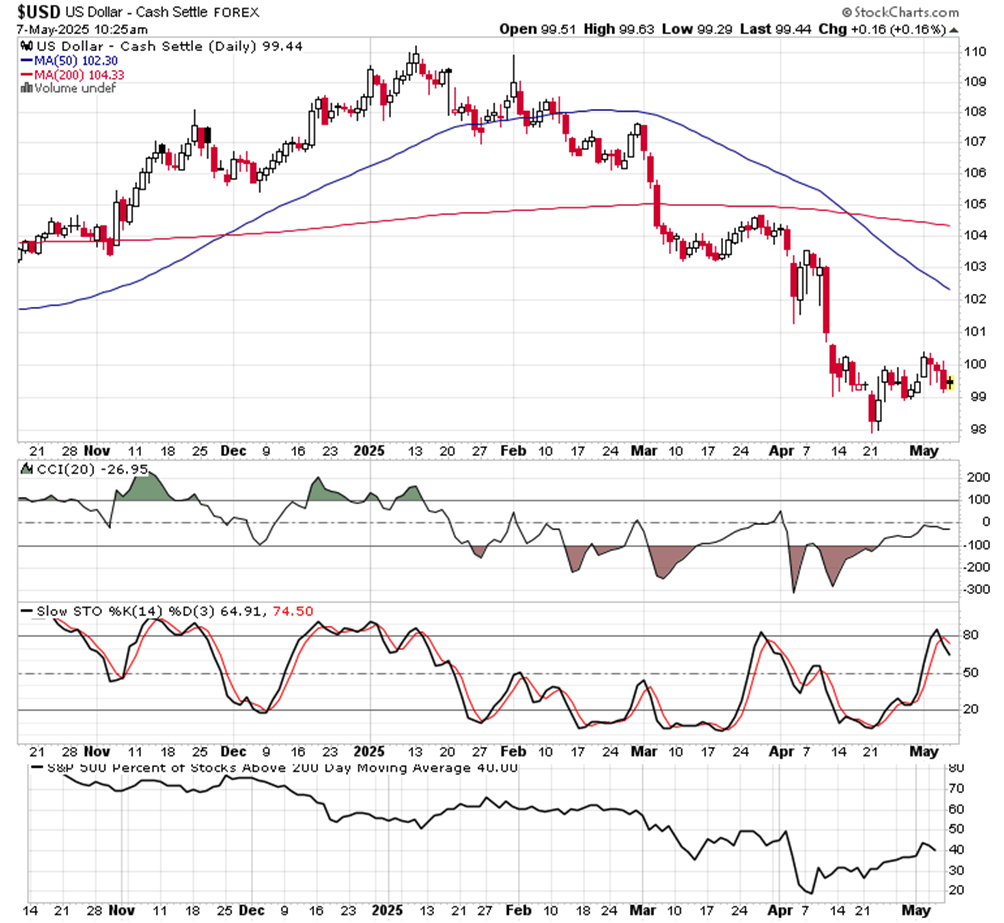

USD is failing to stabilize above 100, and the amount of time spent below this key area of 100-101 is pretty telling as far as those elusive international flows to the States go – look at DAX if in doubt (Merz flush yesterday, but that‘s about it). So much for the S&P 500 trouble in returning above 200-day moving average – are we consolidating or rolling over here? Full details presented below to clients – volatility message is quite clear.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.