Coffee Elliott Wave technical analysis [Video]

![Coffee Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Agriculture/Coffee/coffee-beans-44253278_XtraLarge.jpg)

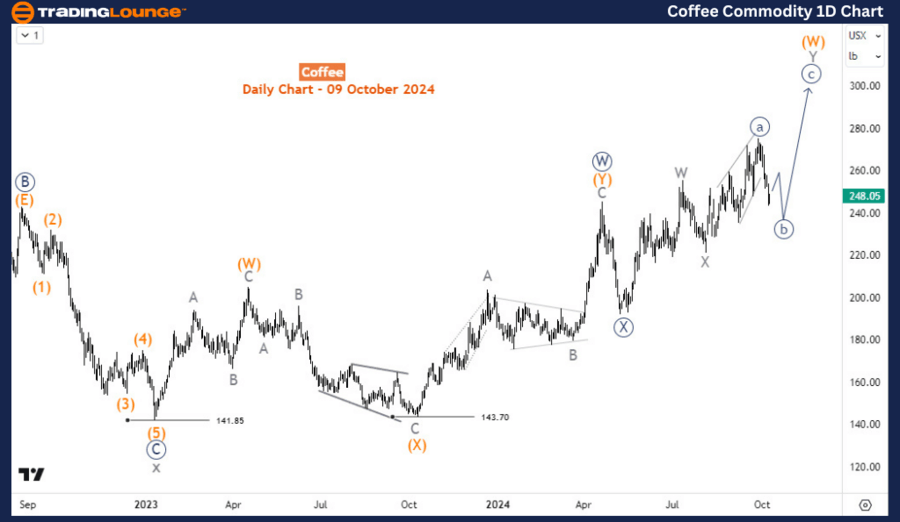

Coffee Elliott Wave analysis

Coffee breached the February 2022 previous high to continue the long-term bullish corrective cycle from May 2019. In the long term, the commodity could reach 317 which is about 28% of the current price level. Thus, buyers might consider buying the dips along this path.

The long-term bullish corrective cycle started in May 2019. Aside from triangles, corrective structures are often subdivided into 3-waves. The first wave ended in February 2022 - cycle degree wave w. A pullback for the cycle degree wave x followed and ended in January 2023. From there, the cycle degree wave y began.

The daily chart captures the wave development of the cycle degree wave y - subdivided into wave ((W))-((X))-((Y)). Wave ((W)) and ((X)) ended already and price is in ((Y)). ALong ((Y)), the price is currently in a pullback for ((b)) of Y of (W) of ((Y)). This summarizes that the upside is still favored for Coffee and prices should make fresh rallies from pullbacks of different degrees.

The H4 chart shows that ((b)) is not yet complete. It’s probably in its 3rd sub-wave i.e. wave (c) of ((b)). While still developing, we are not sure yet how it’s going to end. However, it should finish above 221.2. If the price turns upside and breaches ((a)) high, then the expectation for further rallies from the dip increases significantly.

Technical analyst: Sanmi Adeagbo.

Coffee Elliott Wave analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.