Cocoa Elliott Wave technical analysis [Video]

![Cocoa Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Agriculture/cocoa3-637443210162219163_XtraLarge.jpg)

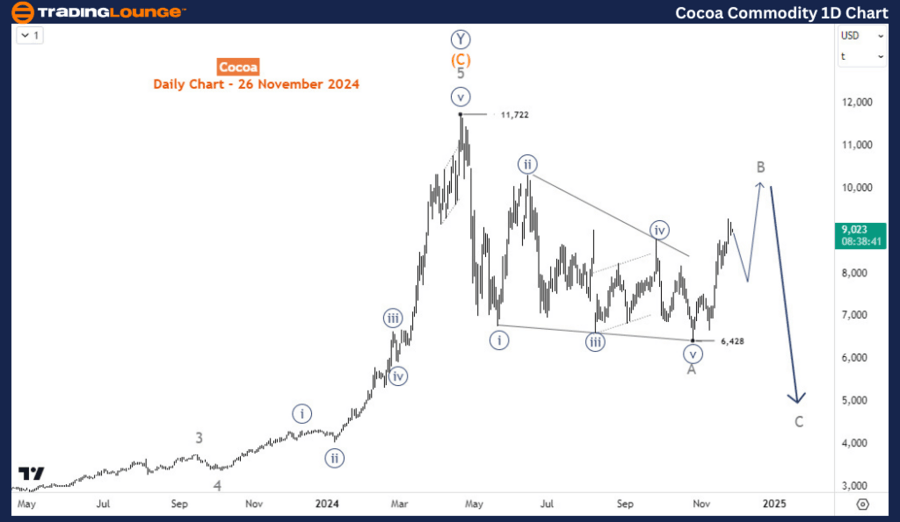

Cocoa Elliott Wave analysis

Cocoa continues to build on the recovery from late October against the April 2024 record high. While the recovery should continue higher, traders shouldn't write off further decline.

Daily chart analysis

From October 2022, cocoa prices rallied in a 5-wave impulse structure from 2198 to a record high of 11,722 in April 2024. From the Elliott wave perspective, a 3-wave correction follows a 5-wave trend in the opposite direction. After the 11722 peak, prices have plunged from April 2024 to October 2024 at 6428. Meanwhile, this decline completed a diagonal structure identified as wave A of the entire correction from 11722. This means traders can anticipate a 5-3-5 zigzag structure. Thus, the current bounce should be wave B emerging into a corrective structure. However, it appears wave B has not yet finished. Following the end of wave B should be another decline for wave C below 6428 toward 5,000. Meanwhile, it’s important to note this forecast for wave C will be valid if the bounce from 6428 completes a corrective structure below 11722.

Four-hour chart analysis

The H4 chart shows the price in wave ((a)) of B. Wave ((a)) is close to completion and should be followed by wave ((b)) correction soon. Meanwhile, one more leg higher should happen for eave ((c)) of B before the decline from 11722 continues lower for wave C.

Cocoa Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.