Cocoa Elliott Wave technical analysis [Video]

![Cocoa Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Agriculture/cocoa1-637443210149250422_XtraLarge.jpg)

Cocoa Elliott Wave analysis

Cocoa market analysis

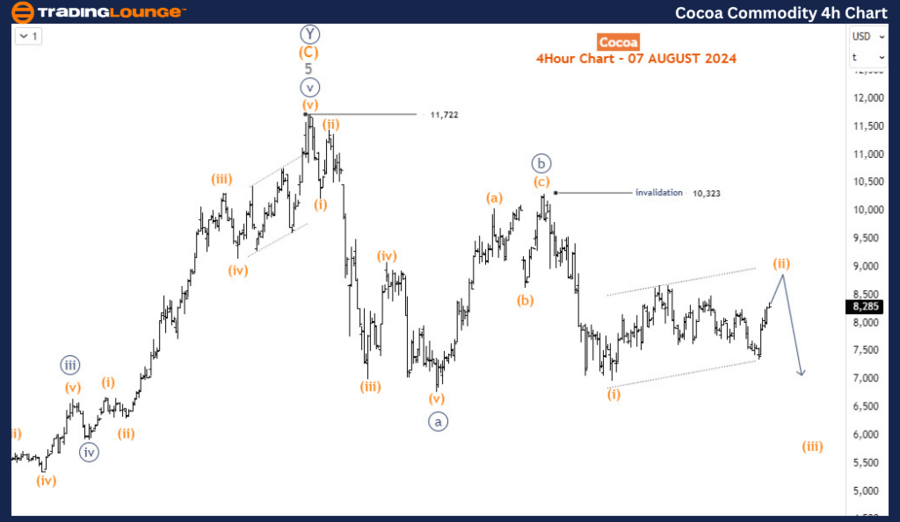

Cocoa prices have seen reduced volatility since July 2024, following significant price swings in June. The commodity is expected to continue its corrective decline from the all-time high of 11,722, which was reached on April 19th.

Daily chart analysis

On the daily chart, cocoa completed a major bullish impulse wave cycle that began in September 2022 when prices were around 2,000. By April 2024, this impulse wave had driven prices up by over 430%, culminating in an all-time high. According to the Elliott Wave theory, the market typically undergoes a three-wave corrective phase after an impulse wave. The current decline from the all-time high is likely part of this corrective phase, unfolding in an a-b-c wave pattern.

In this structure, waves a and b (circled) have already been completed, and the price is now in wave c. This wave c is projected to extend lower, potentially reaching 5,000 or below before the overall bullish trend resumes. This decline aligns with the typical behavior of corrective waves following a strong impulsive move.

H4 chart analysis

The H4 chart provides a detailed view of the sub-waves within the ongoing decline, suggesting a potential 5-3-5 corrective pattern. Within this pattern, wave c is currently progressing through its 2nd sub-wave, wave (ii), which could rally to retest the 9,000 level. As long as this bounce remains corrective and encounters resistance below the 10,323 high, the downtrend is expected to resume, driving prices toward the 5,000 major support level.

Conclusion

Cocoa is in the midst of a corrective phase following a significant bullish run. The expected continuation of the decline, especially if wave c extends as projected, presents opportunities for sellers. Traders should monitor the 9,000 and 10,323 levels for signs of resistance, which could signal the renewal of the downward trend.

Technical analyst: Sanmi Adeagbo.

Cocoa Elliott Wave analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.