CNH: China authorities loosening their grip, but devaluation unlikely

Key points

-

Chinese yuan has depreciated to its lowest levels since November.

-

Chinese authorities have allowed the yuan to weaken by fixing the midpoint for onshore yuan weaker.

-

Reports of bond buying by the Chinese central bank have also underpinned, as these could signal the start of quantitative easing.

-

Broader easing measures are still likely to be delayed until the Fed easing begins.

-

Chinese authorities are unlikely to let yuan weaken steeply with trade tensions rising.

-

But USDCNH has shifted to a higher trading band, and yuan's direction remains tilted towards that of weakness.

China’s economic pressures have continued to deepen, with the housing market struggling, and manufacturing falling short of expectations. The central bank policy stance has also remained accommodative, while most other central banks have been tightening policy.

Still, the yuan has not weakened significantly this year. The onshore yuan has weakened by just over 2% against the USD year-to-date, compared to an over 10% decline in the Japanese yen, a 7% decline in the Korean won and a 5% drop in the Taiwanese dollar.

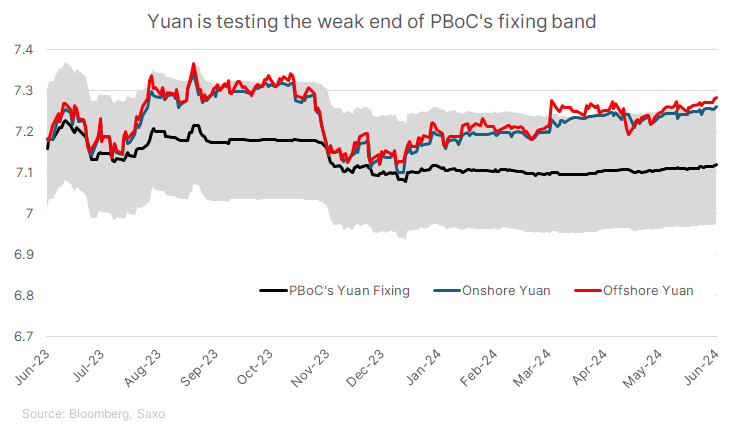

This is because the central bank has maintained a firm grip on the yuan with its daily fixings. The central bank sets the onshore spot midpoint daily and allows it to trade within a +/- 2% range from that level. The offshore yuan (CNH) also closely follows the onshore yuan, although it has traded above the band for much of this year.

Today’s onshore spot midpoint fixing was the weakest since November, with the USDCNY midpoint at 7.1192. This might indicate that the People's Bank of China (PBoC) is willing to let the yuan weaken further to manage depreciation pressure. This has pushed onshore and offshore yuan to their weakest levels since November.

Reports of quantitative easing are also adding to the pressure, with reports suggesting the PBoC might buy its own bonds. However, Pan Gongsheng, the governor of the PBoC, dismissed the idea that this bond trading is a form of massive monetary easing, describing it instead as a liquidity management tool.

Chinese authorities are likely to remain cautious about sudden yuan weakness or devaluation to avoid being tagged as currency manipulators, especially as export restrictions from the US and Europe increase.

Still, market participants are positioned to weaken the yuan at the slightest sign of China expanding its easing measures or loosening its grip on fixings. The yuan's direction remains clear, although the pace of depreciation is likely to be measured. For now, the trading band for USDCNH has likely shifted higher.

Source: Bloomberg. Note: Past performance does not indicate future performance.

Read the original analysis: CNH: China authorities loosening their grip, but devaluation unlikely

Author

Saxo Research Team

Saxo Bank

Saxo is an award-winning investment firm trusted by 1,200,000+ clients worldwide. Saxo provides the leading online trading platform connecting investors and traders to global financial markets.