Chinese Gold demand charted another strong month in April

Despite a rising price, Chinese gold demand remained robust in April.

Strong investment demand more than made up for some weakness in the gold jewelry market.

This continues a trend of gold moving from West to East.

China ranks as the number one gold consumer in the world.

The gold price was up about 5 percent in April in dollar terms. Gold charted a 3 percent gain based on the Shanghai Gold Benchmark. Year-to-date, gold is up about 14 percent in yuan terms. According to the World Gold Council, this is drawing continued attention from local investors.

The Shanghai Gold Exchange reported 131 tons of gold withdrawn in April. Metal moving out of the exchange correlates with Chinese gold demand. Gold withdraws were up 7 tons month-on-month and 10 tons year-on-year.

According to the World Gold Council, investment strength canceled weakness in jewelry demand.

"Anecdotal evidence suggests physical gold investment remained strong amid persistent value preservation needs and the rising gold price, especially during the first half of April. But the gold price strength made many jewelers cautious about re-stocking for the traditional Labour Day holiday sales boost."

According to official data, China imported 85 tons of gold in March (Import data lags reports from the Shanghai Gold Exchange). That was an 8 percent rise month-on-month. This pushed the first quarter gold import total to 324 tons, a 17 percent increase from the same period in 2023. It was the strongest quarter for gold imports since 2015.

A rise in the local premium also indicates strong gold demand. The premium rose to $42 an ounce on a monthly average, up $16 from the previous month.

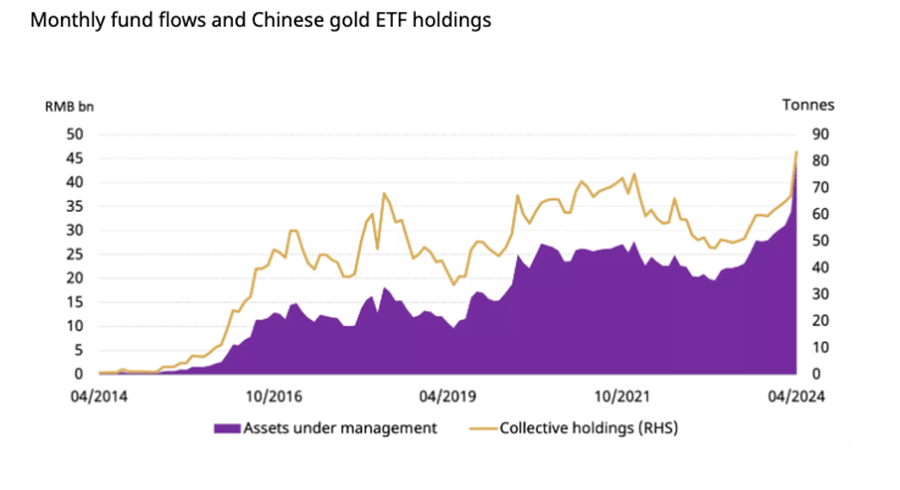

Meanwhile, Chinese gold-backed ETFs saw net inflows of metal for the fifth straight month. This bucks the global trend which is gold flowing OUT of ETFs.

About 9 billion yuan ($1.3 billion) in gold flowed into Chinese funds, a monthly record. Total gold holdings rose by 17 tons in April. Assets under management in Chinese ETFs stand at a historical high of 46 billion yuan ($6.4 billion).

Meanwhile, the People's Bank of China added another 2 tons of gold to its official reserves in April. It was the 18th straight month of gold buying by the Chinese central bank.

China’s official gold holdings now stand at 2,264 tons, and they make up 4.9 percent of its total foreign exchange reserves. That's the highest percentage on record.

China may hold far more gold than it officially reports. As Jim Rickards pointed out on Mises Daily back in 2015, many analysts believe that China keeps several thousand tons of gold “off the books” in a separate entity called the State Administration for Foreign Exchange (SAFE).

It's clear that the Chinese have a strong appetite for gold and they seem to be getting even hungrier.

Chinese, and more generally Asian, gold demand has helped drive the recent gold bull market. Gold has gained about 22 percent since mid-February. According to the World Gold Council, demand will likely remain strong.

"Jewelry consumption may remain weak amid seasonality and the elevated gold price. But despite some signs of weakening, we believe the continuing need for value preservation and gold’s current high profile will likely support gold investment in China."

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

Author

Mike Maharrey

Money Metals Exchange

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.