China’s measured tariff response keeps negotiation hopes alive

China has unveiled a series of retaliatory actions following the implementation of an additional 10% tariff on 4 March by the US. These measures include imposing new tariffs on agricultural products and expanding the Unreliable Entities List to include more companies.

China's retaliatory tariffs hit back on US agricultural exports

The US's tariffs on China have come into effect.

Following the broad-based 10% tariff increase on 4 March, China immediately announced its retaliatory measures.

Effective on 10 March, the following tariffs will be implemented:

-

An additional 15% tariff will be imposed on chicken, wheat, corn and cotton.

-

An additional 10% tariff will be imposed on sorghum, soybeans, pork, beef, aquatic products, fruits, vegetables and dairy products.

Agricultural products as a broader category accounted for around USD 25bn of exports from the US to China in 2024, or around 15% of total exports. This covers more than the roughly 10% of goods targeted in the first round of retaliation measures but is still a relatively muted response compared to the 10% broad-based tariffs implemented by the US.

More companies have been added to the unreliable entities list

China's Ministry of Commerce also announced that 10 new companies were added to the unreliable entities list, which has little immediate impact but opens them up to restrictions, including possible bans on investment and trade with China.

In February, two firms (PVH Corp and Illumina Inc) were added to this list. A point of note is that although there were more companies added to the list this time around, the companies featured on the list are mostly concentrated in sensitive industries such as aviation and defence. This round of new additions has thus far avoided the escalatory scenario where the key mega-cap US conglomerates with a heavy reliance on the Chinese market would be targeted.

It's possible that if we see a negotiation breakdown, companies on the Unreliable Entities list could start to face restrictions in their business dealings with China, so this list remains worth monitoring.

Restraint in retaliation keeps negotiation on the table, but the path ahead remains narrow

Our initial take is that China's countermeasures are still relatively measured for now. Along with the retaliation to the February tariffs, after both countermeasures have come into play, only around a quarter of US exports to China have been hit with tariffs. The retaliation could have been a lot stronger, and with every further escalation the risks are also rising for a stronger response.

New talks are unlikely to happen over the next week with the Two Sessions kicking off, but with key dates coming in April, markets will continue to monitor if the US and China can finally come to the table before then.

We previously indicated that the fentanyl issue was one where it could be easier to find some common ground for cooperation, but the closer we move toward, the April key windows including the review of China's Phase One Trade Deal purchases, the end of the TikTok ban moratorium, and Trump's "reciprocal tariff" plans, it seems less likely to see smaller piecemeal agreements but rather negotiations for a bigger deal or none at all.

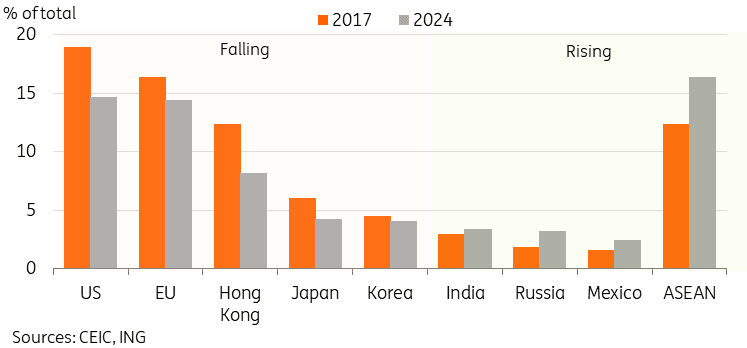

Export reliance on the US has fallen since 2017

Tariff hikes on Mexico could necessitate some export re-routing, but impact on China is likely overstated

From China's perspective, the new 25% tariff hikes on Mexico will also hamper efforts to reroute exports.

Looking at 2024 data, China's exports to Mexico more than doubled compared to the pre-trade war baseline of 2017, rising 150% from USD 36bn to USD 90bn. Exports to Mexico as a percentage of total exports rose from 1.6% to 2.5%. This is comparable to the US case where exports grew by only 21% between 2017 and 2024, and the percentage of total exports fell from 19% to 14.6%.

China's outward direct investment into Mexico also picked up since 2018, with USD 2.6bn of new investments between 2018-23. If tariffs on Mexico end up holding for a longer period, these relocated operations will likely be facing greater headwinds as well.

However, this angle looks a little overplayed relative to its actual impact - outward direct investment into Mexico represented just 0.3% of all outward direct investment for China. The biggest risk for China would be if tariffs start coming into effect on other Southeast Asian economies - China's ODI to ASEAN countries were over 40x what was invested in Mexico in the same time period.

China's outward direct investment has been focused in ASEAN not Mexico

Read the original analysis: China’s measured tariff response keeps negotiation hopes alive

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.