China’s export growth moderates as price competition ramps up

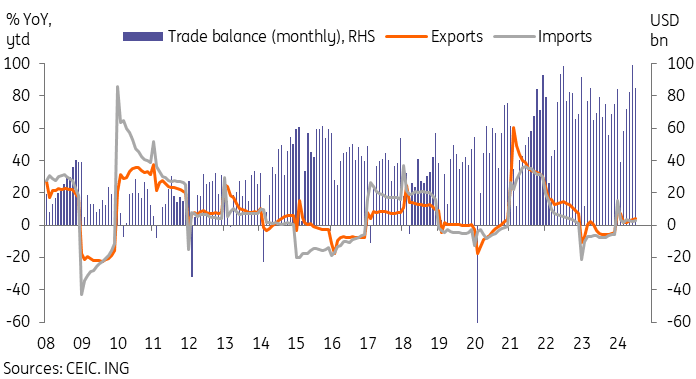

Export growth moderated to a three-month low of 7.0% while imports recovered to a three-month high of 7.2%.

Export growth edges down but Silver linings to be found

Export demand has been stronger than most anticipated through the first half of the year, but markets have monitored recent survey data and the prospect of incoming tariffs as factors that could lead to some moderation of exports and manufacturing in China in the second half of the year. Today's data releases appear to support this theme, though a closer look at the data shows some export categories continuing to build on momentum.

China's export growth slowed to 7.0% year-on-year in July, down from 8.3% YoY which was broadly in line with our expectations, while import growth saw a larger-than-expected rebound to 7.2% YoY. Net, this translated to a smaller trade surplus of USD 84.6bn on the month. This was more or less a reversal of last month's data, where we had seen exports surprise on the upside and imports surprise on the downside.

By export product, export categories saw some divergence over the past month. On one hand, auto exports continued to slow, with year-to-date growth slowing to 18.1% YoY from 18.9% YoY. The slowdown of exports primarily reflected increasing price competition in the electric vehicle sector, as volume growth actually accelerated to 25.5% YoY year-to-date from 25.3% YoY YTD. We continued to see drags from steel (-8.4% YoY YTD), shoes (-5.4% YoY YTD), and mobile phone (-3.7% YoY YTD) exports.

In contrast, exports of household electronics picked up in July, bringing the year-to-date value growth to 15.1% YoY ytd, up from 14.8% YoY ytd. Similar to autos, the price competition can be seen in the disparity of volume growth, which grew by a more impressive 24.6% YoY YTD. Semiconductor export growth also picked up further to 22.5% YoY YTD, as China continues to ramp up capacity in the sector.

By export destination, unsurprisingly growth to ASEAN (10.8% YoY YTD) continued to be the primary area of strength, with Vietnam (22.3%), Malaysia (12.7%), and Indonesia (11.8%) accounting for the bulk of the export strength. The glaring exception among ASEAN countries was the Philippines, where Chinese exports declined -1.6% YoY YTD amid heightened geopolitical tensions. Exports to Latin America also grew strongly by 11.7% YoY YTD, with electric vehicle sales performing strongly in the region. Exports to developed markets remained weak, but saw some marginal improvements over the past month as well, with a smaller contraction of exports to the EU (-1.1% vs -2.6% in 1H24) and Korea (-3.1% vs -3.7% in 1H24), and a slight acceleration of exports to the US (2.4% vs 1.5% in 1H24).

Stronger-than-expected imports led to a lower trade surplus

Imports rebounded by more than expected

After June's unexpected drop in import growth to negative territory, we had expected a return to low single-digit growth in July. The rebound to 7.2% YoY was higher than most market forecasts on the month, and marked a three-month high.

As we have seen in the past few months, import demand remained very much uneven. Many import categories have been in negative territory in the year to date, with contracting imports in auto (-9.3%) and aircraft (-16.8%) sectors amid a boom in domestic industry. We've also seen declines in real estate-related imports with steel (-10.7%) and lumber (-2.9%) imports remaining in negative territory. Agricultural imports of meat (-21.2%), grain (-15.6%) and soybeans (-18.4%) are also down sharply this year.

So where is the strength coming from? The answer is fairly clear. The electric vehicle sector continued to drive import demand so far this year with copper (13.0%) and auto parts (4.4%) seeing positive growth, though momentum could slow if current trends persist. The other big theme that should have more staying power is China's technological self-sufficiency and manufacturing upgrade drive, which has driven strong demand for hi-tech imports (11.9%), semiconductors (11.5%), and automatic data processing equipment (56.7%).

Overall, the details from import product categories indicate that this recovery is not being driven by a recovery of household demand but rather instead reflects the national strategy to drive growth through investing in hi-tech fields and innovation.

Read the original analysis: China’s export growth moderates as price competition ramps up

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.