China’s divergent monetary path: Navigating economic slowdown and policy responses

Similar to some of my more recent posts, we have witnessed another example of divergent monetary policies between Central Banks. While there are many global economies still dealing with stubborn inflationary pressures, The People’s Bank of China (PBOC) has been battling an economic slowdown in the world’s second largest economy. In China, we are seeing a declining real estate sector, increasing debt obligations for Chinese companies, declining trade deals due to a stronger US Dollar, youth unemployment, along with overall slower growth. Their post-Covid recovery is waning. The most recent economic indicators, which were published last week by Benzinga Newswires, illustrated weaker than expected results for both Industrial Production and Retail Sales. The expectations for Industrial Production were for a 4.4% increase, while the actual number was 3.7%. Retail Sales figures were expected to show a 4.5% increase, but the actual number came in at +2.5%.

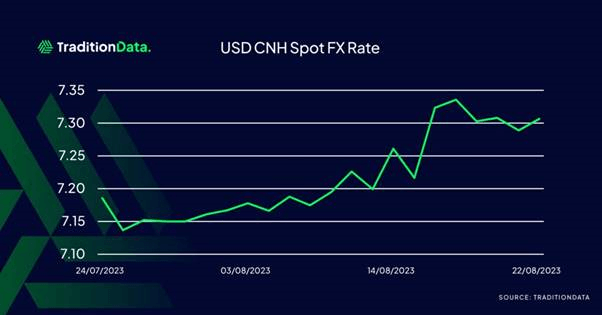

Also last week, the PBOC unexpectedly slashed policy rates again, in an effort to stimulate the economy. Specifically lowering the rate on one-year medium term lending facility loans (MLF), to some financial institutions, in order to help take the pressure off their increasing loan obligations. Following in line with this downturn and reduction in interest rates, the Yuan has weakened by more than 5% against the US Dollar, so far this year. As the attached line chart shows, looking at USDCNH (offshore yuan) FX spot rates for the period from July 24th – Aug 21st, we have seen significant US Dollar appreciation versus CNH. During this last month period alone, CNH has depreciated approximately 2.8% versus US Dollar. USDCNH has gone from an intraday low of 7.1375 (7/25/23) to an approximate intraday high of 7.3450.

In another attempt to stem the downward slide in USDCNH, Reuters reported earlier this week [reuters.com] that China’s major state-owned banks were visible in their efforts to purchase offshore yuan (CNH) against the US Dollar. As you can see from our data in the chart below, there was a short-term rally in the offshore yuan vs US Dollar, sending USDCNH down to a range of 7.2875-90, from the prior day’s range of 7.3100 – 7.3075. There still remains downward pressure on the currency, as economic indicators still point to a further slowdown. But as we have seen with the other global economies, each Central Bank’s monetary policy decisions are data dependent. It will be very interesting to see what the PBOC does to turn this around.

Author

Sal Provenzano

TraditionData

Sal Provenzano Is the FX Product Manager for the TraditionData business and has been tasked with shaping the future of the FX product range.