China wants additional talks before an agreement will be signed

Highlights:

Market Update: Stocks finished the day down on light holiday trading (Columbus Day). The Total World Stock Market ETF (VT) finished down -0.25%. Long-term bond ETFs finished the day up, despite bond markets being closed. TLT finished higher by 0.73%. It appears that the market got ahead of itself regarding the phase one trade agreement with China. Chinese State Media was cited suggesting that China wanted additional talks before an agreement will be signed. Volatility fell and oil dropped -2.03%.

Economic Data: The ECRI weekly leading index is now positive on a year-over-year basis. The four-week moving average is still negative, however, suggesting that the coast is not clear. The move back positive for the weekly leading index is encouraging though. The ECRI WLI is well below its peak.

Long-Term Treasuries: The long-term Treasury ETF rallied yesterday, regaining some of the losses from Friday. Long-term Treasuries remain in a positive trend and are consolidating above a rising 200-day moving average. A breakdown by long-term Treasuries could signal upside in risk assets. However, a break-out to all-time highs could warn of significant downside.

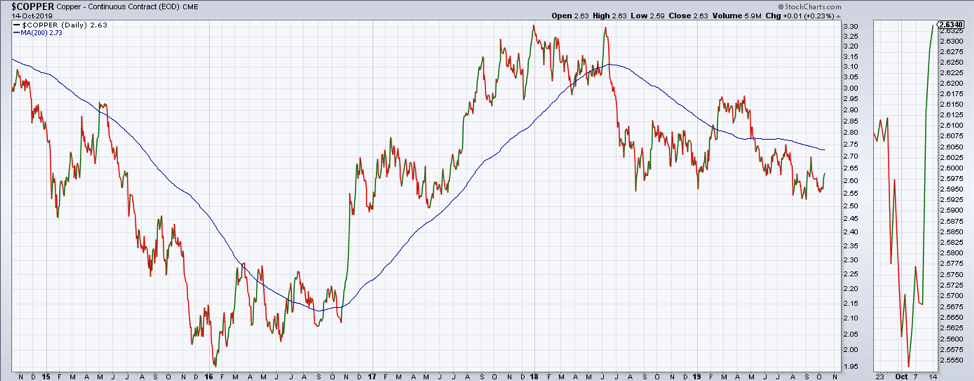

Copper: Copper positively diverged from broad commodities markets yesterday, finishing higher. Copper has recently successfully held support and could be threatening a move higher. A successful breakout above its 200-day moving average could signal a potential rebound in the global economy. Is Copper telling us that the economy has bottomed or is this just a relief rally before the next leg down?

Defense Wins Championships: Defensive factors and sectors remain in positive trends relative to the broad market (SPY). They have been dominant from a performance perspective over the last 12 months and, unless current trends reverse, could continue to be. REITS, utilities, staples, dividend growth, and low volatility all remain above rising 200-day moving averages relative to SPY. If these ratios begin to reverse and breakdown, we would look for a broader cyclical rotation to materialize and economic growth to accelerate.

Chart of the Day: The Crescat guys are out with another great chart. Yesterday, they posted this gem on Twitter, showing the major balance sheet expansion of the Fed in recent weeks. But don’t worry, it is not QE4.

Futures Summary:

News from Bloomberg:

China wants more talks by the end of October to hammer out the details of the "phase one" trade deal touted by President Trump before Xi Jinping agrees to sign it, people familiar said. Beijing may send a delegation led by Liu He, its top negotiator, to finalize a written deal that may be signed by the presidents at the APEC summit next month in Chile.

Syria latest: The Kurds struck a deal with Syrian government forces—a sworn enemy of the U.S. President Bashar al-Assad sent troops to the country's northeast for the first time in years to repel Turkish fighters, while Trump ordered the withdrawal of U.S. troops from the region and said he's " ready to go " with sanctions on Turkey. Germany and France announced they'll stop selling arms to the country. Here's some background on the Syrian Kurds.

WeWork is considering two bailout options to ease its cash crunch, people familiar said. One will hand operating control to SoftBank, further sidelining founder Adam Neuman. And JPMorgan is working on a $5 billion debt deal. The board may meet today to choose between them, the NYT said.

Hunter Biden will step down from the board of a Chinese-backed private equity firm and won't work for any foreign companies if his dad becomes president. He reiterated they never discussed his business activities. Biden told reporters he didn't consult with his son about the decision. Have a look at the wild claims about the Bidens and Ukraine.

U.S. stock-index futures and European shares extended losses on signs a limited trade pact isn't a done deal. Treasury futures climbed, with the market for cash bonds closed for American and Japanese holidays. The yen and gold advanced. Oil tumbled. The pound led declines among G-10 currencies.

Author

Clint Sorenson, CFA, CMT

WealthShield