China Walking Back Trade Deal

Earlier today, CNBC’s Eunice Yoon tweeted that the “mood is pessimistic regarding US-China trade deal being passed; China is trouble after US President Trump said no tariff rollback- Strategy is to talk, but wait for impeachment/election” citing a government source.

Wait….what?? Pessimistic trade deal will be passed? Day after day, haven’t we had President Trump, Director of the National Economic Council Larry Kudlow and United States Trade Representative Robert Lighthizer marching out and telling us that China wants a deal very badly; and that Phase One is very close to being done? Markets initially are looking at this tweet as extremely pessimistic as these are the most negative comments we have seen from a government source regarding the US-China trade deal. Of course, the US can always come out and refute these comments, however the comments allegedly have been made and at least for now there is temporarily some doubt to Phase One.

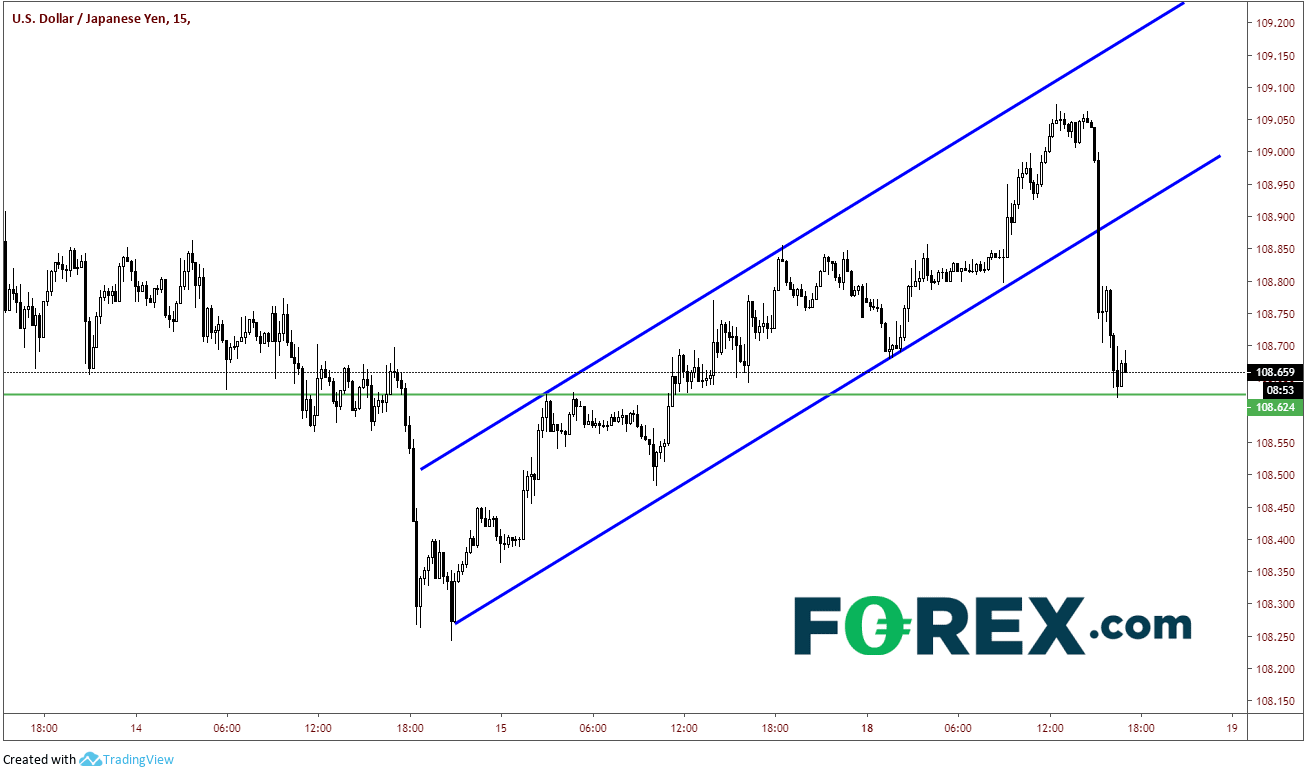

The fx markets did not take kindly to the tweet, and USD/JPY turned to risk off mode, selling off from 109.03 down t 108.65. The pair broker an upward sloping channel on a short-term 15-minute chart and moved down to horizontal support at 108.62.

Source: Tradingview, FOREX.com

Last week we discussed how USD/JPY was ready for a pickup in volatility, as the pair may break higher out of the inverted head and shoulders pattern on a daily timeframe or may break lower out of a rising wedge on the 240-minute timeframe. For the moment, the latter appears to be the case as prices have broken lower. The target for the rising wedge is near 108.00. Price fell as low at 108.25 on Thursday and bounced just above 109 today until the comments came out. A bearish engulfing candlestick was formed at the highs and is creating a very nice potential AB = CD harmonic formation. If this pattern plays out, the target near 108 will also be the target from the rising wedge, as well as the 50% retracement level from the lows on October 3rd to the highs on November 7th. Prices need to get back above today’s highs at 109.07 to negate the pattern.

Source: Tradingview, FOREX.com

One more thing to note is the positioning of Yen from Nov 12th. As my colleague Matt points out in his review of the weekly COT report,

Traders are their most bearish on JPY in 5-months.

What does this mean? It means that traders expect Yen pairs (xxx/jpy) to go higher! And if subscribe to the contrarian theory that traders are wrong at elevated levels, this would indicate that Yen pairs (including USD/JPY) will be moving lower.

As we wait to see if US officials have a rebuttal to the headline, USD/JPY could be on its was to 108.00. And if negative comments from China continue to come out, USD/JPY could end up being much lower.

Author

Forex.com Team

Forex.com