China, like Japan in the 1990s, Will Be Dominated by Huge Zombie Banks

Michael Pettis has some words of wisdom for those who believe China will soon overtake the US as the world leader.

"Having the smaller banks absorbed by the bigger ones, which seems to be Beijing's new strategy, will mean that China, like Japan in the 1990s, will be dominated by huge zombie banks," says Michael Pettis at China Financial Markets in a series of Tweets.

The Tweets were in reference to the Wall Street Journal article Why China’s Smaller Banks Are Wobbling.

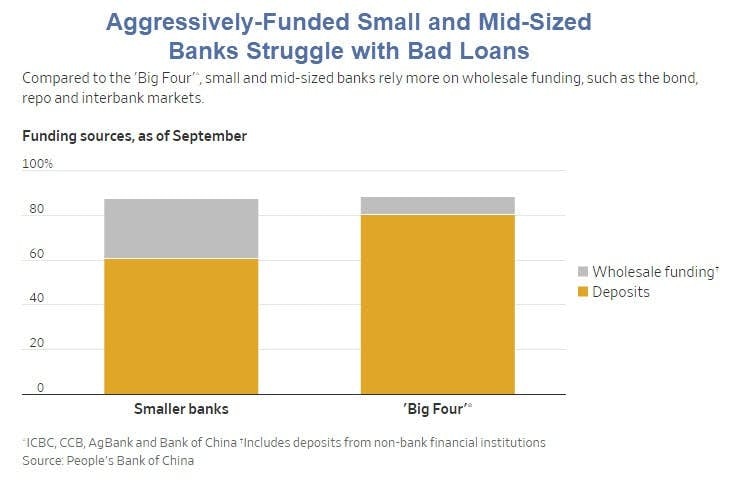

China’s banks come in various flavors. There are a handful of giants, and a few more medium-size banks that can also operate nationally. Below that lies a bigger cohort of city commercial banks, and more than a thousand tiny rural commercial lenders. Both city and rural banks have their roots in local credit unions, and tend to have limited geographic reach. Cracks are emerging at some small and midsize banks after years of rapid growth.

Smaller banks lent liberally to local governments and businesses, and bad debts are rising as China’s economy sputters. Poor governance probably created problems at some banks, too, such as Hengfeng Bank. In late 2017, the official Xinhua News Agency, citing a company statement, said Hengfeng Chairman Cai Guohua was being investigated for “alleged serious violation of discipline and law.”

Possible state intervention depends on how large and important a bank is, and who is backing it. In May, national authorities seized Baoshang Bank, a lender in the northern province of Inner Mongolia that was linked to missing tycoon Xiao Jianhua, calling it a “severe credit risk.” This was the first such takeover in more than two decades. In contrast, a big bank and two bad-loan managers bought stakes in the struggling Bank of Jinzhou from existing shareholders. Industry-watchers expect capital injections to follow.

Many banks aren’t profitable enough to boost capital through retained earnings. And existing stockholders may be reluctant to buy new shares, given questions over reporting and ownership.

Zombification Four Point Synopsis

Forget the Yuan: King Dollar is Here to Stay

Many believe deficit spending will kill the US dollar as a reserve currency and the yuan will take over.

They are wrong. Forget the Yuan: King Dollar is Here to Stay for quite some time. I don't know what the replacement will be if any, but it won't be the Yuan.

The having the reserve currency is actually a curse that no one wants, especially China, but also Trump.

That is correct!

I was discussing from the point of view of what every country wants, however, illogical.

My "correct" is in reference to the first two sentences not the third about impeachment. There should not be a Fed.

Reserve Currency Curse

For further discussion, please see Nixon Shock, the Reserve Currency Curse, and a Pending Dollar Crisis

Meanwhile, negative interest rates are destroying the European banks as noted In Search of the Effective Lower Bound.

The Fed and Central Banks brought this on by refusing to let zombie banks and corporations go under and insisting on cramming more debt into a global financial system choking on debt.

The central banks want to stop "deflation"

Economic Challenge to Keynesians

Of all the widely believed but patently false economic beliefs is the absurd notion that falling consumer prices are bad for the economy and something must be done about them.

My Challenge to Keynesians “Prove Rising Prices Provide an Overall Economic Benefit” has gone unanswered.

BIS Deflation Study

The BIS did a historical study and found routine deflation was not any problem at all.

“Deflation may actually boost output. Lower prices increase real incomes and wealth. And they may also make export goods more competitive,” stated the BIS study.

It’s asset bubble deflation that is damaging. When asset bubbles burst, debt deflation results.

Deflationary Outcome

Central banks’ seriously misguided attempts to defeat routine consumer price deflation is what fuels the destructive asset bubbles that eventually collapse.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc