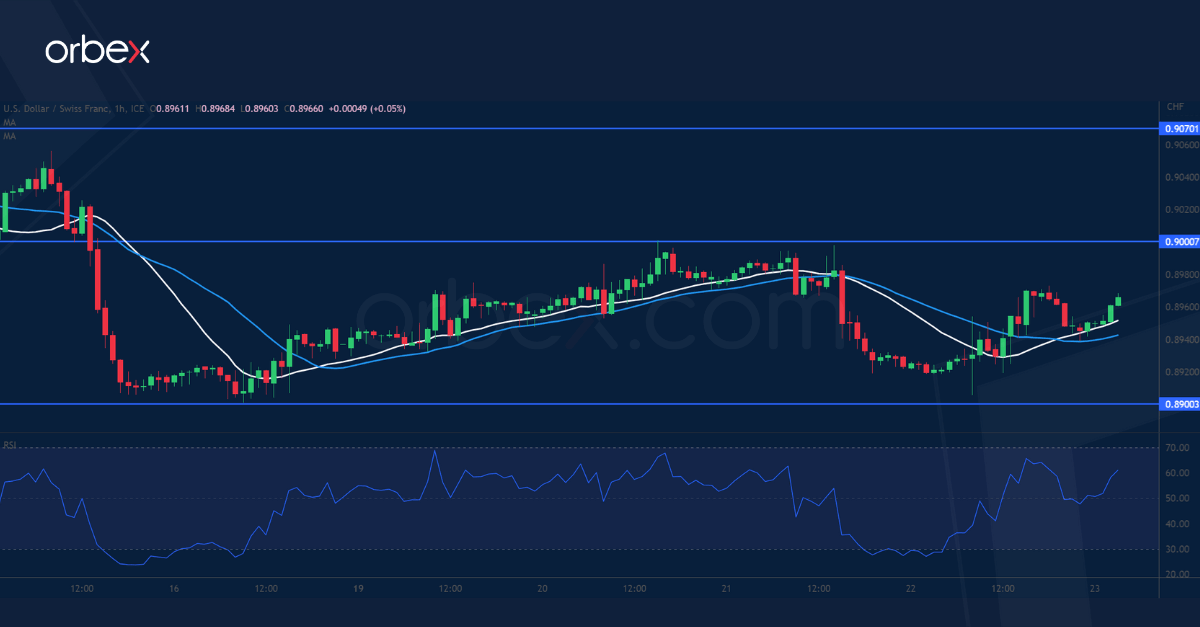

CHF gives up gains

USD/CHF bounces back

The Swiss franc softened as the SNB disappointed with a mere 25 basis point rate hike. A previous rebound came under pressure in the supply zone of 0.9000, which was a sign of a lingering downbeat mood as sellers were eager to fade the rally. The bulls will need to clear this psychological hurdle then 0.9070 before a recovery could materialise. 0.8900 is a fresh support and its breach would invalidate the rebound and send the pair to the May lows around 0.8830, confirming a bearish MA cross on the daily chart in the process.

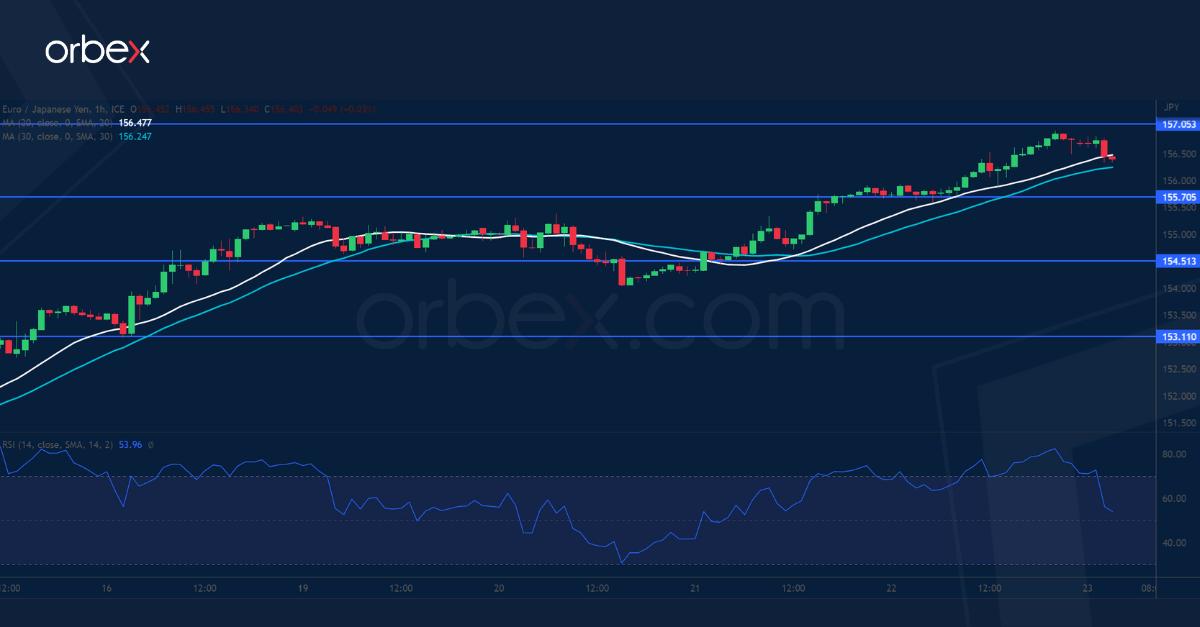

EUR/JPY seeks support

The Japanese yen recouped some losses after May’s CPI beat expectations. The bulls have doubled down after pushing above the previous peak of 155.30, resuming the uptrend with 157.00 as the next milestone ahead. The RSI’s new top in the overbought zone may lead to a temporary pullback, which is likely to meet interest from trend followers. 155.70 is the first support level should the bulls start to take some chips off the table, and 155.00 at the base of the current leg of rally would be a key level to maintain the momentum.

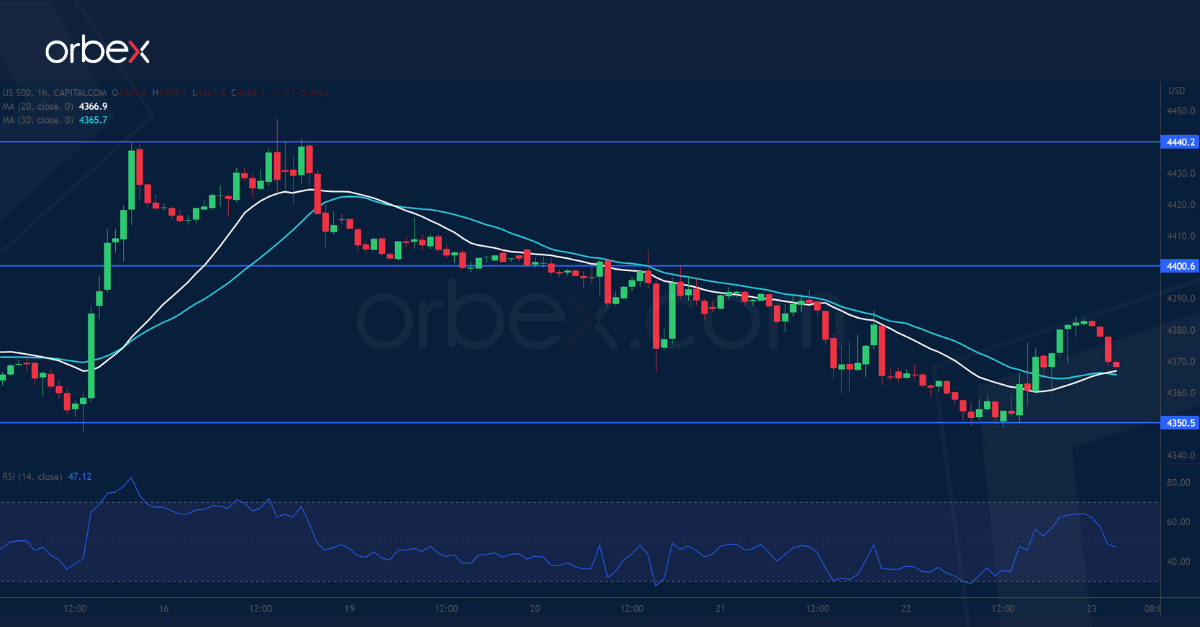

US 500 grinds support

The S&P 500 struggles as Fed Chair Powell defends his hawkish stance on the second day of his testimony. The index is pulling back from its 14-month peak of 4440 and is testing 4350 with the daily RSI dropping back into the neutral area. A bearish breakout would force leveraged long positions to liquidate and cause a correction to 4300 which coincides with the 30-day SMA. Medium-term sentiment remains upbeat and the bulls would be looking for a stable entry point. A close back above 4400 could put the index back on track.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.