Chart of the week: WTI bulls back in charge, taking on a 61.8% retracement

As markets scramble to cover following US President Trump's comments that a cut of up to 10-15M bpd is being touted, as well as prospects of with Saudi Arabia and Russia returning to the negotiating table, the bulls are back in charge. The price of oil has taken an interesting turn on the charts and below we map out the price action and bullish potential, should a 61.8% and key volume area give way.

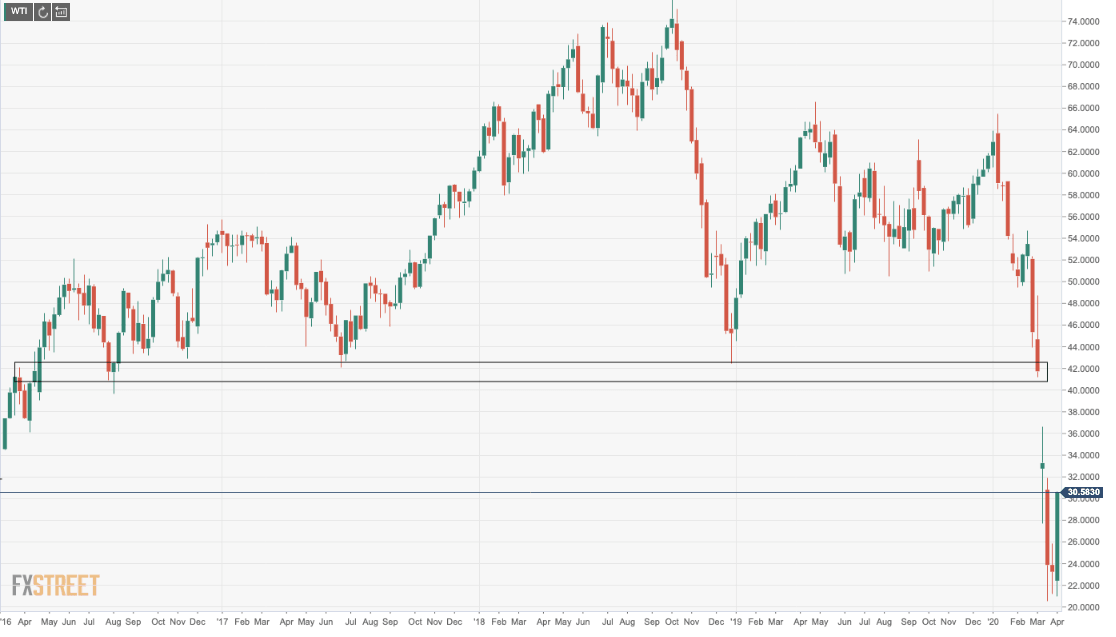

Weekly structure: Bulls seek a close of the gap

The price of oil has been boosted by a broader coalition of OPEC+ countries stepping into to protect support levels to the downside giving way towards $10.00 bbls.

An emergency meeting is expected to take place imminently by video conference, as early as this Monday/Tuesday which should keep prices elevated, especially considering its technical structure, holding above key support.

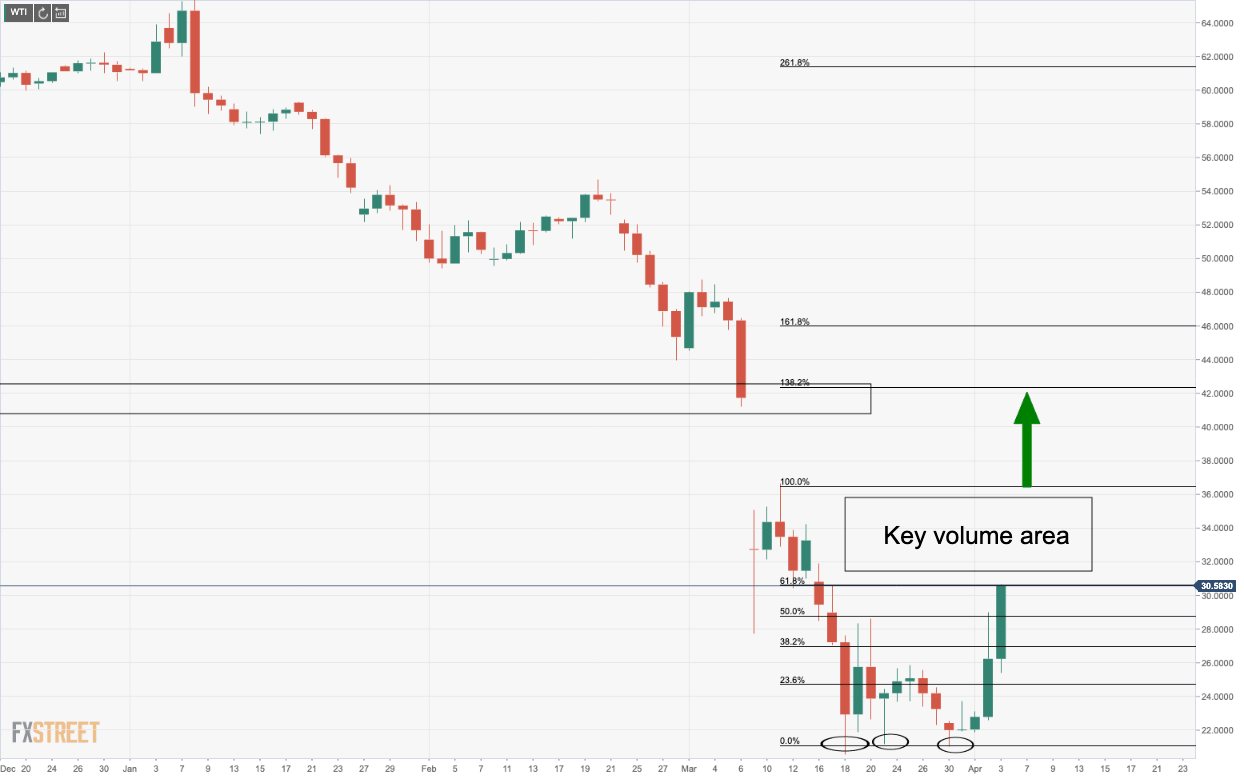

Daily chart: Bulls meet golden ration and high volume area

On a basing formation, the price took off ad sired through the 23.6% Fibo with a positive close above structure after the price met the 50% mean reversion target. The price has met the golden ration and a key volume area as string resistance which meets prior support.

A breakthrough here and hold above the 100% retracement target opens risk of a 138.2% retracement and a close of the gap. However, a phase of consolidation could come into play at this juncture while we await the outcome and further updates.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.