Chart of the week: USD/JPY testing bear's commitments at key resistance, 109.70/80

- USD/JPY is testing a monthly resistance line established in October 2018 and confluence of a 200-week moving average.

- USD/JPY closed above the 50-month moving average, tested and pierced 21-month EMA.

- Failures at this juncture open risk of a 50% mean reversion to 21-week moving average at 108.60/65.

- 4-HR 500/200 moving average cross over in the making, albeit price stalling and RSI below OB territory, 109 to hold initial pullback.

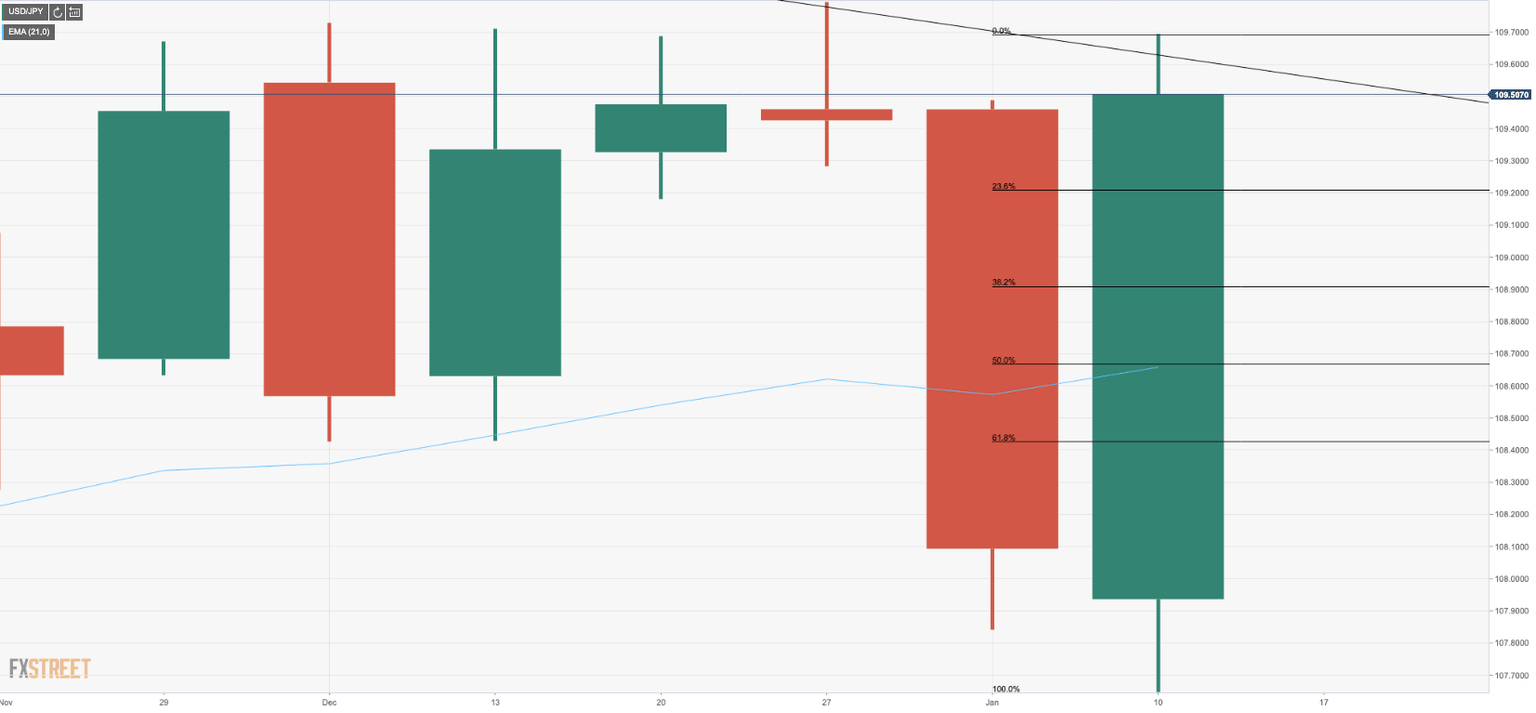

Weekly chart

USD/JPY has surged in recent days to meet a monthly resistance line established in October 2018 that has the confluence of the 200-week moving average, a firm resistance around 109.70/80 which is expected to hold at this juncture, although a break of the resistance would be significant and set the stage for a sustained uptrend.

21-Weekly EMA confluence with 50% mean reversion target

Bears can target a strong correction back to the 21-week EMA on failures below 109 the figure, meeting a 50% reversion point. This also has a confluence of the 200-DMA as seen below:

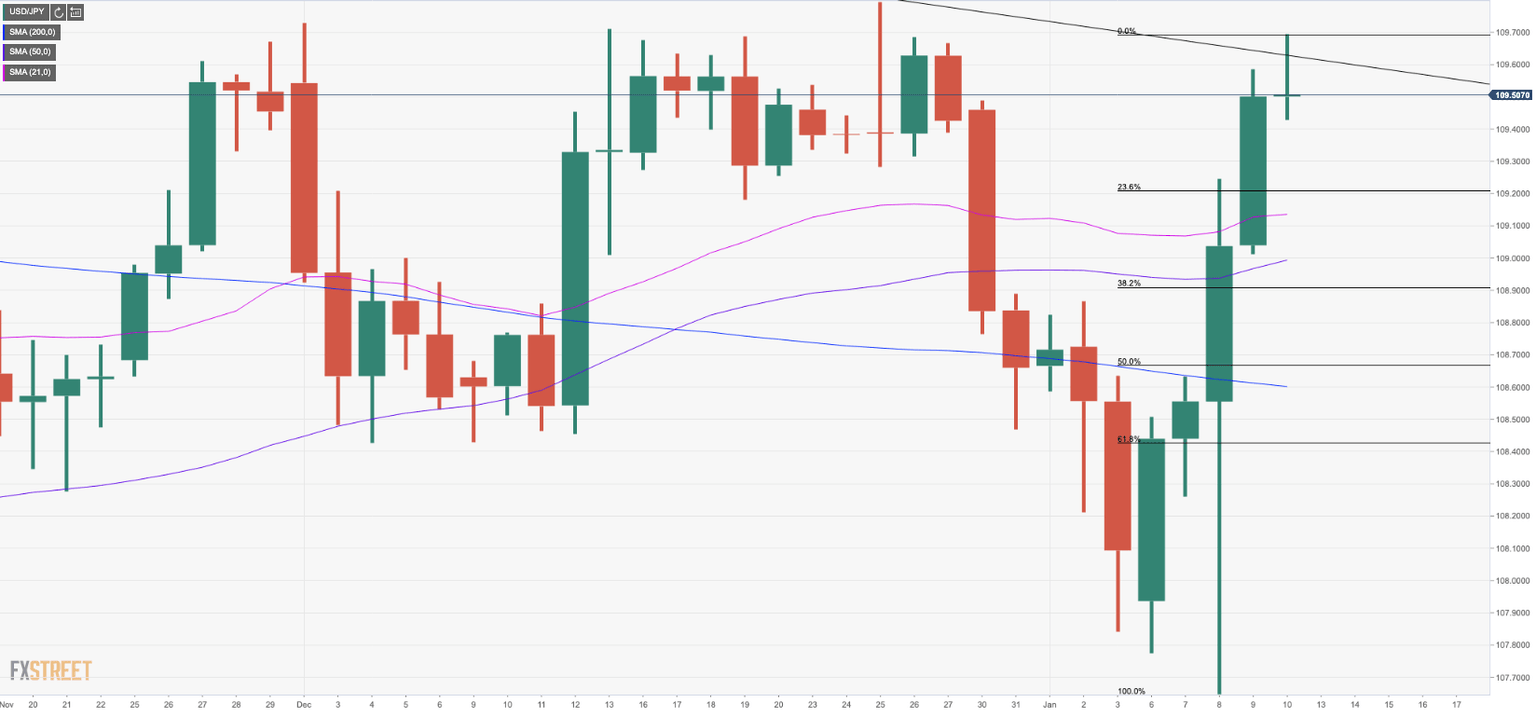

USD/JPY sliced above the 200-DMA

- USD/JPY has comfortably broken through the 200-DMA, flirting with a topside breakout above 109.70 hard resistance with eyes on the 110 handle. However, while the US dollar stalls and geopolitical tensions remain in the driving seat, an imminent breakout is unlikely.

- 109.20 (23.6% Fibo retracement) and the 21-day moving average at 109 the figure (38.2% Fibo 108.90) could be supportive into the highly anticipated so-called, 'phase-one' trade deal signing on the 15th Jan between US and Chinese officials.

4-hour chart showing potential for key moving average cross-over

A golden cross is most commonly referred to a daily 50/200 moving average upside cross over, but it's worth noting on a 4-hour time frame as well and is often a significant development, as confirmation of a strong and ongoing trend. Should it occur on a break and hold above the hard resistance line, then bulls can be more satisfied with a higher conviction long position.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.