- Risk-off flows not supporting yen, bulls in control seeking out the 114 handle.

- Symmetrical Triangle breaking down to the upside, eyes on 112.50s.

- Resistance levels to hold in near-term, ahead of low volume nodes.

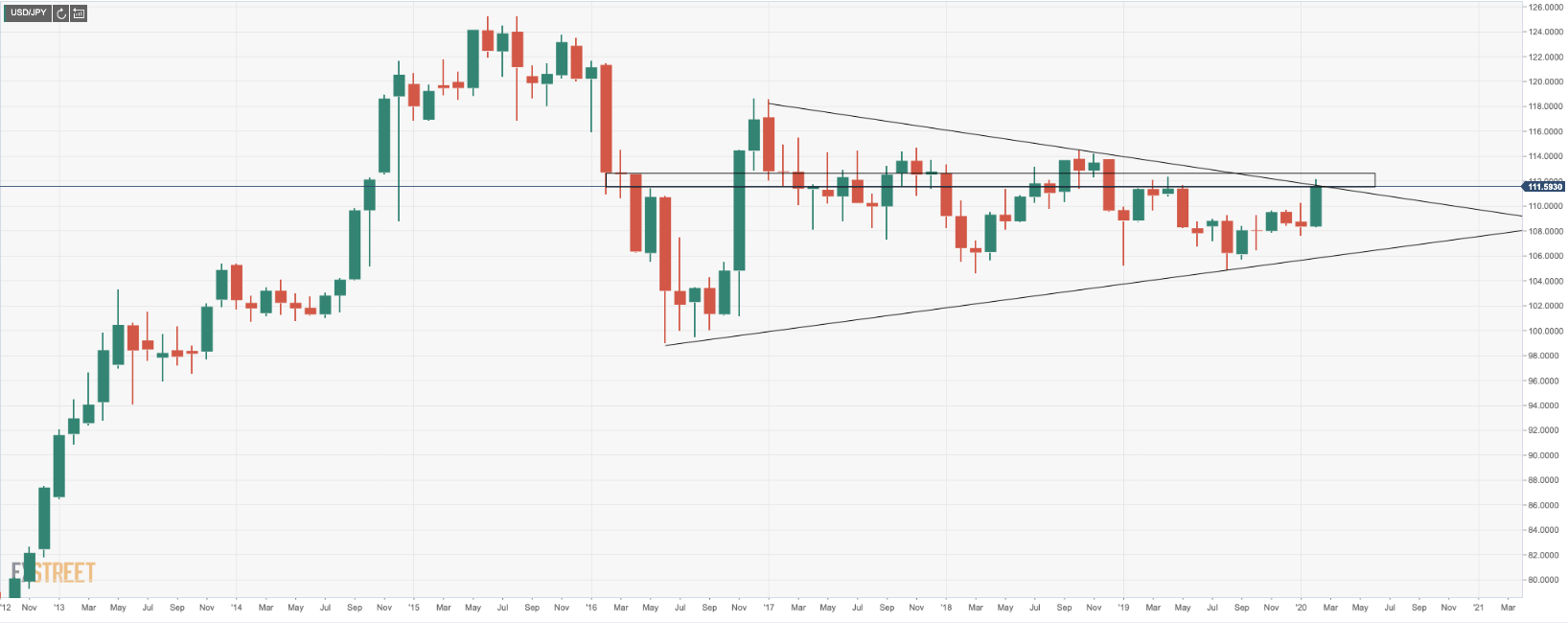

The 2015-2020 downtrend has been taken put and bulls are controlling with a weekly close above 110.31. Bulls can target a run beyond 112.50s for a move towards 114.55, 2018 high.

USD/JPY monthly chart: Symmetrical Triangle

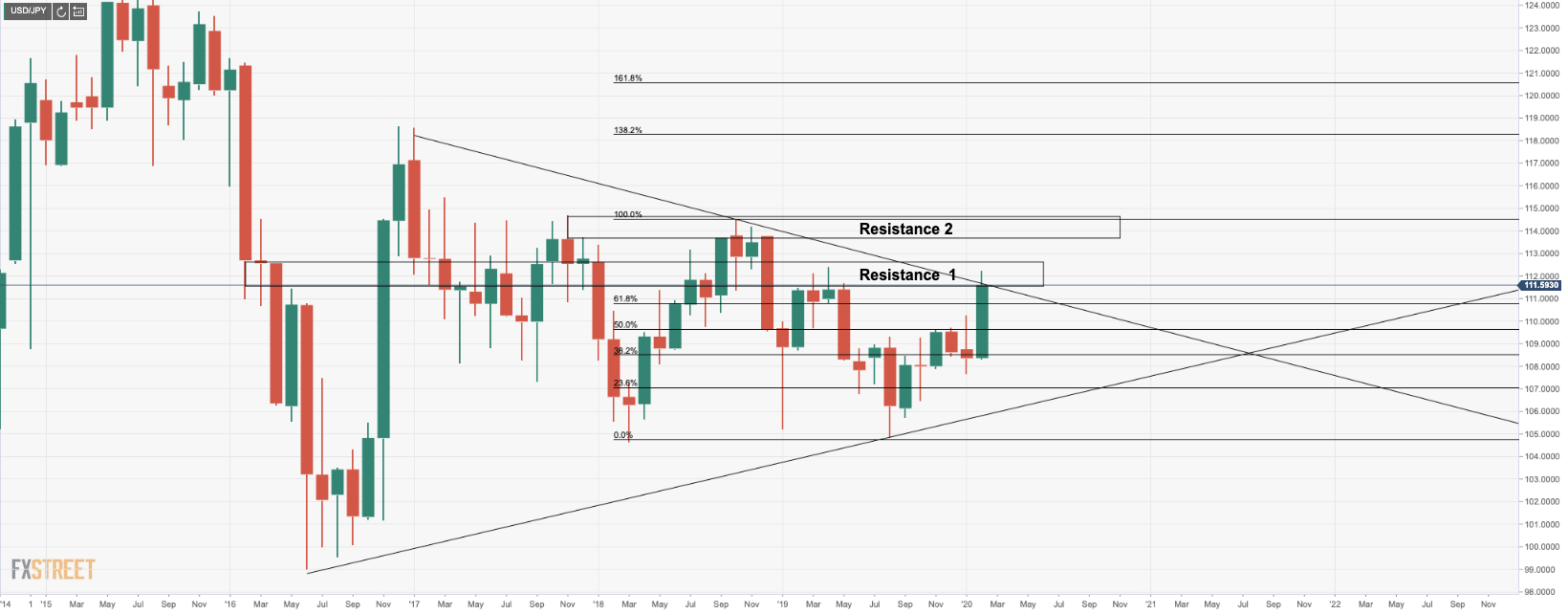

Characterized by two converging trend lines connecting a series of sequential peaks and troughs, the symmetrical triangle (ST) could lead to an extensive breakout, one way or the other, although a critical level of resistance at this juncture will need to give in. We have been here before and 112.50/113.00 has been a high area of acceptance by the bulls and bears, so we could see a period of consolidation prior to extensive gains towards the 114 handle.

Break-out may struggle through two key resistance areas

The 61.8% Fibonacci has been priced and the price is now testing the ST's resistance. Resistance 1 on the chart may lead to a head fake on initial attempts beyond the resistance and then the 112 handle. Resistance 2 will likely hold numerous attempts through the 114.55, 2018 high.

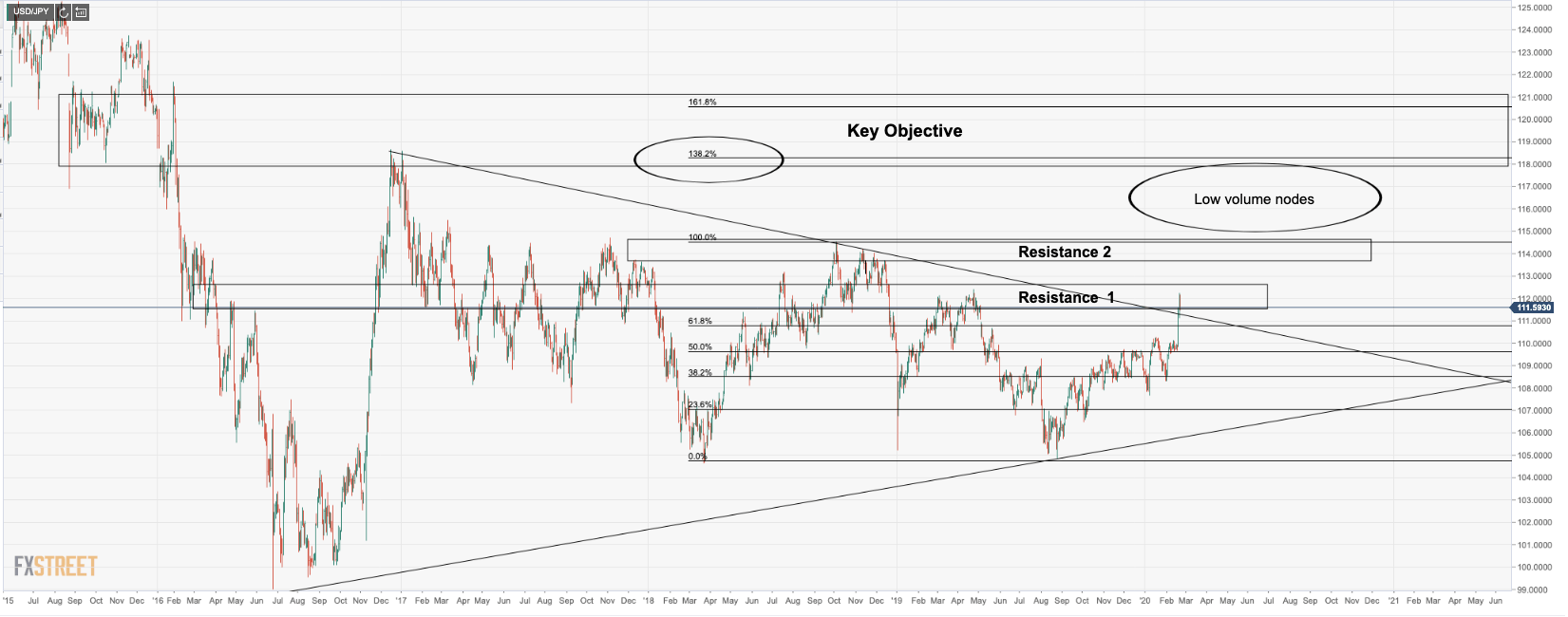

Bulls to target low volume nodes

As far fetched as it may seem, the reality is that the yen correlation to risk-off has been dismantled in recent sessions. Gold has rallied some 6.5% vs the US dollar yet the yen has dropped 3.6% in the same time frame. The coronavirus and economic impact it is seen to have in Asia is the likely reason for an exodus from the yen. On such a foundation, it is more feasible to see USD/JPY rally and should it breach the Resistance 2 on the chart above, according to historic price action, there would appear to be little resistance towards a 138.2% and 116.8% levels, the 'Key Objective' area marked out on the chart above.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD gains ground above 0.6300 ahead of Chinese data

The AUD/USD pair gathers strength to near 0.6325 during the early Asian session on Monday. The uptick of the pair is bolstered by the weaker US Dollar and special plans from the Chinese government to boost consumption and raise incomes.

EUR/USD: A move to 1.1000 re-emerges on the horizon

EUR/USD enjoyed a broadly upbeat run last week, extending its strong recovery and briefly surpassing the 1.0900 handle to reach multi-month highs. Although the rally lost some momentum as the week wore on, the pair still ended with a solid performance on the weekly chart.

Gold: Bulls act on return of risk-aversion, lift XAU/USD to new record-high

Gold capitalized on safe-haven flows and set a new record high above $3,000. The Fed’s policy announcements and the revised dot plot could influence Gold’s valuation. The near-term technical outlook suggests that the bullish bias remains intact.

Week ahead: Central banks in focus amid trade war turmoil

Fed decides on policy amid recession fears.Yen traders lock gaze on BoJ for hike signals. SNB seen cutting interest rates by another 25bps. BoE to stand pat after February’s dovish cut.

Week ahead – Central banks in focus amid trade war turmoil

Fed decides on policy amid recession fears. Yen traders lock gaze on BoJ for hike signals. SNB seen cutting interest rates by another 25bps. BoE to stand pat after February’s dovish cut.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.