Chart of the Week: NZD/JPY and gold bulls taking the reins

- Gold bulls taking the reins from a weekly perspective.

- NZD/JPY bulls looking for a discount and a subsequent daily continuation.

The following analysis looks into the price of gold as well as NZD/JPY.

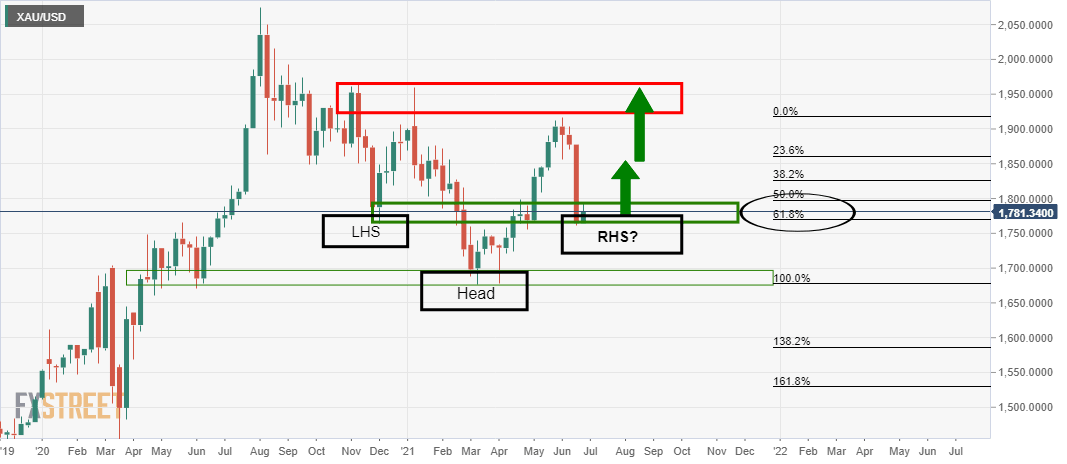

Last week's analysis is still in the process of playing out in the form of a weekly reverse head and shoulders: Chart of the Week: Gold meets critical landmark

Weekly chart, prior analysis

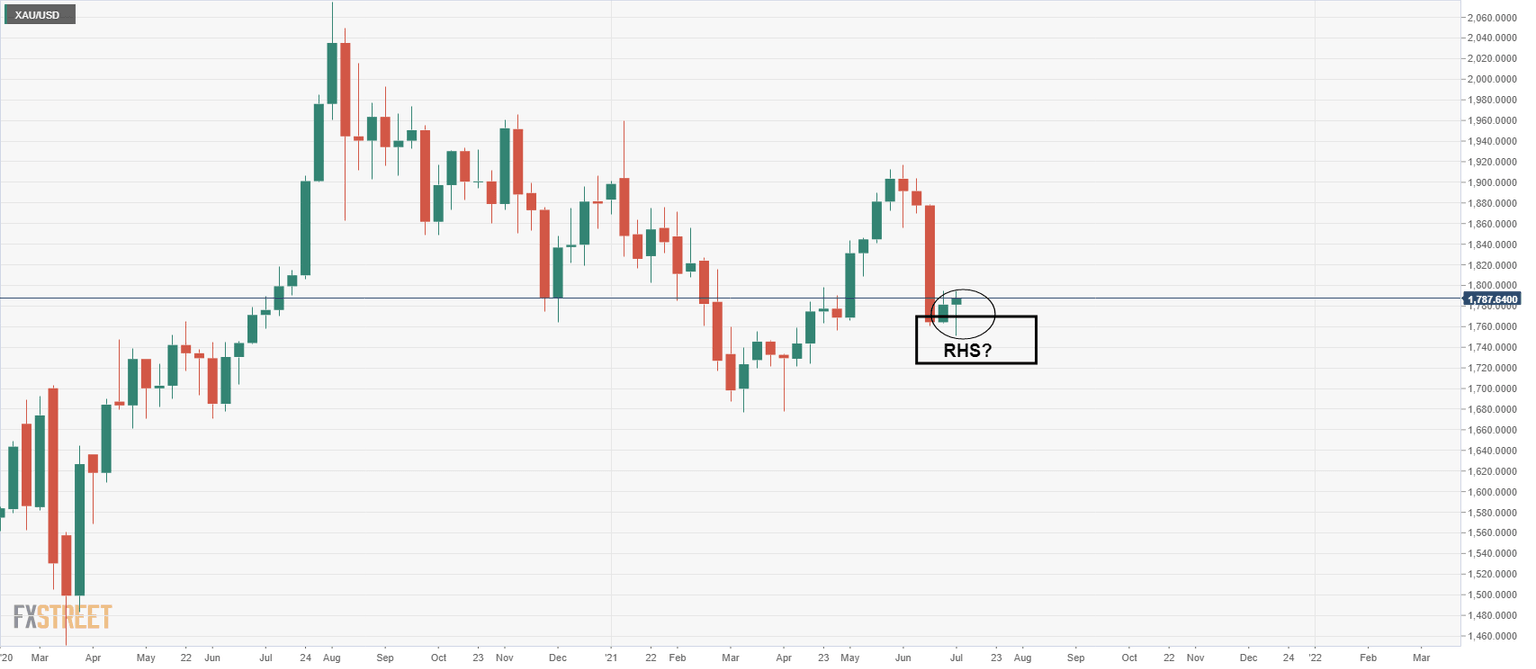

Live market, positive weekly progress

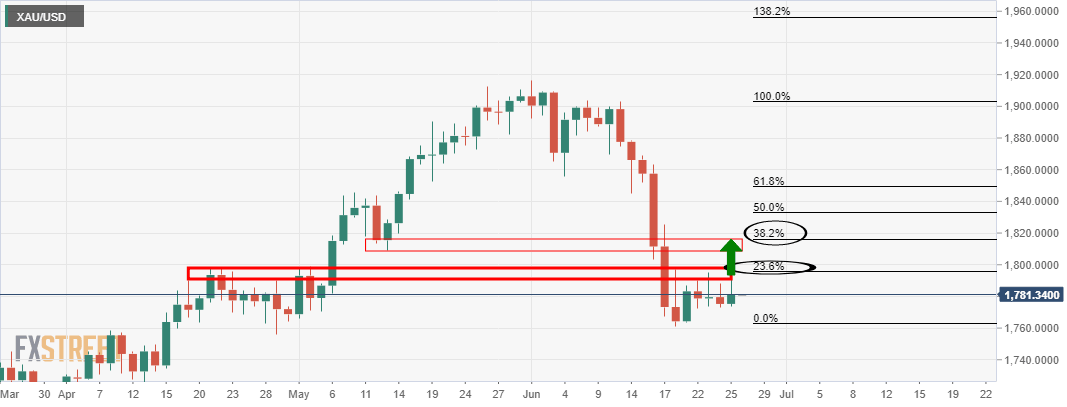

From a daily perspective, the price is en route to the near term 38.2% target near to 1,815:

Daily chart, prior analysis

Live market, positive progress

NZD/JPY bullish outlook

Meanwhile, the readiest cross on the list for taking into consideration is NZD/JPY.

As per the prior analysis, NZD/JPY Price Analysis: Bulls stepping in at a critical confluence of support, the price indeed respected the 77.40/60 support structure:

Prior analysis, 4-hour & weekly charts

... the price has formed new support structure above 77.40 in the process at a well worn historic level as follows:

In the above 4-hour chart, the price tested the prior 23 June lows and was rejected there a number of times.

Also, the price has formed a supporting structure within the bullish impulse near 77.60.

There is also a confluence of the 21 EMA.

Moreover, zooming all the way out to the weekly chart, we can see that this is in fact a key level on the higher time frames also:

Weekly chart

Live market, positive progress (4-hour chart)

Meanwhile, for bulls that had missed the entry opportunity since the prior analysis, there could be a second chance to get on board the train.

The next stop could be at a restest of the W-formation's neckline as follows:

The 61.8% Fibonacci at the expected support structure comes in at 77.74 and a restest of which, if it holds, would be expected to lead to an onward upside continuation on a daily chart basis for the week ahead.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.

-637607839757024387.png&w=1536&q=95)

-637607829833353593.png&w=1536&q=95)

-637610246705181380.png&w=1536&q=95)

-637610248626919445.png&w=1536&q=95)