- Gold bulls seeking an extension from critical levels of support.

- A break of $1,852 could be game over for the bulls in the meantime.

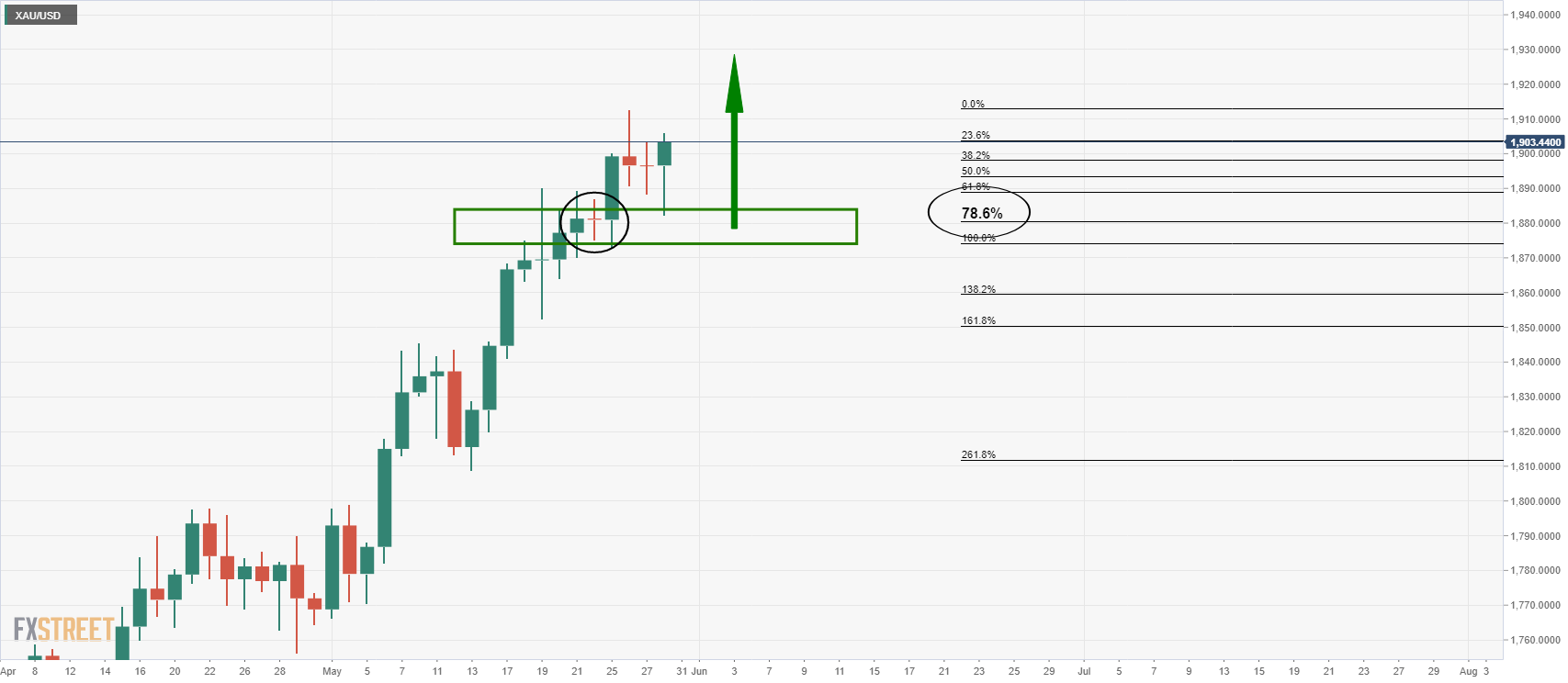

The gold price has made a significant correction to test the confluence of the 78.6% Fibonacci of the prior daily bullish impulse and the 10-day moving average.

This area of support is also the 24 May range that closed bearishly in a doji indicating a strong area of liquidity and potential support.

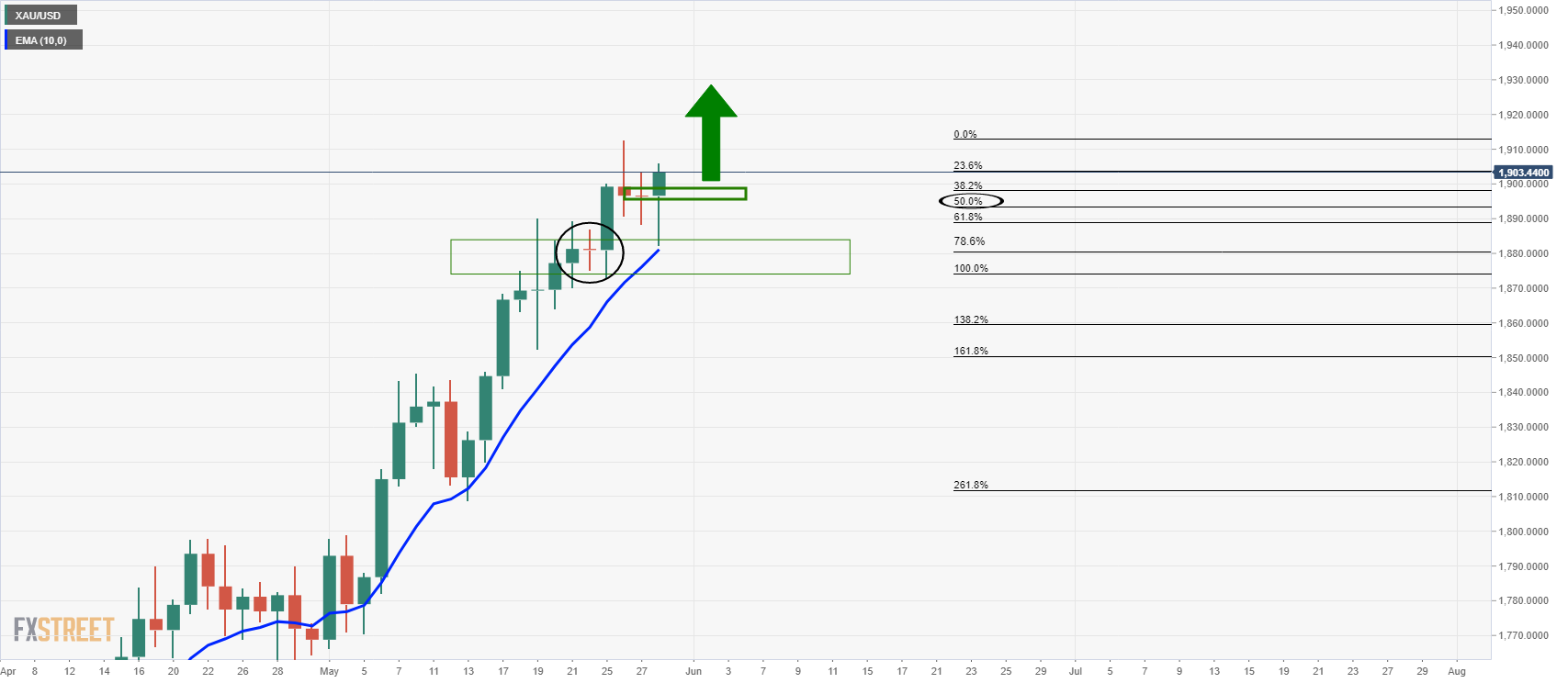

As seen, there has already been a strong rejection of the level, and the open of Friday's price action could well hold for the open at the 50% mark of the current daily range:

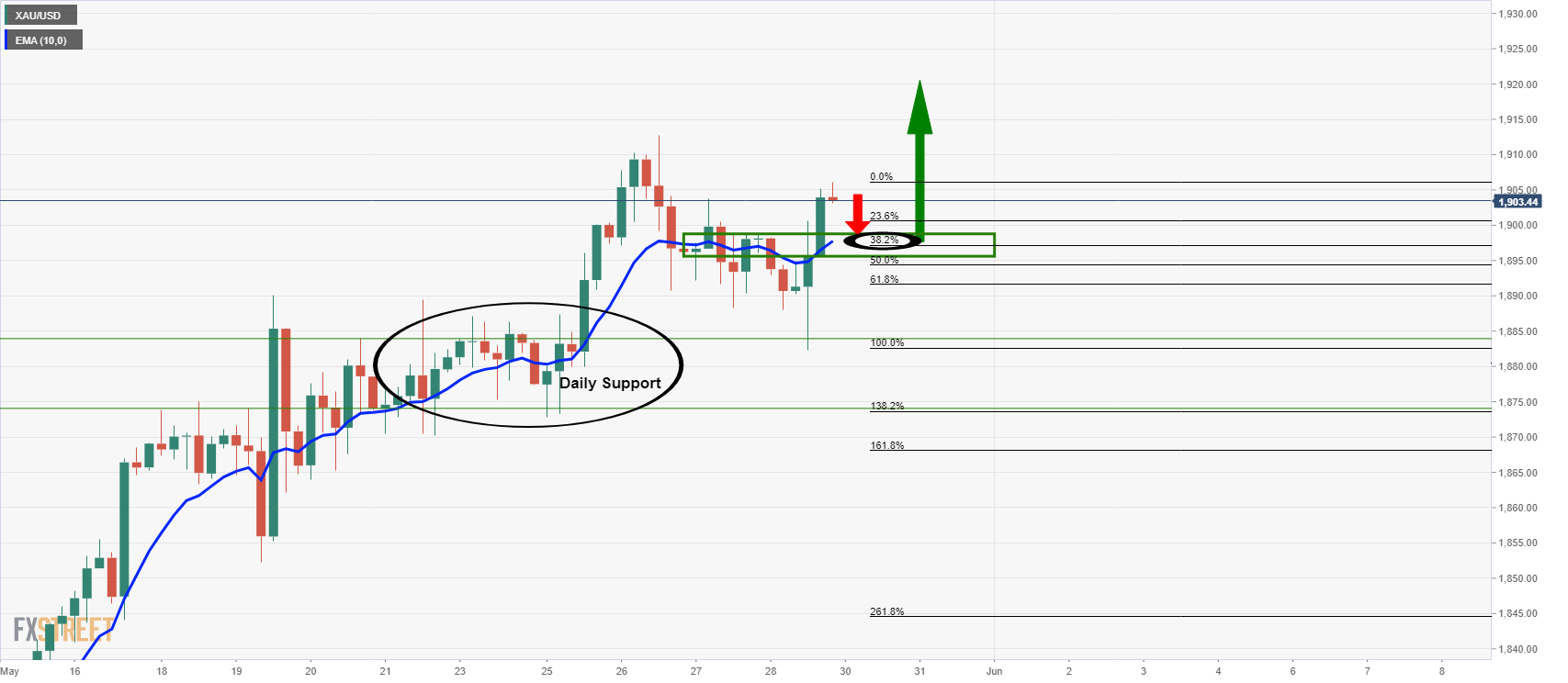

Intesteringly, the 4-hour chart's price shows signs of a bullish breakout, but the support structure is yet to be retested, which is something to keep an eye out for in the forthcoming sessions.

1,898 aligns with the 4-hour 10 EMA in this regard. Daily support at 1,881 remains critical at this juncture.

On the upside, 1,919.50 comes in as the -272% Fibonacci retracement of the current 61.8% Fibo daily correction.

On the downside, however, there are prospects of a move to test the weekly 38.2% Fibo at 1,852 if support gives out.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD: Momentum favours further gains

In line with the broad recovery in the risk-linked complex, AUD/USD left behind a two-day negative streak and resumed its uptrend towards the 0.6400 region, always on the back of the resurgence of quite a strong downside pressure hitting the US Dollar on Thursday.

EUR/USD: Extra advances appear in the pipeline

EUR/USD followed the widespread improved sentiment in the risk-linked galaxy and managed to set aside two daily drops in a row and refocus on the upper end of its recent range around the 1.1400 zone on Thursday.

Gold price climbs past $3,300 on uncertainty about trade and weak USD

Gold snaps two-day losing streak, gaining 1.5% on fresh trade war fears. Trump softens tariff talk, but China denies negotiations and demands full rollback. Fed rate cut bets rise as yields drop and economic uncertainty builds.

Ondo Finance hits $3B market cap as CEO Nathan Allman meets SEC to discuss tokenized US securities

Ondo Finance met with officials of the SEC and the law firm Davis Polk to discuss the regulation of tokenized US securities. Topics included registration requirements, broker-dealer rules and proposed compliant models for tokenized securities issuance.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.