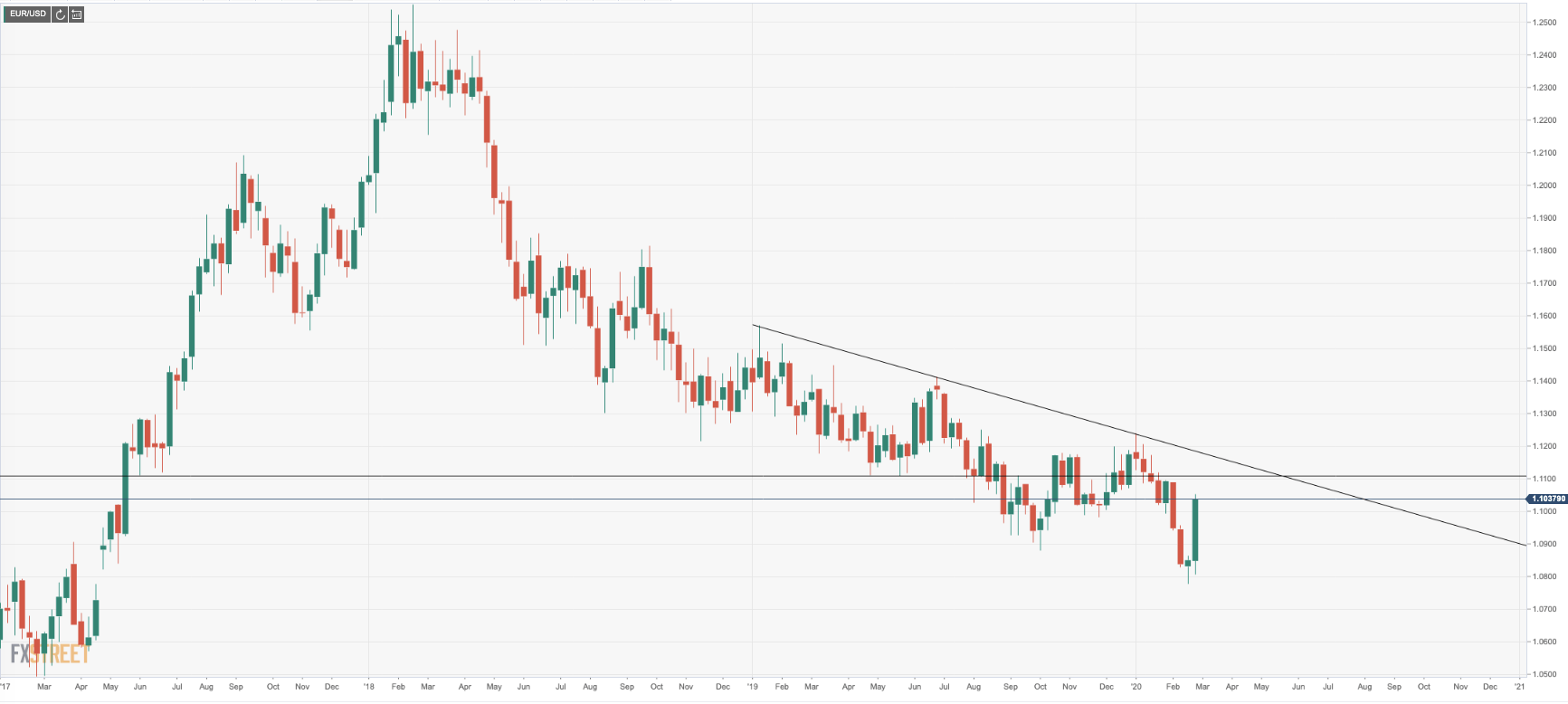

EUR/USD has been a funding currency of choice due to the second most negative implied yield in the G10 FX space behind the CHF. Prior to the coronavirus, in Sep 2019, we saw a low of 1.0879 due to weak eurozone fundamentals. Then, in 202, the US dollar took over as the driver and we saw a fresh low of 1.0779. We have seen a recent reversal of price to a high of 1.1053 due to what appears to be an unwind of the carry trade as investors seek to step away from the risks of the contagion effects of the global economy, buying back the euro that had been used as a liquid currency to finance risker investments at a low borrowing cost. This is what makes the charts so compelling and taking a deeper dive into the volume profile, technical analysis, we can assume a downside correction is on the cards as a low-risk trade set-up.

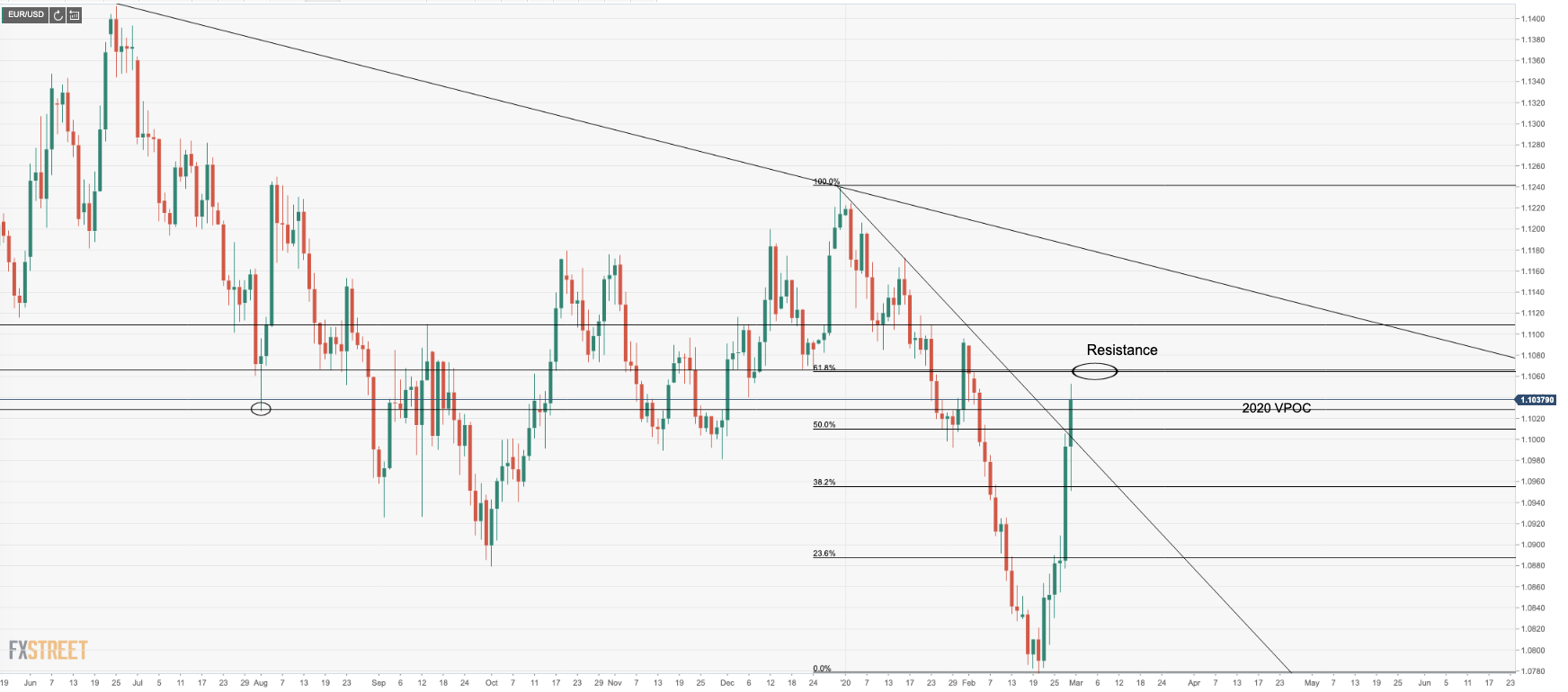

Weekly trendline (bearish below)

While there is room to the weekly trendline, the 1.1150s, there is a fairly high hurdle above 1.1095 (2020 VPOC) for a continuation of EUR/USD rally at this juncture. The path of least resistance appears to be to the downside when factoring in the volume profile and the 61.8% Fibonacci retracement of the 31st December peak to YTD lows. The 1.1095 (2020 VPOC) would usually act as a magnet/support/resistance target, so it should not be ignored at this juncture, despite the recent rally sitting in overbought conditions.

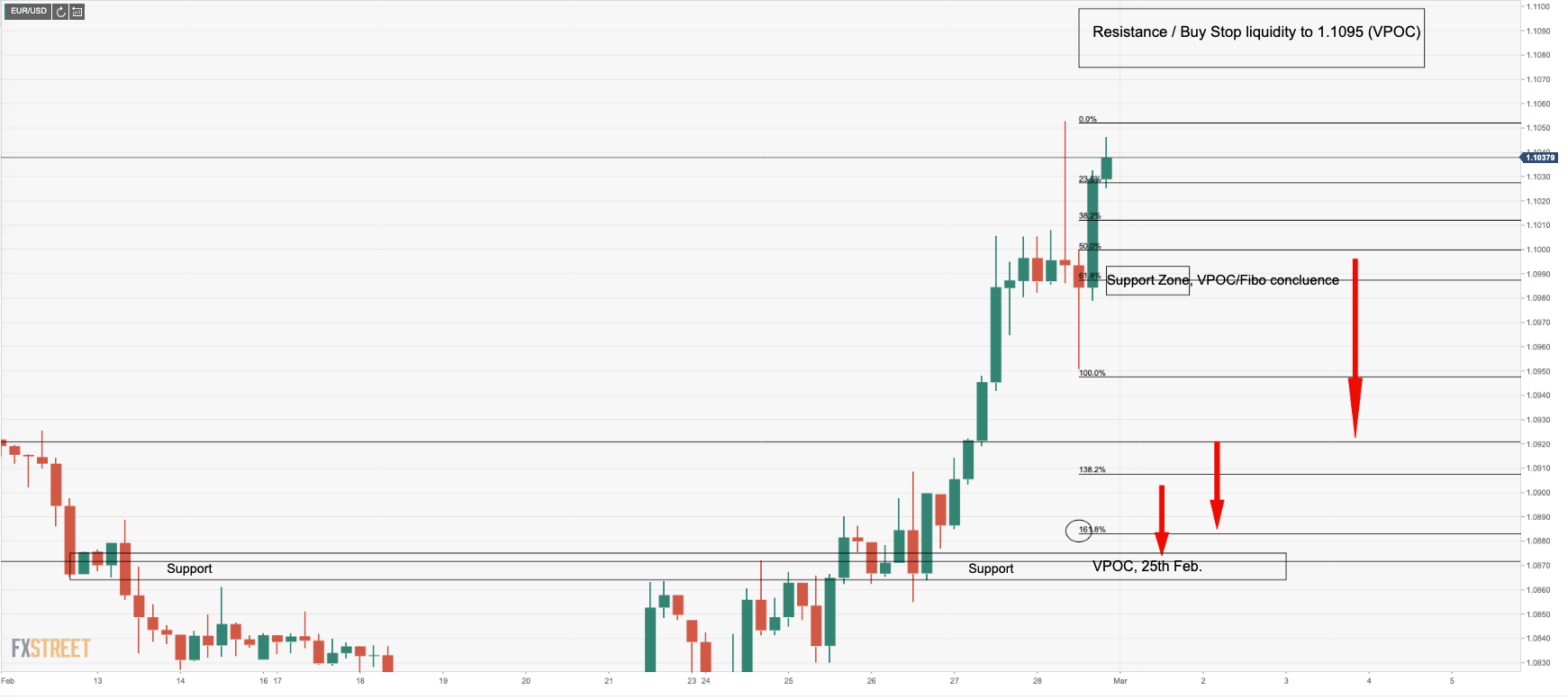

Daily chart, price runs towards 61.8% Fibo/resistance

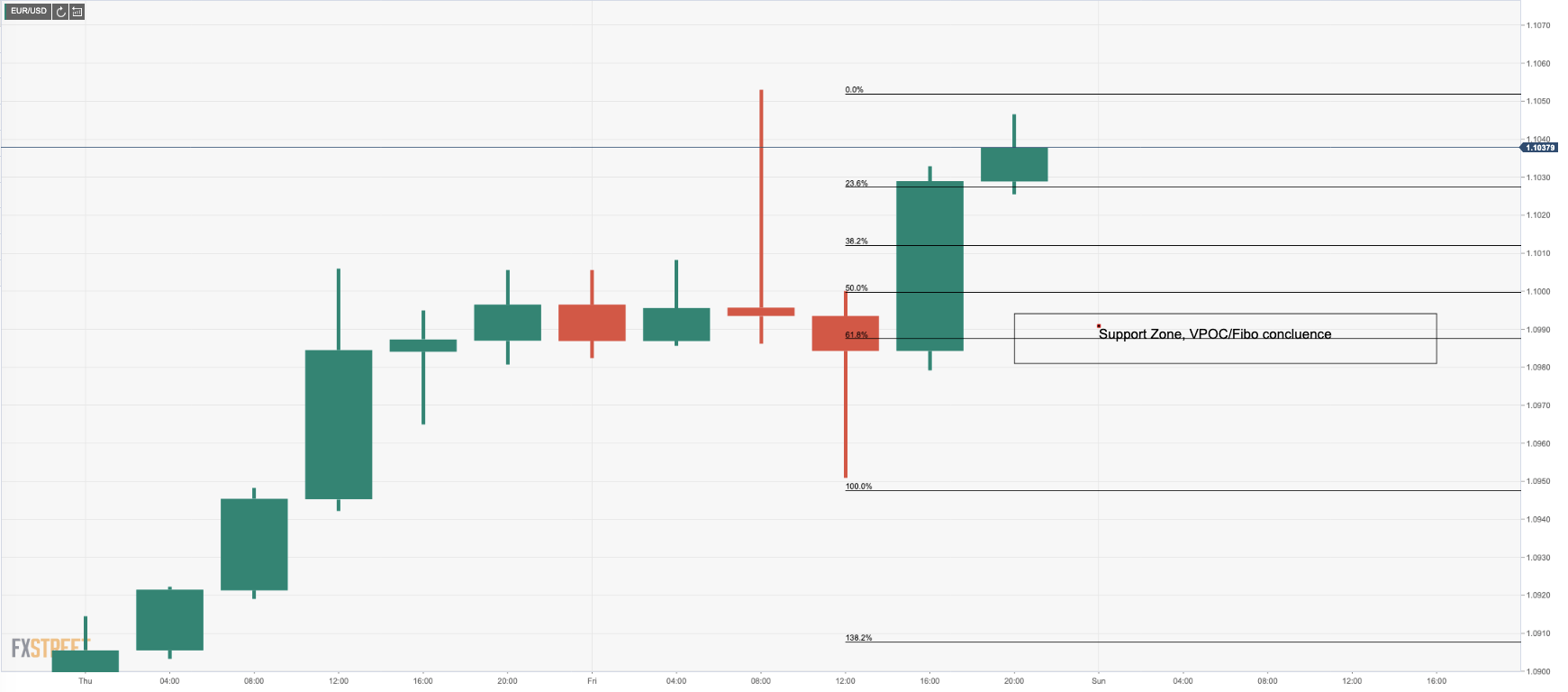

The 2020 VPOC should prove to be a strong level of resistance and a level which bulls will target the accumulation of buy stop liquidity. On the daily chart, we now have a doji, (bearish). High volume nodes are accumulated below the close of 1.1025 and the prior day's VPOC is located at 1.0977, a support zone seen clearly on the 4-hour time frame and a 61.8% retracement of Friday's range.

4-HR support

The VPOC of Friday is located at 1.1000, a 50% retracement of the range which is the first target for a mean reversion trade. On a break and follow trough, beyond the aforementioned 61.8% retracement opens risk to 1.0950 and low volume nodes of price on Friday's session. Bears will be motivated on a spike of hourly sell tick-volume in the open with A/D moving back into distribution territories. 1.0920 guards a drop to 1.0870 according to VPOC, 25th Feb (correlates with a 161.8% Fibo).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD loses momentum to near 1.0300 ahead of Eurozone Retail Sales release

The EUR/USD pair trades in negative territory for the third consecutive day around 1.0310 during the early European session on Thursday. The downbeat German November Factory Orders and the expectation of aggressive rate cuts by the European Central Bank this year weigh on the Euro against the Greenback.

GBP/USD trades near 1.2350 after rebounding from nine-month lows

The GBP/USD pair remains under pressure for the third consecutive session, hovering near 1.2360 during Thursday's Asian trading hours. Technical analysis of the daily chart highlights a prevailing bearish bias, with the pair falling back to the descending channel pattern.

Gold price sticks to modest intraday losses amid bullish USD; downside seems limited

Gold price snaps a two-day winning to a multi-week top amid the Fed’s hawkish stance. Retreating US bond yields undermine the USD and lend some support to the XAU/USD pair. Traders look to Fed speakers for some impetus ahead of the US NFP report on Friday.

BNB poised for a decline on negative Funding Rate

BNB price hovers around $696.40 on Thursday after declining 4.58% in the previous two days. BNB’s momentum indicators hint for a further decline as its Relative Strength Index and Moving Average Convergence Divergence show bearish signals.

Bitcoin edges below $96,000, wiping over leveraged traders

Bitcoin's price continues to edge lower, trading below the $96,000 level on Wednesday after declining more than 5% the previous day. The recent price decline has triggered a wave of liquidations across the crypto market, resulting in $694.11 million in total liquidations in the last 24 hours.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.