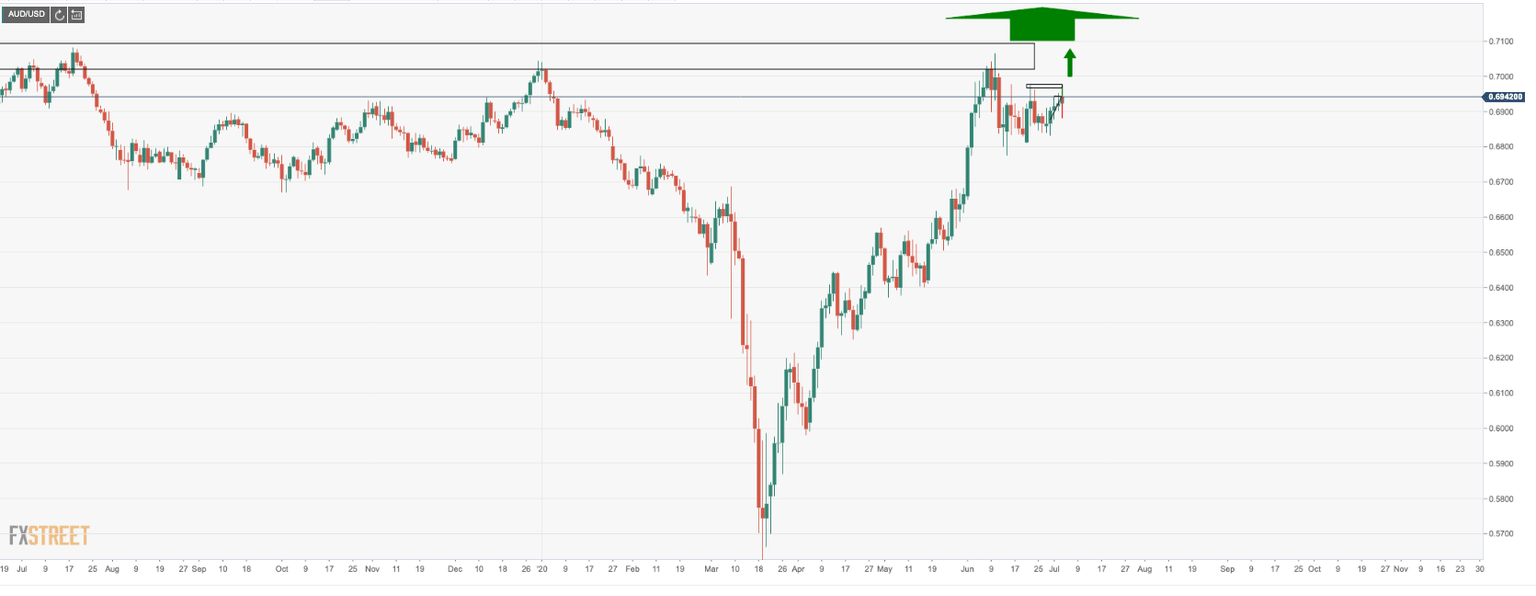

Chart of The Week: AUD/USD traders enter the barroom brawl

- AUD/USD on the brink of a breakout out as price tests critical resistance.

- There is something for everyone on these charts, just prick your side and take your pick.

AUD/USD is one of the most compelling set-ups in the making on the forex board.

We are seeing that the price is some 28% higher since the COVID-19 recovery got underway. The price is meeting tough resistance and it may only be a matter of time before a tidal wave of supply kicks in.

However, that is not to say that there will not be any further room to the upside, for is resistance is broken with daily support structure subsequent of the break, then the upside will remain the favoured outlook.

On repeated failures of this resistance and a switch-up in the market's positioning, the path of least resistance will be to the downside.

At this juncture, it is a waiting game for longer-term investors who don't want to be caught up in the barroom brawl.

For shorter-term traders, there are plenty of opportunities on the cards.

Major resistance structure has taken crucial form

Bull/Bear sandwich, AKA, the barroom brawl

Three further attempts to test resistance so far

Tripple top in the making

Bearish divergence

This smoothed volume indicator is showing that there is less volume going through the market for the pair, indicating traders are on the sidelines with little interest to be holding longs at such extremes. A flurry of selling activity will likely lead to a surge of price action to the downside without much obstruction from the bulls, clearing out the stale stop losses.

Last dance from the buyers before major sell-off?

As we can see, from the On Balance Volume (OBV) and the Accumulation and Distribution indicators, as well as reading from COT data of late, we have seen a trimming of shorts in a phase of an accumulation from institutions.

We will wait to see how things develop, but this makes the perfect storm for a bull trap on the breakout of the ascending triangle and current resistance.

Paying particular notice to the OBV, which is based on the distinction between institutional investors and retail investors, the theory here is that as institutional investors will begin to buy into what retail investors have been selling.

The increase in volume should drive the price upward, at which point, larger investors begin to sell, trapping the bulls and making for a major switch in trajectory in the price away from resistance in a fresh phase of distribution.

Up, UP and away

On the other hand, a break of top side structure will lead to a continuation of the Aussie's remarkable resilience for 2020 so far.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.