Chart of The Week: AUD/JPY in a precarious position at daily support

- AUD/JPY in focus as market uncertainty weighs.

- Bears lining up with their entry signals at the ready.

We gravitate to the usual suspects at times of geopolitical uncertainty. The weekend headlines put the US and Chinese tensions at the forefront of markets. More on that here: China's plan of national security law in Hong Kong puts Trump in an unwelcome spot with Xi

Besides fundamentals, the market's risk barometer is already compelling due to its technical stance on the charts. AUD/JPY is ripening for a short but there could be a last breath from the bulls at daily support.

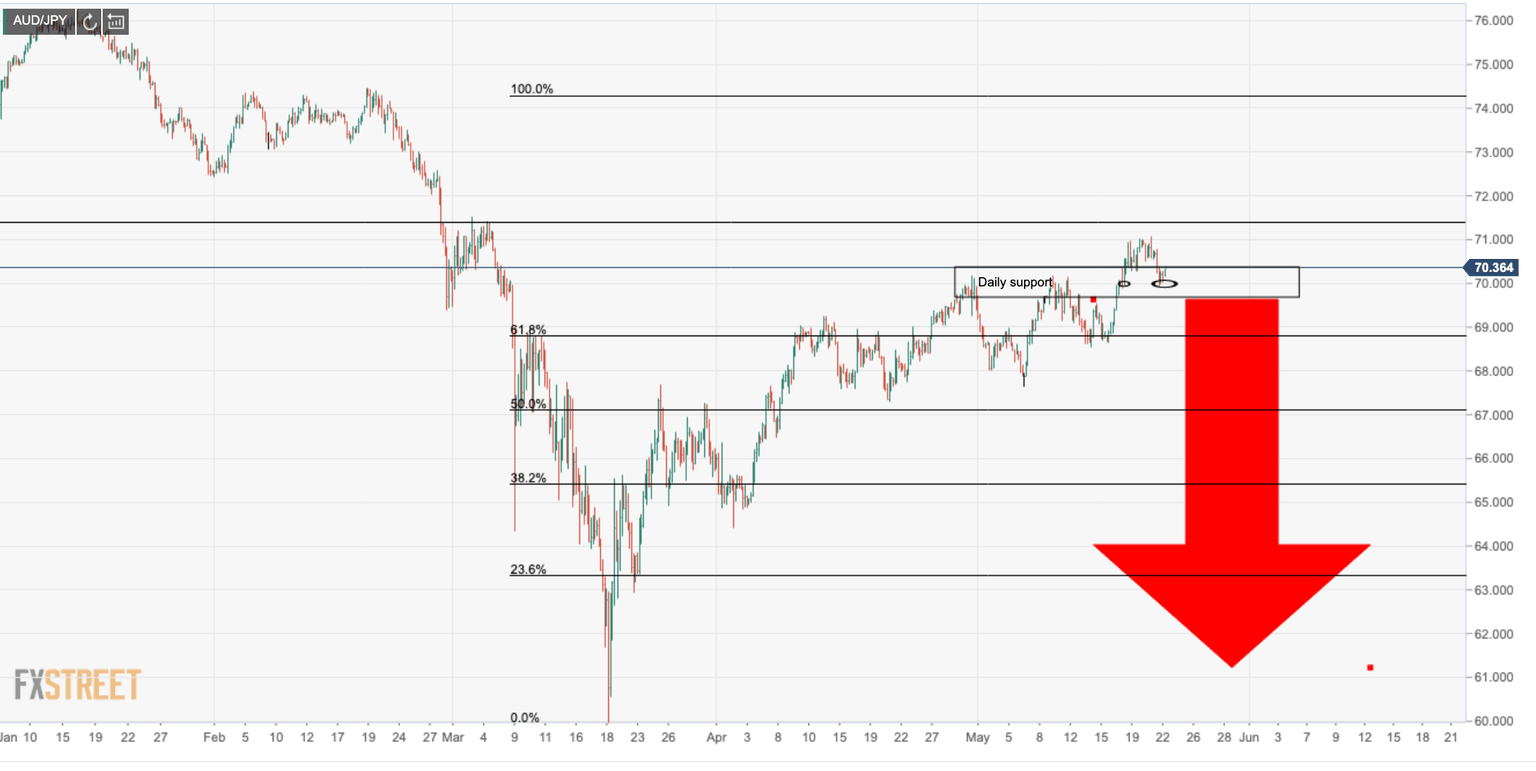

The 78.6% Fibonacci retracement could well be tested fully before bears take over. On the other hand, a risk-off open this week could set the stage for the making of a new bearish market and an impulse destined into a 67 handle target.

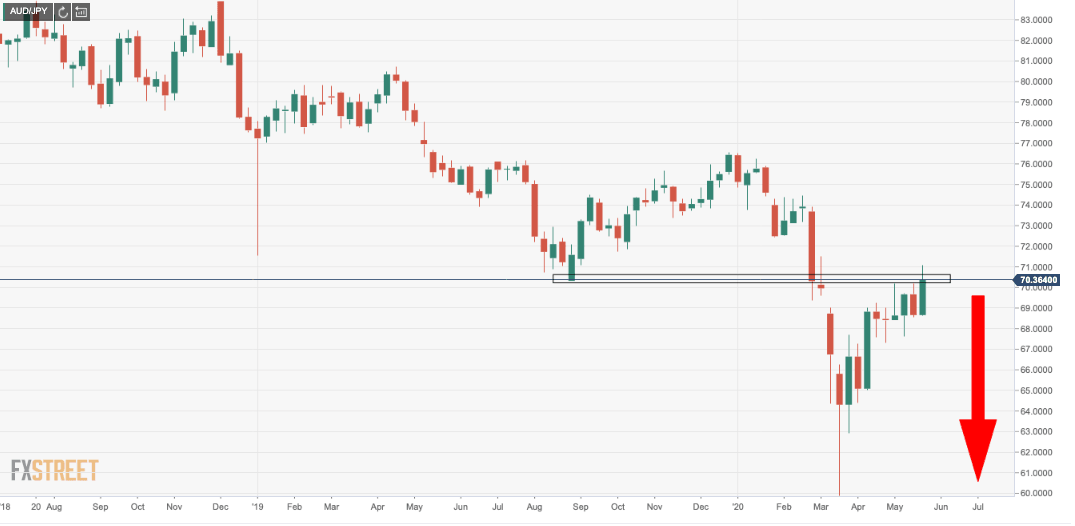

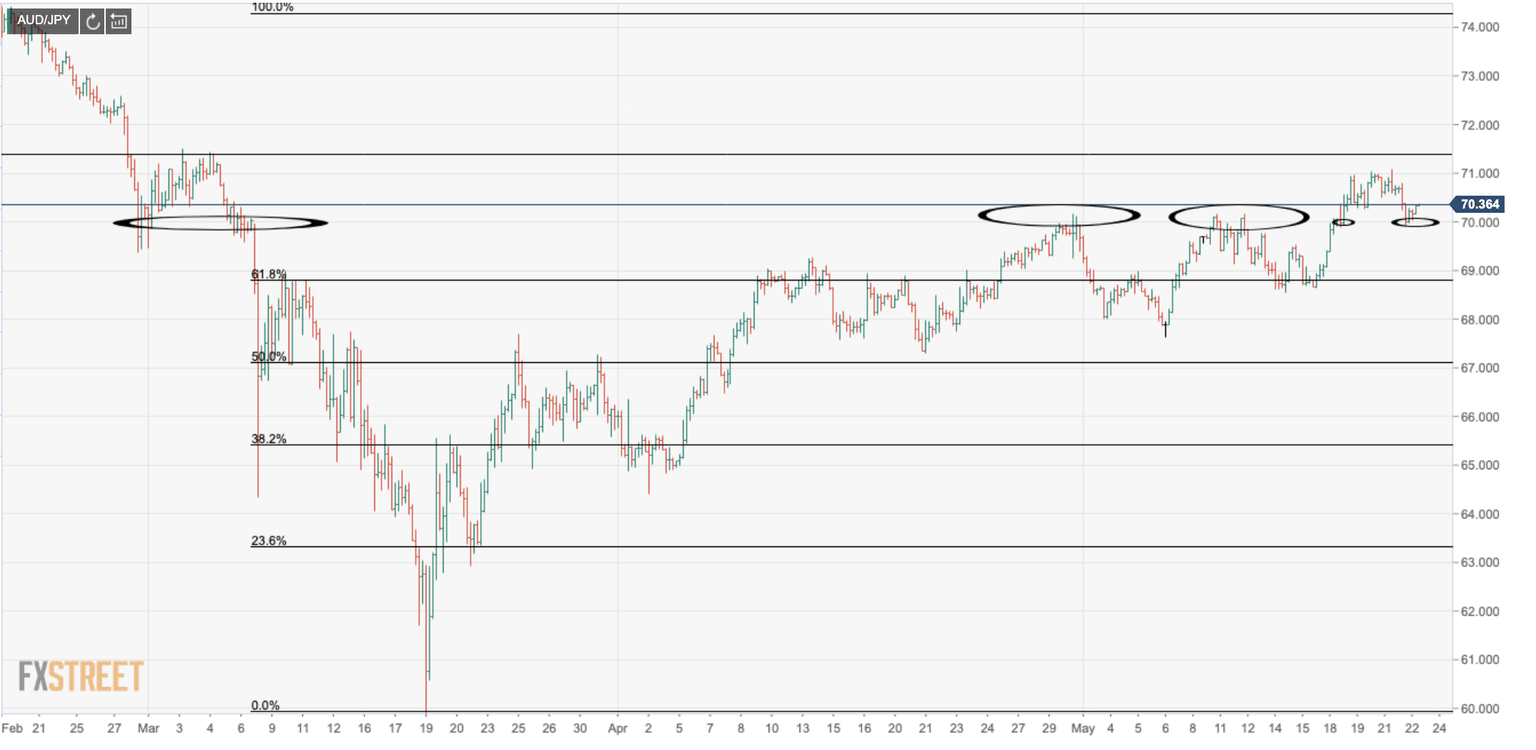

The weekly chart shows the bearish trend:

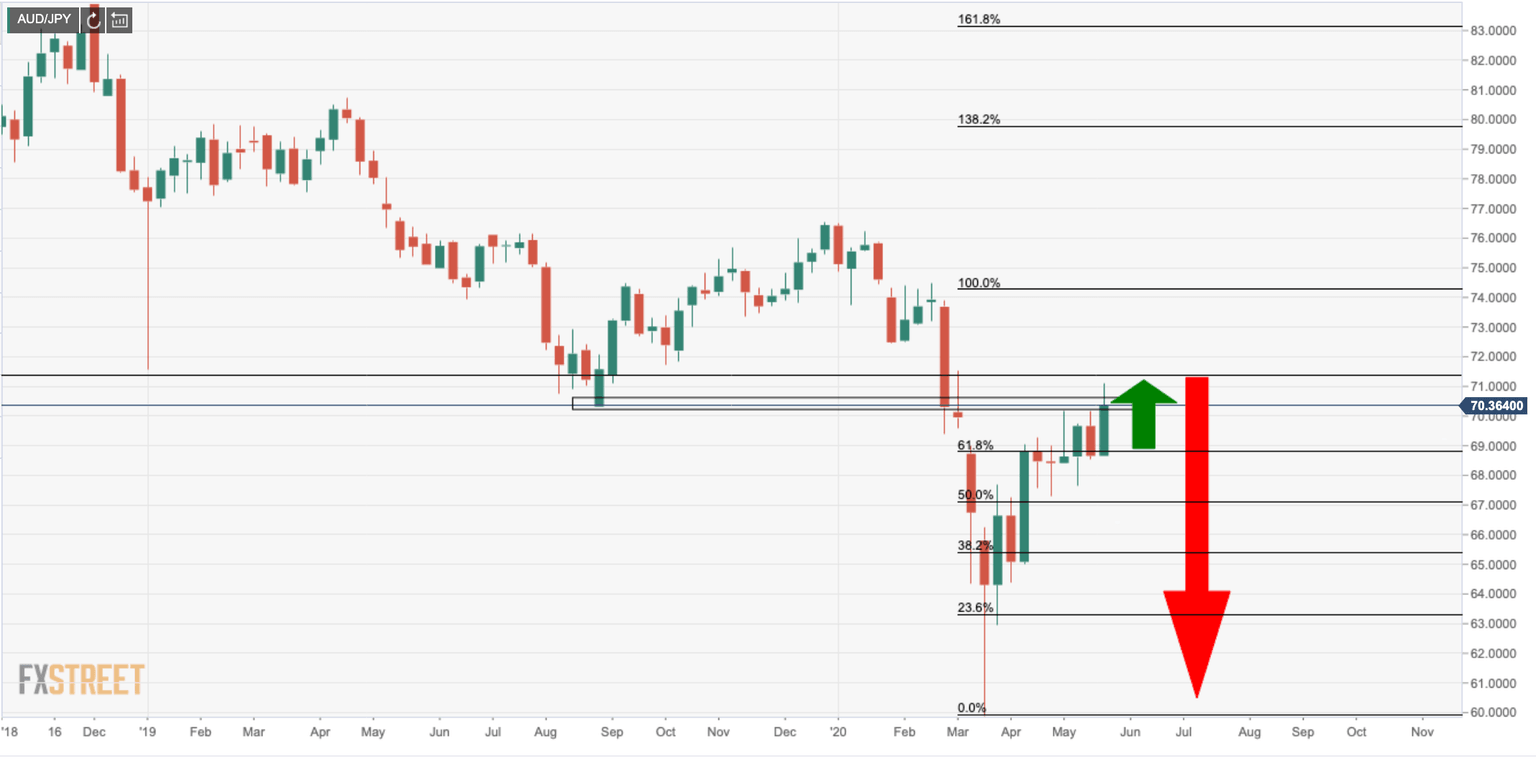

Fibonacci retracements of 78.6% has a confluence with Dec 2019 lows:

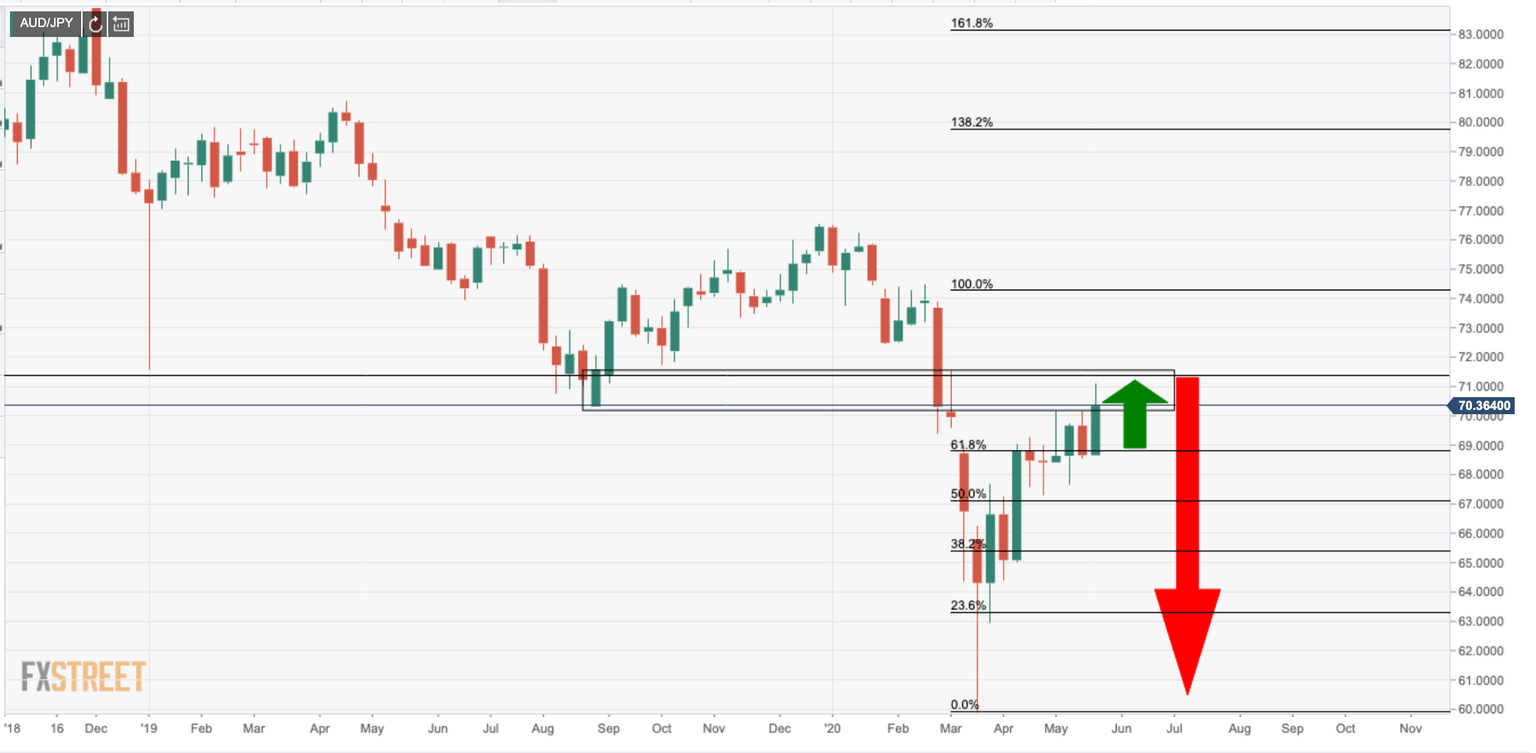

The daily charts show daily support and resistance area...

... and here:

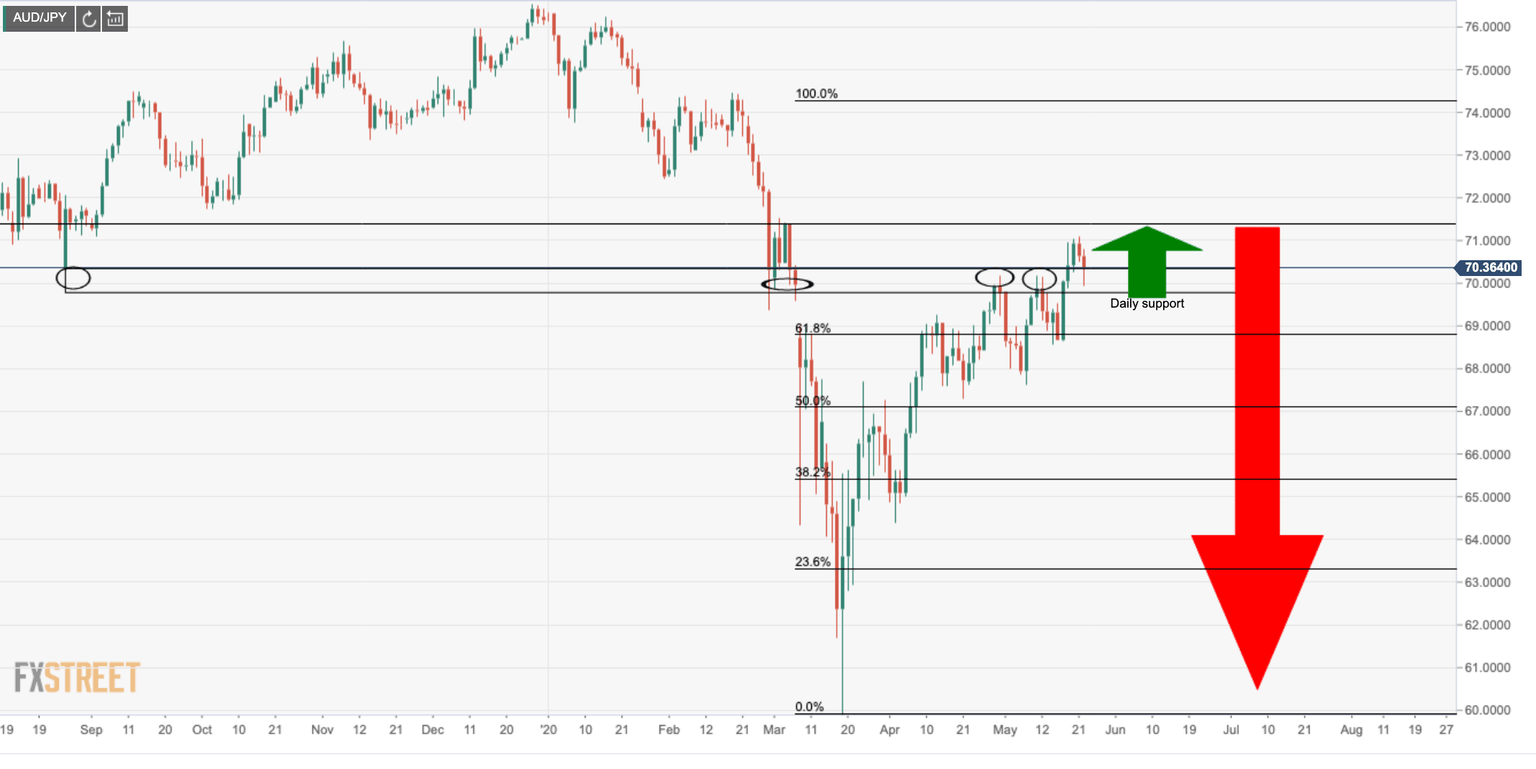

The 4 HR time frame shows price reacting to the daily support structure:

A break below daily support opens the case for lower:

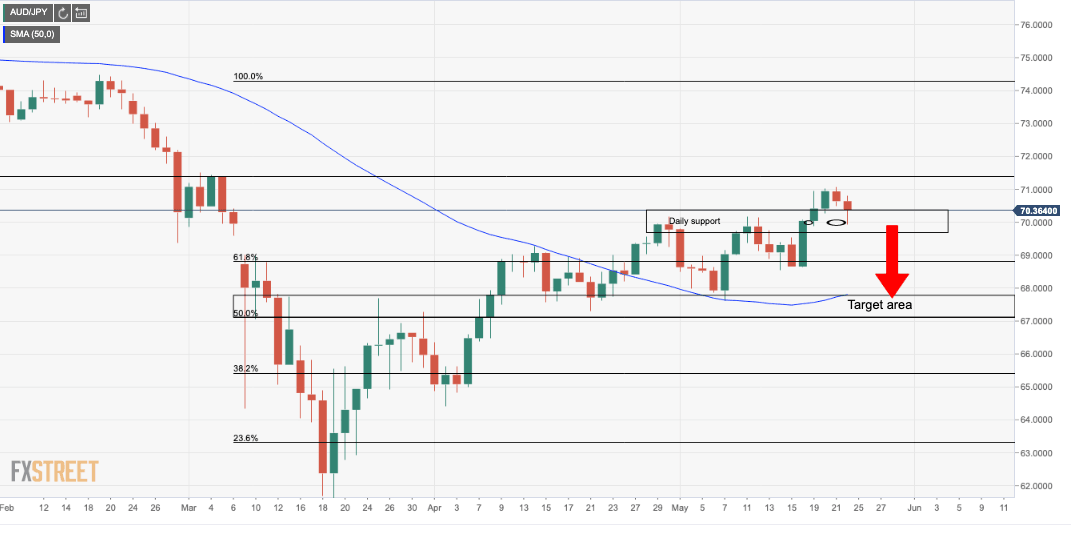

Bears can target a 50-day moving average, prior support and resistance structure, with the confluence of a negative 61.8% Fib of prior bullish impulse:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.