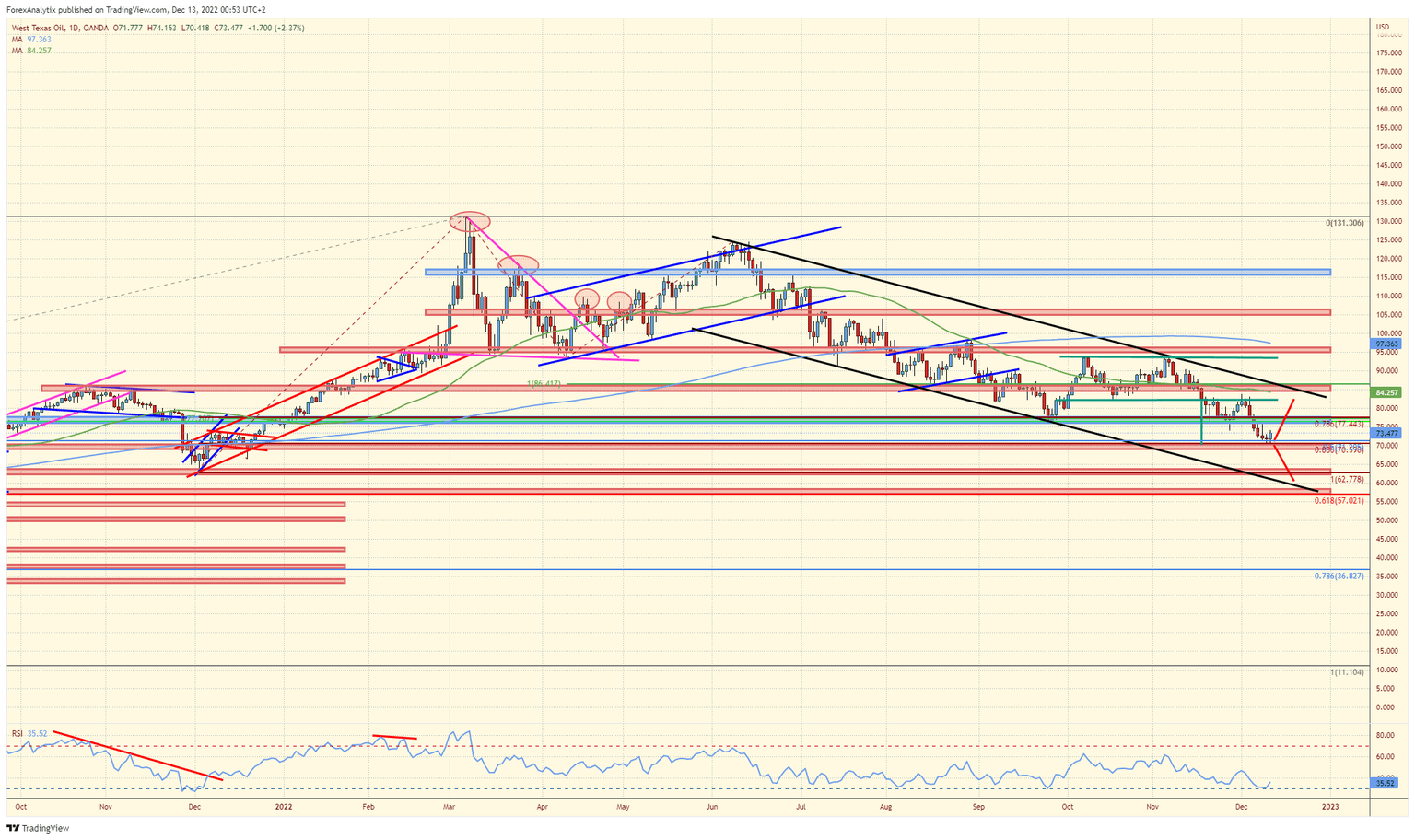

Chart of the Day: WTI

Crude is stalling at confluence of supports

Crude oil closed last week at a key confluence of supports ~$77, while completing a double top target. These are: the 88.6%% Fib of the last bullish leg (December 2021- March 2022), the 50% Fib of the whole move from $11 to $131 (using the continuous as a reference) and the double top target (October - November highs). What happens from here is important. An initial rebound is extremely likely but the level to watch is a back-test of $77.50. A break above that level will start pointing to a developed bottom but until that happens, we have to respect the recent trend.

Author

Blake Morrow

Forex Analytix

Blake Morrow spent most of his professional career as the Chief Currency Strategist for Wizetrade group for 15 years, and then the Senior Currency Strategist for Ally Financial after the acquisition of Tradeking which owned the Wizetrade Group.