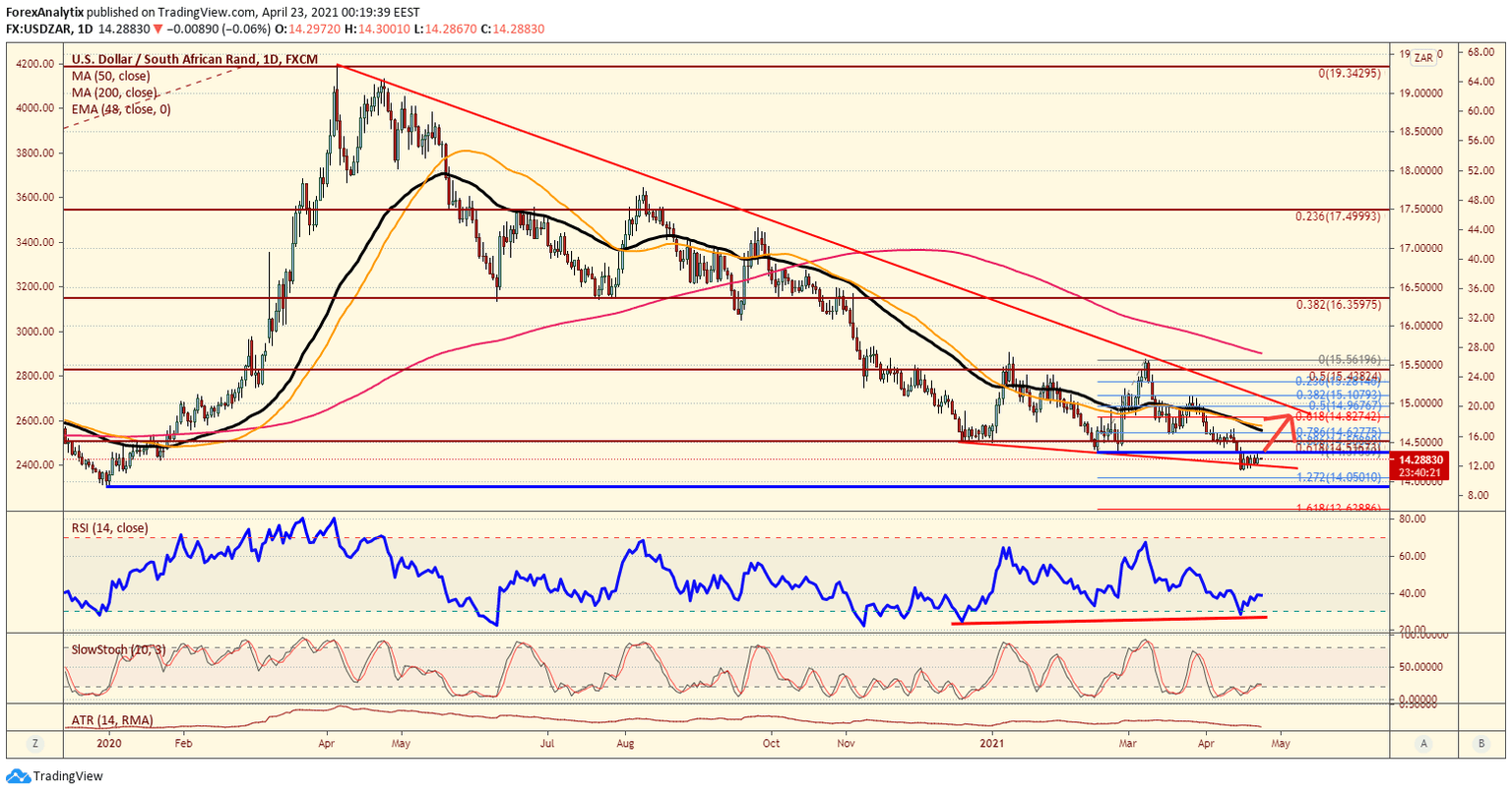

Chart of the day: USD/ZAR

Many US Dollar pairs have similar setups, but the USD/ZAR is in a descending wedge which may be suggesting a bullish reversal soon. A break of the 14.4000 level could mean a move back to the 15.0000 level which is the long term descending trend line. we should also note, despite the rally to all time highs in US equities, the USDZAR has not broken the lows from the end of 2019, so if the pair does not break the 13.9300 level we could be creating a higher low longer term.

Author

Blake Morrow

Forex Analytix

Blake Morrow spent most of his professional career as the Chief Currency Strategist for Wizetrade group for 15 years, and then the Senior Currency Strategist for Ally Financial after the acquisition of Tradeking which owned the Wizetrade Group.