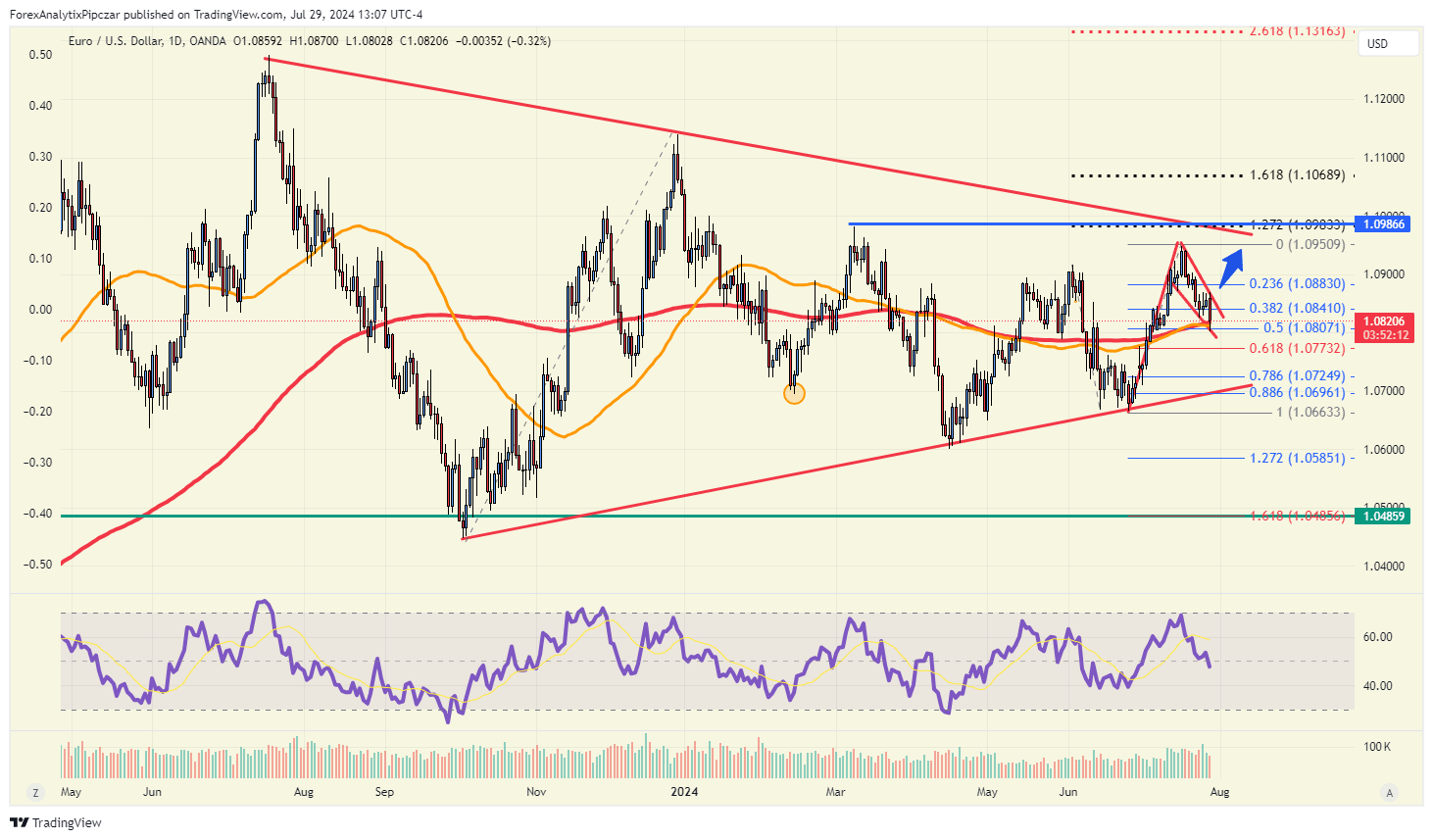

Chart of the day: EUR/USD

The EURUSD is at key support ahead of the big events this week!

The EURUSD is back at the 200 and 50dma. You can see below, they are very tightly wound up and are providing the market near term support ahead of the key FOMC meeting and Non-Farm Payroll report this week. Although the Fed is expected to keep rates unchanged, but there is a good chance they could lean dovish based on some recent economic data points. Also, many feel that the jobs report could show some weakness in the economy as well on Friday.

With both of these factors in play, being long the EURUSD near the 1.0800 level may be the play, especially with the bullish pennant developing. Above the 1.0880 level would confirm the bullish setup. Below the 1.0773 would negate this setup.

Author

Blake Morrow

Forex Analytix

Blake Morrow spent most of his professional career as the Chief Currency Strategist for Wizetrade group for 15 years, and then the Senior Currency Strategist for Ally Financial after the acquisition of Tradeking which owned the Wizetrade Group.