Changing of the guard at the Swiss National Bank

The Swiss franc is calm on Wednesday. In the European session, USD/CHF is trading at 0.8454, up 0.13% on the day.

SNB welcomes Schlegel – Will he bring more of the same?

Martin Schlegel has taken over as the new president of the Swiss National Bank, replacing long-term head Thomas Jordan. Schlegel gave his first speech as president on Tuesday and investors are keen to know whether he will continue Jordan’s policies.

Under Jordan, the SNB was one of the first major central banks to raise interest rates in response to rising inflation. In the case of the SNB, that meant ensuring that inflation did not stray far from the upper level of the 0%-2% target. The SNB got the job done and the SNB has been aggressive in cutting rates as inflation has been falling. The SNB has lowered rates at three consecutive meetings since March, bringing the cash rate to 1%.

Schlegel didn’t make any waves with his first speech, which was no surprise. He said that the central bank’s “main instrument” was the policy rate and hinted at further rate cuts, saying that the downward risks to inflation were higher than the upside risks and that negative rates “can’t be excluded”.

Schlegel was vague about the SNB intervening in the currency markets, saying such a move couldn’t be excluded. The Swiss franc has soared a massive 8% since May 1 and the spike in tensions in the Middle East could push the safe-haven asset even higher. The SNB has intervened in the past when the franc has sharply appreciated in order to keep Swiss exports competitive and there is speculation that the SNB might step in if the Swissy’s appreciation continues.

On the data calendar, Switzerland will release the September inflation report on Thursday. The market estimate stands at 0%, compared to -0.1% in August. Yearly, inflation is expected to remain unchanged at 1.1%.

USD/CHF technical

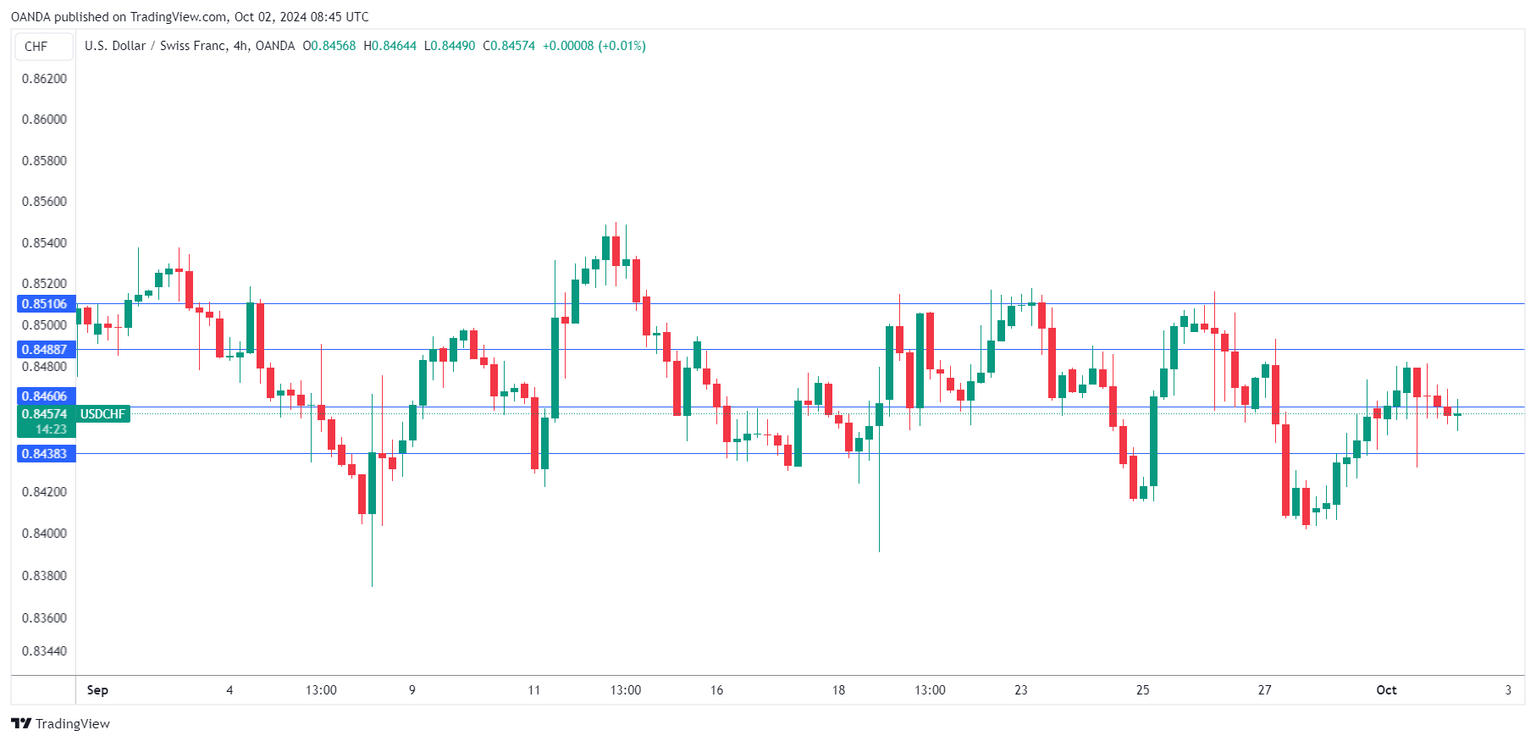

-

USD/CHF is testing support at 0.8460. Below, there is support at 0.8438.

-

0.8488 and 0.8510 are the next resistance lines.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.