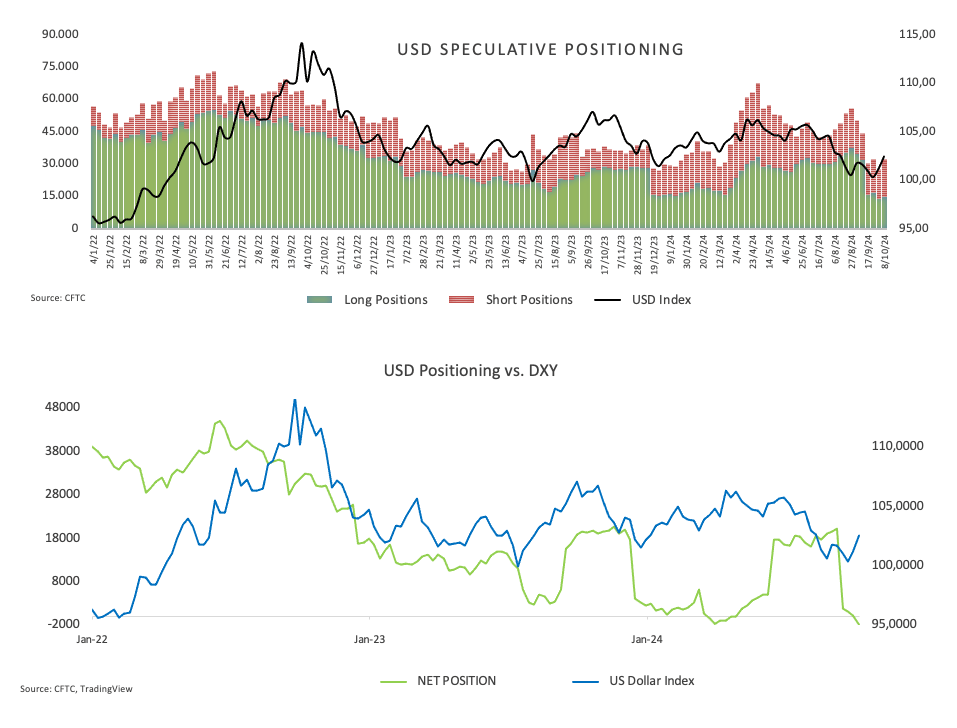

CFTC Positioning Report: USD turns net short for the first time since April

These are the main takeaways of the CFTC Positioning Report for the week ending October 8.

- Non-Commercial traders held net shorts in the US Dollar for the first time since April at nearly 2K contracts amidst a slight retracement in open interest. During this period, the US Dollar Index (DXY) continued its recovery from lows around the key 100.00 level, pushing well beyond the 102.00 threshold. This rebound was driven by diminishing expectations of a 50 bps rate cut in November, alongside data and Fedspeak supporting a soft landing for the US economy.

- Speculators trimmed their net longs in the Japanese yen to six-week lows around the 36.5K contracts, while hedge funds and other commercial players also reduced their net shorts to multi-week lows, all amidst a marginal increase in open interest. The resurgence of a firm selling pressure around the Yen motivated USD/JPY to advance to new two-month peaks past the 149.00 hurdle.

- Speculative net longs in the Euro shrank to eight-week lows around 39K contracts, while commercial players sent their net shorts to levels last seen in late July. Open interest, in the meantime, contracted for the second week in a row. EUR/USD embarked on a corrective decline, which broke below the key support at 1.1000, almost exclusively on the back of the resumption of Dollar’s strength.

- Net longs in the British pound dropped slightly from the previous week, along with a small decline in open interest. In line with the rest of the broad risk complex, GBP/USD edged lower, accelerating its corrective move after hitting yearly peaks north of 1.3400 the figure in late September. In addition, dovish remarks from the BoE’s Bailey also collaborated with the retracement.

- Non-Commercial net longs in Gold deflated to levels last seen in mid-August around 278K contracts amidst a marked reduction of gross longs, while open interest retreated modestly for the second straight week. Gold prices have made several attempts to consolidate near their record highs, consistently supported by the $2,600 mark per ounce troy.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.