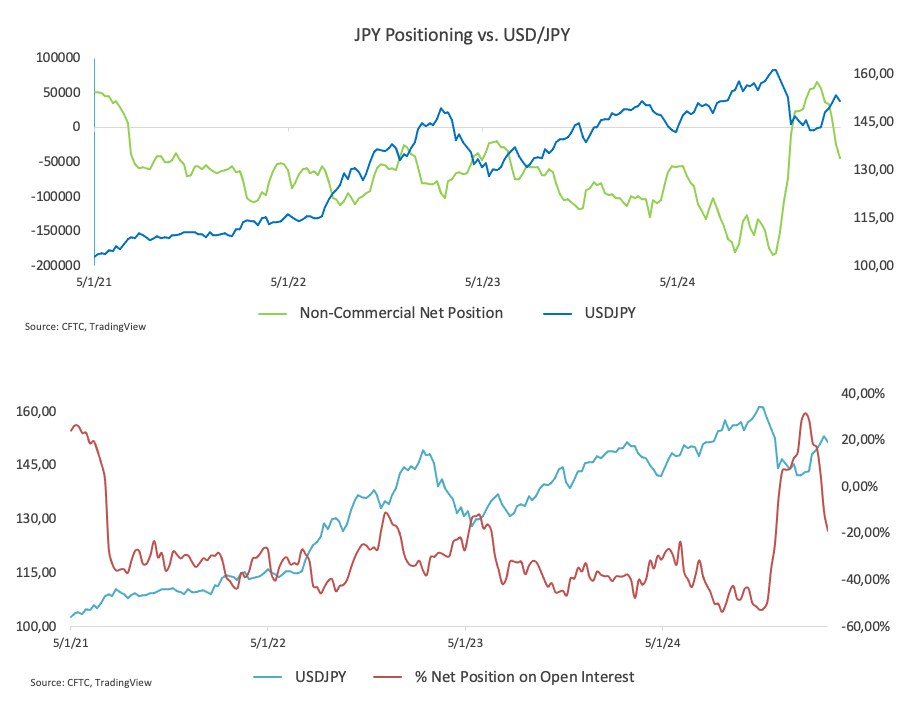

CFTC Positioning Report: Japanese Yen net shorts kept rising

These are the main takeaways of the CFTC Positioning Report for the week ending November 5.

- Speculators remained net sellers of the Japanese Yen for the second consecutive week, increasing their net shorts to approximately 44.1K contracts. At the same time, non-commercial traders added to the previous week’s net longs, reaching around 47.3K contracts, all amidst the fifth consecutive weekly gain in open interest. During this period, USD/JPY traded with a gradual downward bias around the 152.00 region as investors continued to assess the BoJ’s decision to keep its interest rate unchanged.

- Speculative net shorts in the Euro declined to three-week lows, hovering around 21.6K contracts, while hedge funds and other commercial players trimmed their net longs to just above 600 contracts, against the backdrop of a moderate drop in open interest. EUR/USD embarked on a modest uptrend, with investors exercising caution ahead of the US election and the FOMC event.

- Non-commercial net longs in the US Dollar retreated to three-week lows, standing at just 95 contracts amidst a modest decline in open interest. The US Dollar Index (DXY) remained on the defensive after peaking in October, surpassing the 104.50 level, as markets awaited the upcoming US election and the Fed’s interest rate decision.

- Net longs in the British Pound fell for the fifth consecutive week, to just above 45K contracts, while open interest also receded to multi-week lows. GBP/USD exhibited a slight upside bias as investors digested the Autumn Budget (October 30) and looked ahead to the BoE’s interest rate decision.

- Non-commercial net longs in Gold declined to levels last seen in early August, at nearly 255.3K contracts, while open interest fell to three-week lows. Gold prices faced renewed selling pressure after nearing an all-time peak just below the $2,800 mark per troy ounce, finding temporary support around the $2,720 level.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.