CFTC Positioning Report: Japanese Yen net longs kept growing

These are the main highlights of the CFTC Positioning Report for the week ending September 3.

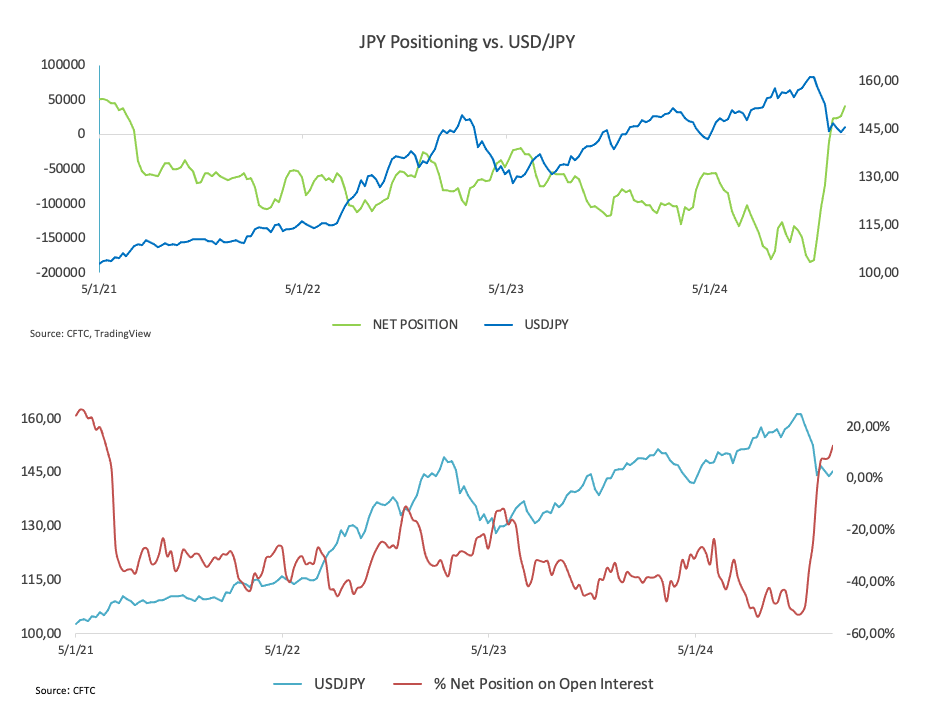

- Non-commercial (speculative) net long positions in the Japanese yen increased for the fourth consecutive week, reaching levels last seen in February 2021, around 41K contracts. Notably, both the net long/short ratio and the net position/open interest ratio surged to over a decade-high, surpassing 1.80 and approaching 13%, respectively. Meanwhile, Commercial participants (hedge funds) continued to maintain a net short position. During the period in question, the USD/JPY climbed to a two-week high near 147.20, only to subsequently reverse and drop to near its lowest levels of 2024. This movement was influenced by expectations of Fed rate cuts, coupled with some hawkish remarks from BoJ officials.

- Speculative net long positions in the euro rose to nearly year-to-date highs, slightly above the 100K mark. This increase was also reflected in the long/short ratio and in the net shorts held by Commercial players. EUR/USD experienced a gradual decline, but this downward movement has so far found solid support around the 1.1030 level. Meanwhile, expectations of a potential rate cut by the Fed in September continued to shape the market sentiment for the pair.

- Speculators increased their net long positions for the third straight week, taking them to fresh five-week peaks north of 108K contracts along with an acceptable build in open interest. Following its risk peers, GBP/USD edged lower, meeting support in the sub-1.3100 region.

- Non-commercial net long positions in the US Dollar increased further, exceeding the 19K mark for the first time since early December 2023. This rise occurred despite a decline in open interest. The US Dollar Index (DXY) showed a solid recovery, approaching the 102.00 level, as investors continued to factor in a widely expected rate cut by the Fed later in the month. Additionally, some positive economic data helped bolster the case for a soft landing of the US economy.

- Speculators' net long positions in WTI crude oil fell to two-week lows amid a significant increase in gross short positions. Meanwhile, traders continued to grapple with persistent demand concerns stemming from the Chinese economy, along with uncertainties surrounding the US economy and the prospect of a smaller rate cut by the Fed this month. These factors contributed to a sharp corrective decline in oil prices, eventually pushing the price per barrel below the $70.00 mark to reach new yearly lows.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.