CFTC Positioning Report: EUR net shorts increased further

These are the key highlights from the CFTC Positioning Report for the week ending November 19.

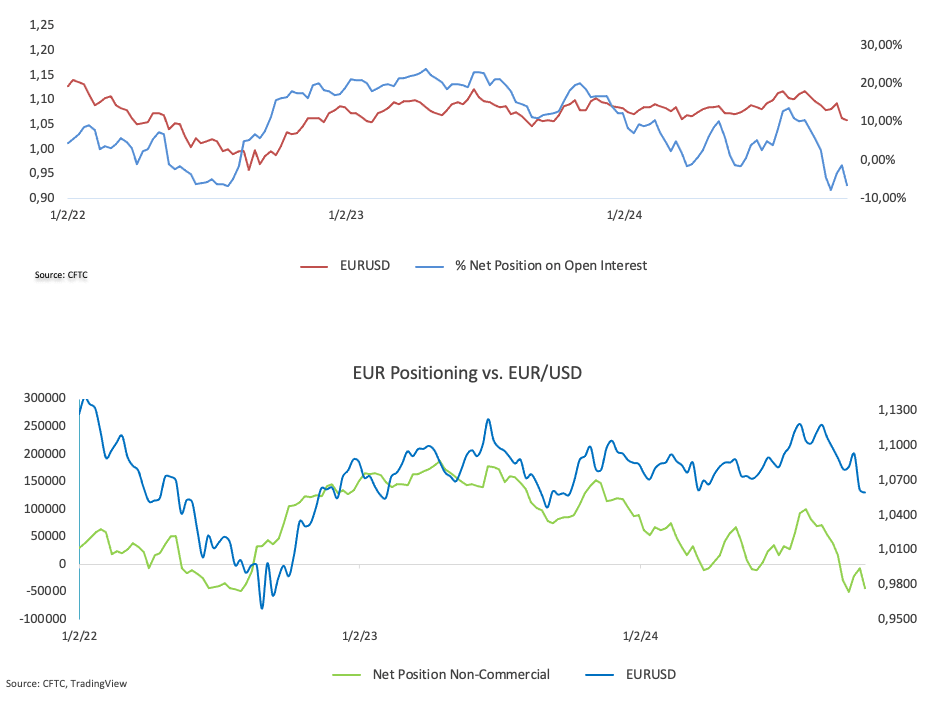

- Speculators remained net sellers of the Euro (EUR), increasing their net shorts to the highest level in the last three weeks, around 42.6K contracts. Meanwhile, commercial net longs rose above 21K contracts, with open interest showing a decent increase after two consecutive weekly drops. EUR/USD extended its downward trend during that period, testing the 1.0500 support before regaining some traction, which may ultimately turn out to be a “dead cat bounce.”

- Speculative net shorts in the US Dollar (USD) increased for the second consecutive week, surpassing 2.7K contracts, while open interest also rose for the second week in a row. The US Dollar Index (DXY) extended its multi-week rally, briefly surpassing the key 107.00 hurdle before retracing part of its bullish move in subsequent days.

- Non-commercial players trimmed their net shorts in the Japanese Yen (JPY) to a two-week low, just shy of 47K contracts, while hedge funds remained net buyers of the Yen for the fourth consecutive week. Meanwhile, open interest shrank modestly. USD/JPY maintained its gradual ascent but lost some impetus after reaching fresh four-month highs above the 156.00 barrier.

- Speculative net longs in the British pound (GBP) retreated to levels last seen in late May, around 40.3K contracts, amid a moderate rebound in open interest. GBP/USD maintained its bearish bias, slipping back to the 1.2600 zone, where it encountered temporary support.

- Speculators remained net buyers of Gold (XAU/USD), although net longs receded to around 234.3K contracts, a region last seen in early June. Open interest, in the meantime, dropped decently and approached 500K contracts. The yellow metal bounced off two-month lows near the $2,530 mark and reclaimed the area beyond $2,600 per troy ounce, almost exclusively propped up by the resurgence of geopolitical concerns.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.